Berkshire Hathaway 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

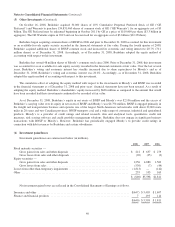

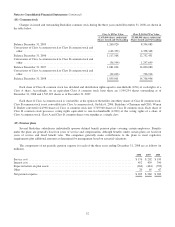

Notes to Consolidated Financial Statements (Continued)

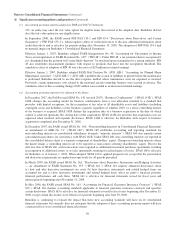

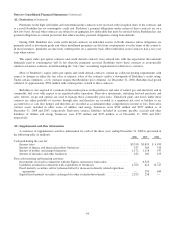

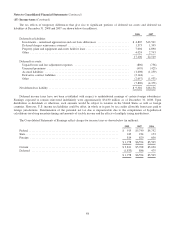

(13) Unpaid losses and loss adjustment expenses (Continued)

The liabilities for environmental, asbestos and latent injury claims and claims expenses net of reinsurance recoverables

were approximately $10.7 billion at December 31, 2008 and $11.2 billion at December 31, 2007. These liabilities included

approximately $9.2 billion at December 31, 2008 and $9.7 billion at December 31, 2007 of liabilities assumed under retroactive

reinsurance contracts. Liabilities arising from retroactive contracts with exposure to claims of this nature are generally subject to

aggregate policy limits. Thus, Berkshire’s exposure to environmental and latent injury claims under these contracts is, likewise,

limited. Berkshire monitors evolving case law and its effect on environmental and latent injury claims. Changing government

regulations, newly identified toxins, newly reported claims, new theories of liability, new contract interpretations and other

factors could result in significant increases in these liabilities. Such development could be material to Berkshire’s results of

operations. It is not possible to reliably estimate the amount of additional net loss or the range of net loss that is reasonably

possible.

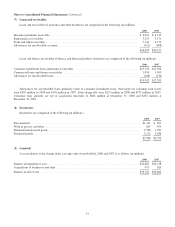

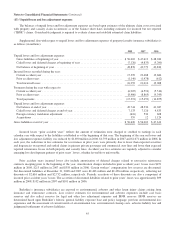

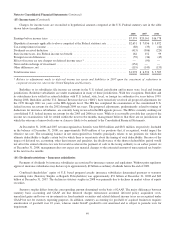

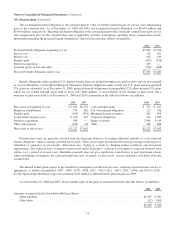

In November 2006, the Berkshire Hathaway Reinsurance Group’s lead insurance entity, National Indemnity Company

(“NICO”) and Equitas, a London based entity established to reinsure and manage the 1992 and prior years’ non-life insurance

and reinsurance liabilities of the Names or Underwriters at Lloyd’s of London, entered into an agreement for NICO to initially

provide up to $5.7 billion and potentially provide up to an additional $1.3 billion of reinsurance to Equitas in excess of its

undiscounted loss and allocated loss adjustment expense reserves as of March 31, 2006. The transaction became effective on

March 30, 2007. The agreement requires that NICO pay all claims and related costs that arise from the underlying insurance and

reinsurance contracts of Equitas, subject to the aforementioned excess limit of indemnification. On the effective date, the

aggregate limit of indemnification, which does not include unallocated loss adjustment expenses, was $13.8 billion. A

significant amount of loss exposure associated with Equitas is related to asbestos, environmental and latent injury claims.

NICO received substantially all of Equitas’ assets as consideration under the arrangement. The fair value of such

consideration was $7.1 billion and included approximately $540 million in cash and miscellaneous receivables plus a

combination of fixed maturity and equity securities which were delivered in April 2007. The cash and miscellaneous receivables

received are included in the accompanying Consolidated Statement of Cash Flows for 2007 as components of operating cash

flows. The investment securities received are reported as a non-cash investing activity.

The Equitas agreement was accounted for as reinsurance in accordance with SFAS No. 113 “Accounting and Reporting for

Reinsurance of Short-Duration and Long-Duration Contracts.” Accordingly, premiums earned of $7.1 billion and losses

incurred of $7.1 billion are reflected in the Consolidated Statement of Earnings. Losses incurred consisted of an estimated

liability for unpaid losses and loss adjustment expenses of $9.3 billion less an asset for unamortized deferred charges

reinsurance assumed of $2.2 billion. The deferred charge asset is being amortized over the expected remaining loss settlement

period using the interest method and the periodic amortization is being charged to earnings as a component of losses and loss

adjustment expenses incurred.

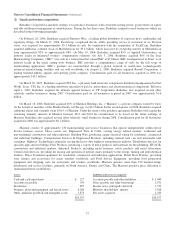

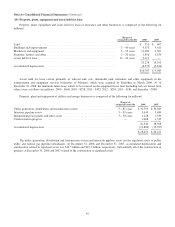

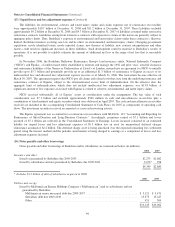

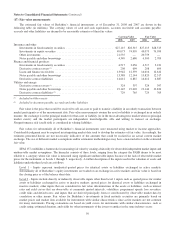

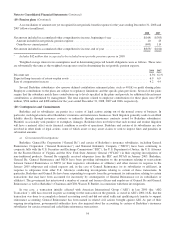

(14) Notes payable and other borrowings

Notes payable and other borrowings of Berkshire and its subsidiaries are summarized below (in millions).

2008 2007

Insurance and other:

Issued or guaranteed by Berkshire due 2009-2035 ............................................ $2,275 $1,682

Issued by subsidiaries and not guaranteed by Berkshire due 2009-2041 ........................... 2,074* 998

$4,349 $2,680

* Includes $1.1 billion of debt of subsidiaries acquired in 2008.

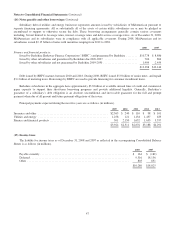

2008 2007

Utilities and energy:

Issued by MidAmerican Energy Holdings Company (“MidAmerican”) and its subsidiaries and not

guaranteed by Berkshire:

MidAmerican senior unsecured debt due 2009-2037 .................................... $ 5,121 $ 5,471

Subsidiary debt due 2009-2038 ..................................................... 13,573 13,227

Other ......................................................................... 451 304

$19,145 $19,002

46