Berkshire Hathaway 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

ERKSHIRE

H

ATHAWAY

INC.

2008

ANNUAL REPORT

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2008 ANNUAL REPORT -

Page 2

... firm. Berkshire's finance and financial products businesses primarily engage in proprietary investing strategies (BH Finance), commercial and consumer lending (Berkshire Hathaway Credit Corporation and Clayton Homes) and transportation equipment and furniture leasing (XTRA and CORT). McLane Company... -

Page 3

... HATHAWAY INC. 2008 ANNUAL REPORT TABLE OF CONTENTS Business Activities ...Inside Front Cover Corporate Performance vs. the S&P 500 ...Chairman's Letter* ...2 3 Acquisition Criteria ...24 Management's Report on Internal Control Over Financial Reporting ...24 Report of Independent Registered Public... -

Page 4

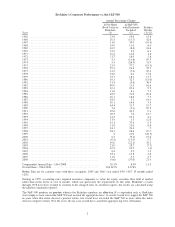

... - 1964-2008 ... Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market rather than at the lower of cost or market, which... -

Page 5

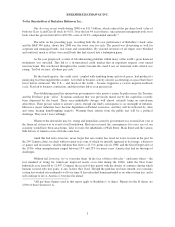

... of Berkshire Hathaway Inc.: Our decrease in net worth during 2008 was $11.5 billion, which reduced the per-share book value of both our Class A and Class B stock by 9.6%. Over the last 44 years (that is, since present management took over) book value has grown from $19 to $70,530, a rate of... -

Page 6

... profits that our insurance businesses realized in 2007 were not repeated in 2008. Nevertheless, the insurance group delivered an underwriting gain for the sixth consecutive year. This means that our $58.5 billion of insurance "float" - money that doesn't belong to us but that we hold and invest... -

Page 7

... our investments: stocks, bonds and cash equivalents. At yearend those totaled $122 billion (not counting the investments held by our finance and utility operations, which we assign to our second bucket of value). About $58.5 billion of that total is funded by our insurance float. Berkshire's second... -

Page 8

... by Berkshire (net of related income taxes) of $72 in 2008 and $70 in 2007. MidAmerican's record in operating its regulated electric utilities and natural gas pipelines is truly outstanding. Here's some backup for that claim. Our two pipelines, Kern River and Northern Natural, were both acquired in... -

Page 9

... has not paid a dividend since Berkshire bought into the company in early 2000. Its earnings have instead been reinvested to develop the utility systems our customers require and deserve. In exchange, we have been allowed to earn a fair return on the huge sums we have invested. It's a great... -

Page 10

..., a level at which the company had long been stuck. Now we have a 7.7% share, up from 7.2% in 2007. The combination of new business gains and an improvement in the renewal rate on existing business has moved GEICO into the number three position among auto insurers. In 1995, when Berkshire purchased... -

Page 11

...to average an underwriting profit. If so, we will be using free funds of large size for the indefinite future. Yearend Float Underwriting Profit (in millions) 2008 2007 2008 2007 $ 342 1,324 916 210 $2,792 Manufacturing, Service and Retailing Operations Our activities in this part of Berkshire cover... -

Page 12

... motley group, which sells products ranging from lollipops to motor homes, earned an impressive 17.9% on average tangible net worth last year. It's also noteworthy that these operations used only minor financial leverage in achieving that return. Clearly we own some terrific businesses. We purchased... -

Page 13

.... And the hangover continues to this day. This 1997-2000 fiasco should have served as a canary-in-the-coal-mine warning for the far-larger conventional housing market. But investors, government and rating agencies learned exactly nothing from the manufactured-home debacle. Instead, in an eerie rerun... -

Page 14

... who are using imaginative methods (or lobbying skills) to come under the government's umbrella - have money costs that are minimal. Conversely, highly-rated companies, such as Berkshire, are experiencing borrowing costs that, in relation to Treasury rates, are at record levels. Moreover, funds are... -

Page 15

Tax-Exempt Bond Insurance Early in 2008, we activated Berkshire Hathaway Assurance Company ("BHAC") as an insurer of the tax-exempt bonds issued by states, cities and other local entities. BHAC insures these securities for issuers both at the time their bonds are sold to the public (primary ... -

Page 16

...many bonds are insured pops up in other areas of finance. "Back-tested" models of many kinds are susceptible to this sort of error. Nevertheless, they are frequently touted in financial markets as guides to future action. (If merely looking up past financial data would tell you what the future holds... -

