Berkshire Hathaway 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

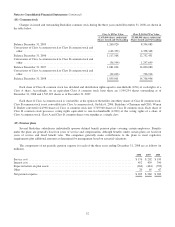

Notes to Consolidated Financial Statements (Continued)

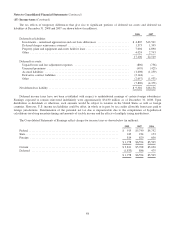

(20) Contingencies and Commitments (Continued)

MidAmerican’s commitments to purchase coal, electricity and natural gas. As of December 31, 2008, commitments under all

such subsidiary arrangements were approximately $6.6 billion in 2009, $4.0 billion in 2010, $2.9 billion in 2011, $2.5 billion in

2012, $2.1 billion in 2013 and $7.2 billion after 2013.

Berkshire is obligated to acquire the remaining minority shareholders’ interests of Marmon (36.4%) in stages between

2011 and 2014. Based upon the initial purchase price, the cost to Berkshire of the minority shareholders’ interest would be

approximately $2.7 billion. However, the consideration payable for the minority shareholders’ interest is contingent upon future

operating results of Marmon and the per share cost could be greater than or less than the initial per share price.

Berkshire is also obligated under certain conditions to acquire minority ownership interests of certain consolidated, but not

wholly-owned subsidiaries, pursuant to the terms of certain shareholder agreements with the minority shareholders. The

consideration payable for such interests is generally based on the fair value of the subsidiary. If Berkshire acquired all such

outstanding minority ownership interest holdings as of December 31, 2008, the cost to Berkshire would have been

approximately $4 billion. However, the timing and the amount of any such future payments that might be required are

contingent on future actions of the minority owners and future operating results of the related subsidiaries.

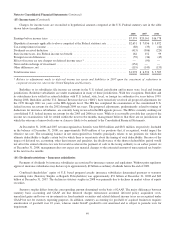

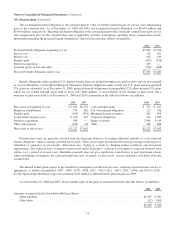

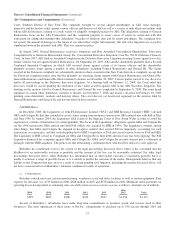

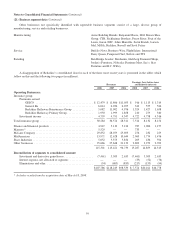

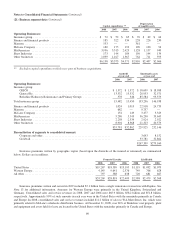

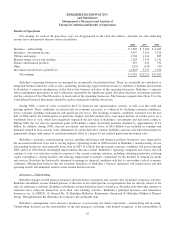

(21) Business segment data

Berkshire’s reportable business segments are organized in a manner that reflects how management views those business

activities. Certain businesses have been grouped together for segment reporting based upon similar products or product lines,

marketing, selling and distribution characteristics, even though those business units are operated under separate local

management.

The tabular information that follows shows data of reportable segments reconciled to amounts reflected in the Consolidated

Financial Statements. Intersegment transactions are not eliminated in instances where management considers those transactions

in assessing the results of the respective segments. Furthermore, Berkshire management does not consider investment and

derivative gains/losses or amortization of purchase accounting adjustments in assessing the performance of reporting units.

Collectively, these items are included in reconciliations of segment amounts to consolidated amounts.

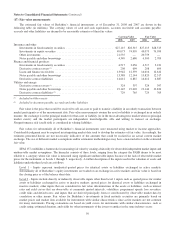

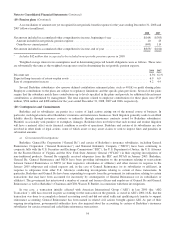

Business Identity Business Activity

GEICO Underwriting private passenger automobile insurance mainly

by direct response methods

General Re Underwriting excess-of-loss, quota-share and facultative

reinsurance worldwide

Berkshire Hathaway Reinsurance Group Underwriting excess-of-loss and quota-share reinsurance for

property and casualty insurers and reinsurers

Berkshire Hathaway Primary Group Underwriting multiple lines of property and casualty

insurance policies for primarily commercial accounts

BH Finance, Clayton Homes, XTRA, CORT and other financial

services (“Finance and financial products”)

Proprietary investing, manufactured housing and related

consumer financing, transportation equipment leasing,

furniture leasing, life annuities and risk management

products

Marmon An association of approximately 130 manufacturing and

service businesses that operate within 11 diverse business

sectors

McLane Company Wholesale distribution of groceries and non-food items

MidAmerican Regulated electric and gas utility, including power

generation and distribution activities in the U.S. and

internationally; domestic real estate brokerage

Shaw Industries Manufacturing and distribution of carpet and floor coverings

under a variety of brand names

58