Berkshire Hathaway 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

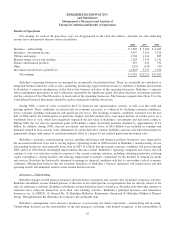

Results of Operations

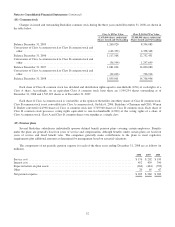

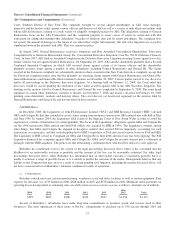

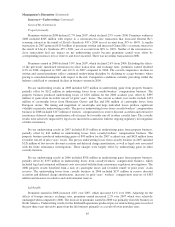

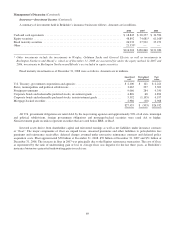

Net earnings for each of the past three years are disaggregated in the table that follows. Amounts are after deducting

income taxes and minority interests and are in millions.

2008 2007 2006

Insurance – underwriting ......................................................... $1,805 $ 2,184 $ 2,485

Insurance – investment income ..................................................... 3,497 3,510 3,120

Utilities and energy .............................................................. 1,704 1,114 885

Manufacturing, service and retailing ................................................ 2,283 2,353 2,131

Finance and financial products ..................................................... 479 632 732

Other ......................................................................... (129) (159) (47)

Investment and derivative gains/losses ............................................... (4,645) 3,579 1,709

Net earnings ............................................................... $4,994 $13,213 $11,015

Berkshire’s operating businesses are managed on an unusually decentralized basis. There are essentially no centralized or

integrated business functions (such as sales, marketing, purchasing, legal or human resources) and there is minimal involvement

by Berkshire’s corporate headquarters in the day-to-day business activities of the operating businesses. Berkshire’s corporate

office management participates in and is ultimately responsible for significant capital allocation decisions, investment activities

and the selection of the Chief Executive to head each of the operating businesses. The business segment data (Note 21 to the

Consolidated Financial Statements) should be read in conjunction with this discussion.

During 2008, a series of crises occurred in the U.S. financial and capital markets systems, as well as in the credit and

housing markets. These conditions accelerated into an economic recession, as evidenced by declining consumer confidence,

lower consumer spending, bankruptcies and significant job losses. The declining economic conditions worsened over the last

half of 2008 and in the fourth quarter in particular. Equity and debt markets have seen major declines in market prices on a

worldwide basis as well, which have negatively impacted the fair value of Berkshire’s investments and derivative contracts.

During 2008, the net after-tax unrealized gains in Berkshire’s equity investment portfolio declined by approximately $13.9

billion. In addition, during 2008, after-tax investment and derivative losses of $4.6 billion were included in earnings and

primarily related to non-cash fair value adjustments of certain derivative contract liabilities and non-cash other-than-temporary

impairment charges with respect to certain investments offset to a degree by net realized gains from investment sales.

Berkshire’s insurance, manufacturing, service, retailing and finance and financial products businesses were impacted by

the recession in different ways and to varying degrees. Operating results in 2008 for most of Berkshire’s manufacturing, service

and retailing businesses were generally lower than in 2007. It is likely that the current economic conditions will persist through

2009 and in to 2010 before meaningful improvements become evident. Berkshire’s operating companies have taken and will

continue to take cost reduction actions in response to the current economic situation, including curtailing production, reducing

capital expenditures, closing facilities and reducing employment to partially compensate for the declines in demand for goods

and services. Berkshire has historically attempted to manage its financial condition such that it can weather cyclical economic

conditions. Management believes that the economic franchises of Berkshire’s business operations will remain intact and that

operating results will ultimately return to more normal historical levels.

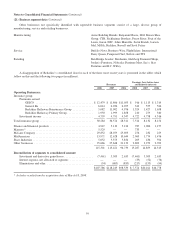

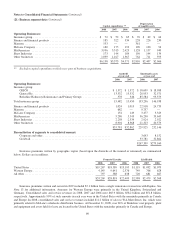

Insurance—Underwriting

Berkshire engages in both primary insurance and reinsurance of property and casualty risks. In primary insurance activities,

Berkshire subsidiaries assume defined portions of the risks of loss from persons or organizations that are directly subject to the

risks. In reinsurance activities, Berkshire subsidiaries assume defined portions of similar or dissimilar risks that other insurers or

reinsurers have subjected themselves to in their own insuring activities. Berkshire’s principal insurance and reinsurance

businesses are: (1) GEICO, (2) General Re, (3) Berkshire Hathaway Reinsurance Group and (4) Berkshire Hathaway Primary

Group. Through General Re, Berkshire also reinsures life and health risks.

Berkshire’s management views insurance businesses as possessing two distinct operations – underwriting and investing.

Underwriting decisions are the responsibility of the unit managers; investing, with limited exceptions, is the responsibility of

62