Page 17

... of float along with hundreds of millions of underwriting profit annually. But how busy can that keep a 31-person group? Charlie and I decided it was high time for them to start doing a full day's work. Investments Because of accounting rules, we divide our large holdings of common stocks this... -

Page 18

... near-zero returns on short-term bonds and no better than a pittance on long-terms. When the financial history of this decade is written, it will surely speak of the Internet bubble of the late 1990s and the housing bubble of the early 2000s. But the U.S. Treasury bond bubble of late 2008 may be... -

Page 19

..., the Fed was right to do so. A normal stock or bond trade is completed in a few days with one party getting its cash, the other its securities. Counterparty risk therefore quickly disappears, which means credit problems can't accumulate. This rapid settlement process is key to maintaining the... -

Page 20

... even and that the substantial investment income we earn on the funds will be frosting on the cake. Only a small percentage of our contracts call for any posting of collateral when the market moves against us. Even under the chaotic conditions existing in last year's fourth quarter, we had to post... -

Page 21

...the company's bonds are selling for 30 after default, we would owe $70 million.) For the typical contract, we receive quarterly payments for five years, after which our insurance expires. At yearend we had written $4 billion of contracts covering 42 corporations, for which we receive annual premiums... -

Page 22

... same price in BHAC, and used the accrual accounting required at insurance companies, we would have recorded a small profit for the year. The two methods by which we insure the bonds will eventually produce the same accounting result. In the short term, however, the variance in reported profits can... -

Page 23

... purchasing the i-house, you should next consider the Forest River RV and pontoon boat on display nearby. Make your neighbors jealous. GEICO will have a booth staffed by a number of its top counselors from around the country, all of them ready to supply you with auto insurance quotes. In most cases... -

Page 24

... having "Berkshire Weekend" discount pricing. We initiated this special event at NFM twelve years ago, and sales during the "Weekend" grew from $5.3 million in 1997 to a record $33.3 million in 2008. On Saturday of that weekend, we also set a single day record of $7.2 million. Ask any retailer what... -

Page 25

... have received only a handful of questions directly related to Berkshire and its operations. Last year there were practically none. So we need to steer the discussion back to Berkshire's businesses. In a related problem, there has been a mad rush when the doors open at 7 a.m., led by people who wish... -

Page 26

...our feeling about new ventures, turnarounds, or auction-like sales: "When the phone don't ring, you'll know it's me." NEW YORK STOCK EXCHANGE CORPORATE GOVERNANCE MATTERS As a listed Company with the New York Stock Exchange ("NYSE"), Berkshire is subject to certain Corporate Governance standards as... -

Page 27

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc. We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the "Company") as of December 31, 2008 and 2007, and the related consolidated statements... -

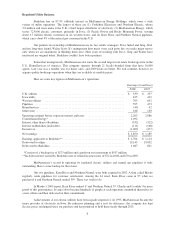

Page 28

... HATHAWAY INC. and Subsidiaries Selected Financial Data for the Past Five Years (dollars in millions except per share data) 2008 Revenues: Insurance premiums earned (1) ...Sales and service revenues ...Revenues of utilities and energy businesses (2) ...Interest, dividend and other investment... -

Page 29

... ...Property, plant, equipment and assets held for lease ...Goodwill ...Deferred charges reinsurance assumed ...Other ...Utilities and Energy: Cash and cash equivalents ...Property, plant and equipment ...Goodwill ...Other ...Finance and Financial Products: Cash and cash equivalents ...Investments... -

Page 30

...per share amounts) 2008 Year Ended December 31, 2007 2006 Revenues: Insurance and Other: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ...Investment gains/losses ...Utilities and Energy: Operating revenues ...Other ...Finance and Financial... -

Page 31

... on loans and finance receivables ...740 1,229 985 Acquisitions of businesses, net of cash acquired ...(6,050) (1,602) (10,132) Purchases of property, plant and equipment and assets held for lease ...(6,138) (5,373) (4,571) Other ...849 798 1,017 Net cash flows from investing activities ...(32,066... -

Page 32

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY AND COMPREHENSIVE INCOME (dollars in millions) Year Ended December 31, 2008 2007 2006 Class A & B Common Stock Balance at beginning and end of year ...Capital in Excess of Par Value Balance at ... -

Page 33

... of consolidation Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in a number of diverse business activities, including property and casualty insurance and reinsurance, utilities and energy, finance, manufacturing, service and retailing. Further... -

