Berkshire Hathaway 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

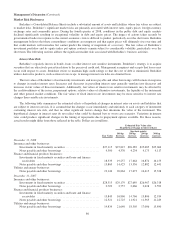

Management’s Discussion (Continued)

Market Risk Disclosures

Berkshire’s Consolidated Balance Sheets include a substantial amount of assets and liabilities whose fair values are subject

to market risks. Berkshire’s significant market risks are primarily associated with interest rates, equity prices, foreign currency

exchange rates and commodity prices. During the fourth quarter of 2008, conditions in the public debt and equity markets

declined significantly resulting in exceptional volatility in debt and equity prices. The impact of actions taken recently by

governmental bodies in response to the current economic crisis is difficult to predict, particularly over the short term. Berkshire

management believes that these extraordinary conditions are temporary and that equity prices will ultimately rise over time and

that credit markets will normalize but cannot predict the timing or magnitude of a recovery. The fair values of Berkshire’s

investment portfolios and its equity index put option contracts remain subject to considerable volatility, particularly over the

short term. The following sections address the significant market risks associated with Berkshire’s business activities.

Interest Rate Risk

Berkshire’s regularly invests in bonds, loans or other interest rate sensitive instruments. Berkshire’s strategy is to acquire

securities that are attractively priced in relation to the perceived credit risk. Management recognizes and accepts that losses may

occur with respect to assets. Berkshire strives to maintain high credit ratings so that the cost of debt is minimized. Berkshire

utilizes derivative products, such as interest rate swaps, to manage interest rate risks on a limited basis.

The fair values of Berkshire’s fixed maturity investments and notes payable and other borrowings will fluctuate in response

to changes in market interest rates. Increases and decreases in prevailing interest rates generally translate into decreases and

increases in fair values of those instruments. Additionally, fair values of interest rate sensitive instruments may be affected by

the creditworthiness of the issuer, prepayment options, relative values of alternative investments, the liquidity of the instrument

and other general market conditions. The fair values of fixed interest rate investments may be more sensitive to interest rate

changes than variable rate investments.

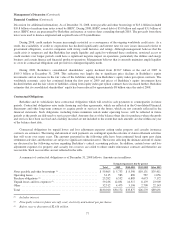

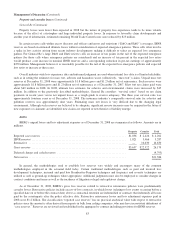

The following table summarizes the estimated effects of hypothetical changes in interest rates on assets and liabilities that

are subject to interest rate risk. It is assumed that the changes occur immediately and uniformly to each category of instrument

containing interest rate risk, and that no other significant factors change that determine the value of the instrument. The

hypothetical changes in interest rates do not reflect what could be deemed best or worst case scenarios. Variations in interest

rates could produce significant changes in the timing of repayments due to prepayment options available. For these reasons,

actual results might differ from those reflected in the table. Dollars are in millions.

Estimated Fair Value after

Hypothetical Change in Interest Rates

(bp=basis points)

100 bp 100 bp 200 bp 300 bp

Fair Value decrease increase increase increase

December 31, 2008

Insurance and other businesses:

Investments in fixed maturity securities ........................ $27,115 $27,847 $26,382 $25,685 $25,064

Notes payable and other borrowings .......................... 4,300 4,370 4,234 4,173 4,117

Finance and financial products businesses:

Investments in fixed maturity securities and loans and finance

receivables ............................................ 18,533 19,257 17,664 16,874 16,155

Notes payable and other borrowings .......................... 13,869 14,425 13,356 12,882 12,441

Utilities and energy businesses:

Notes payable and other borrowings .......................... 19,144 20,864 17,673 16,415 15,328

December 31, 2007

Insurance and other businesses:

Investments in fixed maturity securities ........................ $28,515 $29,179 $27,689 $26,967 $26,318

Notes payable and other borrowings .......................... 2,709 2,757 2,666 2,628 2,593

Finance and financial products businesses:

Investments in fixed maturity securities and loans and finance

receivables ............................................ 15,843 16,860 14,766 13,806 12,934

Notes payable and other borrowings .......................... 12,321 12,725 11,921 11,563 11,229

Utilities and energy businesses:

Notes payable and other borrowings .......................... 19,834 21,640 18,305 17,006 15,890

86