Page 34

... data used to develop the estimates of fair value. Accordingly, estimates of fair value presented herein are not necessarily indicative of the amounts that could be realized in a current or future market exchange. (h) Inventories Inventories consist of manufactured goods and purchased goods acquired... -

Page 35

... utility and energy subsidiaries where losses are offset by the establishment of a regulatory asset to the extent recovery in future rates is probable. (j) Goodwill Goodwill represents the excess of the purchase price over the fair value of identifiable net assets acquired in business acquisitions... -

Page 36

... rates used under statutory accounting principles. The periodic discount accretion is included in the Consolidated Statements of Earnings as a component of losses and loss adjustment expenses. (m) Deferred charges reinsurance assumed The excess of estimated liabilities for claims and claim costs... -

Page 37

... policies and practices (Continued) (o) Regulated utilities and energy businesses Certain domestic energy subsidiaries prepare their financial statements in accordance with SFAS 71, reflecting the economic effects from the ability to recover certain costs from customers and the requirement to return... -

Page 38

...AUG AIR-1"). AUG AIR-1 prohibits the accrual of liabilities in periods before the maintenance is performed. Berkshire elected to use the direct expense method where maintenance costs are expensed as incurred. Previously, certain maintenance costs related to the fractional aircraft ownership business... -

Page 39

... Financial Statements (Continued) (2) Significant business acquisitions Berkshire's long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity and able and honest management at sensible prices. During the last three years, Berkshire acquired... -

Page 40

... Losses * Fair Value 2008 Insurance and other: U.S. Treasury, U.S. government corporations and agencies ...States, municipalities and political subdivisions ...Foreign governments ...Corporate bonds and redeemable preferred stocks ...Mortgage-backed securities ...Finance and financial products... -

Page 41

...Goldman Sachs Group, Inc. ("GS") and The General Electric Company ("GE"). These securities are reflected in other fixed maturity and equity investments in the preceding table. In addition, Berkshire adopted the equity method with respect to its investments in Burlington Northern Santa Fe Corporation... -

Page 42

... Warrants expire in 2013 and can be exercised for an aggregate cost of $3 billion ($22.25/share). Berkshire began acquiring common shares of BNSF in 2006 and prior to December 31, 2008 accounted for this investment as an available-for-sale equity security recorded in the financial statements at fair... -

Page 43

...). 2008 2007 Insurance premiums receivable ...Reinsurance recoverables ...Trade and other receivables ...Allowances for uncollectible accounts ... $ 4,961 $ 4,215 3,235 3,171 7,141 6,179 (412) (408) $14,925 $13,157 Loans and finance receivables of finance and financial products businesses are... -

Page 44

...and thereafter - $384. Property, plant and equipment of utilities and energy businesses is comprised of the following (in millions). Ranges of estimated useful life 2008 2007 Utility generation, distribution and transmission system ...Interstate pipeline assets ...Independent power plants and other... -

Page 45

... all of the contracts is dependent on the loss recovery rate related to the specific obligor at the time of the default. Included in other assets of finance and financial products businesses. (3) (4) As of December 31, 2008, Berkshire has written equity index put option contracts on four major... -

Page 46

...the year for: Income taxes ...Interest of finance and financial products businesses ...Interest of utilities and energy businesses ...Interest of insurance and other businesses ...Non-cash investing and financing activities: Investments received in connection with the Equitas reinsurance transaction... -

Page 47

... of discounted liabilities related to prior years' losses was approximately $99 million in 2008, $102 million in 2007 and $101 million in 2006. Berkshire's insurance subsidiaries are exposed to environmental, asbestos and other latent injury claims arising from insurance and reinsurance contracts... -

Page 48

...In November 2006, the Berkshire Hathaway Reinsurance Group's lead insurance entity, National Indemnity Company ("NICO") and Equitas, a London based entity established to reinsure and manage the 1992 and prior years' non-life insurance and reinsurance liabilities of the Names or Underwriters at Lloyd... -

Page 49

... used to provide financing for consumer installment loans. Berkshire subsidiaries in the aggregate have approximately $3.8 billion of available unused lines of credit and commercial paper capacity to support their short-term borrowing programs and provide additional liquidity. Generally, Berkshire... -

Page 50

... are shown below (in millions). 2008 2007 Deferred tax liabilities: Investments - unrealized appreciation and cost basis differences ...Deferred charges reinsurance assumed ...Property, plant and equipment and assets held for lease ...Other ...Deferred tax assets: Unpaid losses and loss adjustment... -

Page 51

... reinsurance assumed, deferred policy acquisition costs, unrealized gains and losses on investments in fixed maturity securities and related deferred income taxes are recognized under GAAP but not for statutory reporting purposes. In addition, statutory accounting for goodwill of acquired businesses... -

Page 52

... unadjusted quoted prices for identical assets or liabilities exchanged in active markets. Substantially all of Berkshire's equity investments are traded on an exchange in active markets and fair value is based on the closing price as of the balance sheet date. Level 2 - Inputs include directly or... -

Page 53

...the Black-Scholes option valuation model which Berkshire believes is used widely by market participants. Credit default contracts are primarily valued based on indications of bid or offer data as of the balance sheet date. These contracts are not exchange traded and certain of the terms of Berkshire... -

Page 54

... Class A common stock. Class A and Class B common shares vote together as a single class. (19) Pension plans Several Berkshire subsidiaries individually sponsor defined benefit pension plans covering certain employees. Benefits under the plans are generally based on years of service and compensation... -

Page 55

... level of risk. There are no target investment allocation percentages with respect to individual or categories of investments. Allocations may change as a result of changing market conditions and investment opportunities. The expected rates of return on plan assets reflect Berkshire's subjective... -

Page 56

... the same as the weighted average rates used in determining the net periodic pension expense. 2008 2007 Discount rate ...Expected long-term rate of return on plan assets ...Rate of compensation increase ... 6.3% 6.1% 6.9 6.9 4.2 4.4 Several Berkshire subsidiaries also sponsor defined contribution... -

Page 57

... provisions of the federal securities laws in connection with the AIG Transaction. The SEC case is presently stayed. Joseph Brandon, who resigned as the Chief Executive Officer of General Re effective on April 14, 2008, also received a "Wells" notice from the SEC in 2005. Berkshire understands that... -

Page 58

... receivers filed motions to dismiss the Complaint. These motions are pending. Actions related to AIG General Reinsurance is a defendant in In re American International Group Securities Litigation, Case No. 04-CV-8141(LTS), United States District Court, Southern District of New York, a putative class... -

Page 59

.... 2009 2010 2011 2012 2013 After 2013 Total $583 $483 $406 $340 $247 $1,056 $3,115 Several of Berkshire's subsidiaries have made long-term commitments to purchase goods and services used in their businesses. The most significant of these relate to NetJets' commitments to purchase up to 556... -

Page 60

.... Business Identity Business Activity GEICO General Re Berkshire Hathaway Reinsurance Group Berkshire Hathaway Primary Group BH Finance, Clayton Homes, XTRA, CORT and other financial services ("Finance and financial products") Underwriting private passenger automobile insurance mainly by direct... -

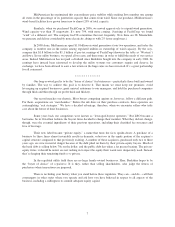

Page 61

...2007 Earnings (loss) before taxes and minority interests 2008 2007 2006 2008 2006 Operating Businesses: Insurance group: Premiums earned: GEICO ...$ 12,479 $ 11,806 $11,055 $ 916 $ 1,113 $ 1,314 General Re ...6,014 6,076 6,075 342 555 526 Berkshire Hathaway Reinsurance Group ...5,082 11,902 4,976... -

Page 62

...business acquisitions. $5,373 $4,571 $2,810 $2,407 $2,066 Goodwill at year-end 2008 2007 Identifiable assets at year-end 2008 2007 Operating Businesses: Insurance group: GEICO ...General Re ...Berkshire Hathaway Reinsurance and Primary Groups ...Total insurance group ...Finance and financial... -

Page 63

...have no practical analytical value. Derivative gains/losses include significant amounts related to non-cash fair value changes in the value of long-term contracts arising from short-term changes in equity prices, interest rate and foreign currency rates, among other factors. After-tax investment and... -

Page 64

... or integrated business functions (such as sales, marketing, purchasing, legal or human resources) and there is minimal involvement by Berkshire's corporate headquarters in the day-to-day business activities of the operating businesses. Berkshire's corporate office management participates in... -

Page 65

... of underwriting results from Berkshire's insurance businesses for the past three years. Amounts are in millions. 2008 2007 2006 Underwriting gain attributable to: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Pre-tax underwriting gain ...Income... -

Page 66

...an annualized rate of three to six percent. General Re General Re conducts a reinsurance business offering property and casualty and life and health coverages to clients worldwide. Property and casualty reinsurance is written in North America on a direct basis through General Reinsurance Corporation... -

Page 67

.../workers' compensation business in 2008 included $117 million of workers' compensation loss reserve discount accretion and retroactive reinsurance deferred charge amortization, offset in part by favorable run-off in other casualty lines. The casualty results were adversely impacted by legal costs... -

Page 68

... rates. During 2008, Berkshire entered into a contract under which it received a payment of $224 million and agreed to purchase, under certain conditions, up to $4 billion of revenue bonds issued by the Florida Hurricane Catastrophe Fund Finance Corporation. Berkshire's obligation was conditioned... -

Page 69

...management of certain workers' compensation business was transferred to the Berkshire Hathaway Primary Group and the related underwriting results have been excluded from BHRG since that date. In December 2007, BHRG formed a monoline financial guarantee insurance company, Berkshire Hathaway Assurance... -

Page 70

... in dividends earned was offset by a decline in interest earned, reflecting lower levels of related fixed maturity investments and generally lower interest rates applicable to cash equivalents and short-term investments. In October 2008, Berkshire subsidiaries acquired the Wrigley, Goldman Sachs and... -

Page 71

... in Burlington Northern and Moody's are included in equity securities. Fixed maturity investments as of December 31, 2008 were as follows. Amounts are in millions. Amortized cost Unrealized gains/losses Fair value U.S. Treasury, government corporations and agencies ...States, municipalities and... -

Page 72

... millions. 2008 Revenues 2007 2006 2008 Earnings 2007 2006 MidAmerican Energy Company ...PacifiCorp ...Natural gas pipelines ...U.K. utilities ...Real estate brokerage ...Other ...Earnings before corporate interest and taxes ...Interest, other than to Berkshire ...Interest on Berkshire junior debt... -

Page 73

...acquisition date (March 21, 2006). In 2007, PacifiCorp's revenues and EBIT were favorably impacted by regulatory-approved rate increases and higher customer usage in retail markets, as well as increased margins on wholesale electricity sales, partially offset by higher fuel and purchased power costs... -

Page 74

... the Consolidated Financial Statements by ($4 million) in 2008, $48 million in 2007 and $79 million in 2006. Marmon Berkshire acquired a 60% interest in Marmon Holdings, Inc. ("Marmon") on March 18, 2008. During the second quarter of 2008, Berkshire acquired additional shares and currently has a 63... -

Page 75

... group are: TTI, a leading electronic components distributor (acquired March 2007); Business Wire, a leading distributor of corporate news, multimedia and regulatory filings; The Pampered Chef, a direct seller of high quality kitchen tools; International Dairy Queen, a licensor and service provider... -

Page 76

... quarter of 2008, the decline accelerated and conditions for most retailers throughout the U.S. deteriorated. Fourth quarter of 2008 revenues and pre-tax earnings of Berkshire's retailers declined 17% and 33%, respectively, versus the fourth quarter of 2007. Finance and Financial Products A summary... -

Page 77

... an increase in interest rates. Partially offsetting these declines was a $22 million gain from the sale of the housing community division in the first quarter of 2008. Revenues and pre-tax earnings from furniture and transportation equipment leasing activities in 2008 declined $37 million (5%) and... -

Page 78

... date of the contract. Financial Condition Berkshire's balance sheet continues to reflect significant liquidity. Consolidated cash and invested assets, excluding assets of utilities and energy and finance and financial products businesses, was approximately $122.0 billion at December 31, 2008... -

Page 79

... Berkshire has ample liquidity and capital to withstand these conditions, restricted access to credit markets over longer periods could have a significant negative impact on operations, particularly the utilities and energy business and certain finance and financial products operations. Management... -

Page 80

... Sheets without discounting for time value, regardless of the length of the claim-tail. Amounts are in millions. Gross unpaid losses Dec. 31, 2008 Dec. 31, 2007 Net unpaid losses * Dec. 31, 2008 Dec. 31, 2007 GEICO ...General Re ...BHRG ...Berkshire Hathaway Primary Group ...Total ... $ 7,336... -

Page 81

Management's Discussion (Continued) Property and casualty losses (Continued) GEICO (Continued) GEICO predominantly writes private passenger auto insurance which has a relatively short claim-tail. The key assumptions affecting GEICO's reserves include projections of ultimate claim counts ("frequency... -

Page 82

...claims reports are required from ceding companies, such reports are generally required at quarterly intervals which in the U.S. range from 30 to 90 days after the end of the accounting period. In continental Europe, reinsurance reporting practices vary. Fewer clients report premiums, losses and case... -

Page 83

... of discounts of $2,616 million. Includes directors and officers and errors and omissions coverage. Includes medical malpractice and umbrella coverage. General Re's process of establishing loss reserve estimates is based upon a ground-up approach, beginning with case estimates and supplemented by... -

Page 84

... limited to the following: changes in client claims practices, changes in claim examiners' use of ACRs or the frequency of client company claim reviews, changes in policy terms and coverage (such as client loss retention levels and occurrence and aggregate policy limits), changes in loss trends and... -

Page 85

... effective date. Retroactive reinsurance losses and loss adjustment expenses paid in 2008 were $1.2 billion. The classification "reported case reserves" has no practical analytical value with respect to retroactive policies since the amount is often derived from reports in bulk from ceding companies... -

Page 86

... data available to the Company that periodically shows trading volume and actual prices. As a result, the values of these liabilities are primarily based on valuation models, discounted cash flow models or other valuation techniques that are believed to be used by market participants. Such models... -

Page 87

...that model include the current index value, strike price, discount or interest rate, dividend rate and contract expiration date. The weighted averaged discount and dividend rates used as of December 31, 2008 were each approximately 4%. Berkshire believes the most significant economic risks relate to... -

Page 88

...market risks associated with Berkshire's business activities. Interest Rate Risk Berkshire's regularly invests in bonds, loans or other interest rate sensitive instruments. Berkshire's strategy is to acquire securities that are attractively priced in relation to the perceived credit risk. Management... -

Page 89

... to its investments provided that the underlying business, economic and management characteristics of the investees remain favorable. Berkshire strives to maintain above average levels of shareholder capital to provide a margin of safety against short-term equity price volatility. Market prices for... -

Page 90

... causes losses insured by Berkshire's insurance subsidiaries, changes in insurance laws or regulations, changes in Federal income tax laws, and changes in general economic and market factors that affect the prices of securities or the industries in which Berkshire and its affiliates do business. 88 -

Page 91

... Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola or American Express shares, we think of Berkshire as being a non-managing partner in two extraordinary businesses, in which we measure our success by the long-term... -

Page 92

through purchases of marketable common stocks by our insurance subsidiaries. The price and availability of businesses and the need for insurance capital determine any given year's capital allocation. In recent years we have made a number of acquisitions. Though there will be dry years, we expect to ... -

Page 93

Besides, Berkshire has access to two low-cost, non-perilous sources of leverage that allow us to safely own far more assets than our equity capital alone would permit: deferred taxes and "float," the funds of others that our insurance business holds because it receives premiums before needing to pay... -

Page 94

...by the company during that holding period. For this to come about, the relationship between the intrinsic value and the market price of a Berkshire share would need to remain constant, and by our preferences at 1-to-1. As that implies, we would rather see Berkshire's stock price at a fair level than... -

Page 95

... in this business to the managers of our subsidiaries. In fact, we delegate almost to the point of abdication: Though Berkshire has about 246,000 employees, only 19 of these are at headquarters. Charlie and I mainly attend to capital allocation and the care and feeding of our key managers. Most of... -

Page 96

... would be difficult to develop a peer group of companies similar to Berkshire. The Corporation owns subsidiaries engaged in a number of diverse business activities of which the most important is the property and casualty insurance business and, accordingly, management has used the Standard and Poor... -

Page 97

...and low sales prices per share, as reported on the New York Stock Exchange Composite List during the periods indicated: 2008 Class A High Low Class B High Low Class A High Low 2007 Class B High Low First Quarter ...Second Quarter ...Third Quarter ...Fourth Quarter ...Dividends $145,900 135,500 147... -

Page 98

BERKSHIRE HATHAWAY INC. OPERATING COMPANIES INSURANCE BUSINESSES Company Employees Company Employees Berkshire Hathaway Homestate Companies ...627 Berkshire Hathaway Reinsurance Group ...593 Boat America Corporation ...377 Central States Indemnity Co...431 GEICO ...22,249 General Re Corporation ... -

Page 99

...of the law firm of Munger, Tolles & Olson LLP WALTER SCOTT, JR., Chairman of Level 3 Communications, a successor to certain businesses of Peter Kiewit Sons' Inc. which is engaged in telecommunications and computer outsourcing. Letters from Annual Reports (1977 through 2008), quarterly reports, press... -

Page 100

BERKSHIRE HATHAWAY INC. Executive Offices - 3555 Farnam Street, Omaha, Nebraska 68131