Anthem Blue Cross 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

Anthem, Inc. 2002 Annual Report 83

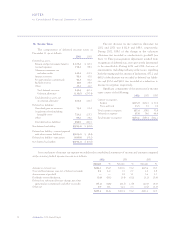

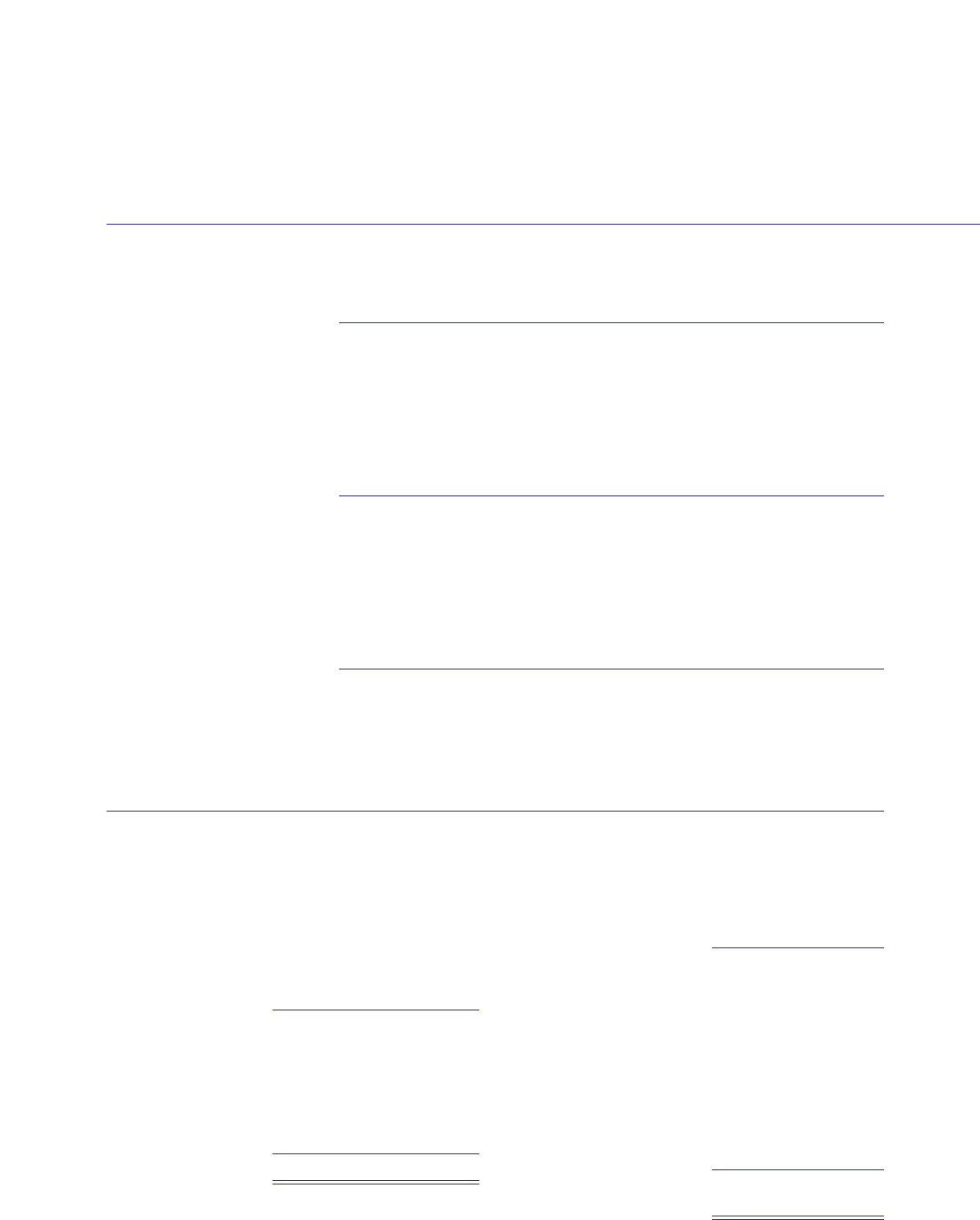

Financial data by reportable segment is as follows:

Other and

Midwest East West Southeast Specialty Eliminations Total

2002

Operating revenue from

external customers $6,050.1 $4,151.3 $919.8 $1,467.5 $224.0 $ 177.8 $12,990.5

Intersegment revenues 1.3 0.2 0.3 0.4 299.5 (301.7) —

Operating gain (loss) 271.6 222.9 74.7 116.0 50.7 (91.4) 644.5

Depreciation and amortization 1.1 2.2 0.5 13.7 3.4 87.2 108.1

Other and

Midwest East West Southeast Specialty Eliminations Total

2001

Operating revenue from

external customers $ 5,093.0 $ 3,667.3 $ 774.4 $ — $ 182.1 $ 403.5 $ 10,120.3

Intersegment revenues — — — — 214.0 (214.0) —

Operating gain (loss) 161.5 128.8 20.1 — 32.9 (23.8) 319.5

Depreciation and amortization 1.0 2.4 2.8 — 2.6 80.8 89.6

Other and

Midwest East West Southeast Specialty Eliminations Total

2000

Operating revenue from

external customers $ 4,452.3 $ 2,921.9 $ 622.4 $ — $ 188.8 $ 358.1 $ 8,543.5

Intersegment revenues 8.2 — — — 143.5 (151.7) —

Operating gain (loss) 87.8 103.8 2.5 — 24.9 (34.9) 184.1

Depreciation and amortization 16.9 17.1 8.7 — 2.1 30.5 75.3

Asset and equity details by reportable segment have

not been disclosed, as they are not reported internally by

the Company.

A reconciliation of reportable segment operating

revenues to the amounts of total revenues included in the

consolidated statements of income for 2002, 2001 and

2000 is as follows:

2002 2001 2000

Reportable segments

operating revenues $12,990.5 $10,120.3 $8,543.5

Net investment income 260.7 238.6 201.6

Net realized gains

on investments 30.4 60.8 25.9

Gain on sale of

subsidiary operations 0.7 25.0 —

Total revenues $13,282.3 $10,444.7 $8,771.0

A reconciliation of reportable segment operating

gain to income before income taxes and minority interest

included in the consolidated statements of income for

2002, 2001 and 2000 is as follows:

2002 2001 2000

Reportable segments

operating gain $644.5 $319.5 $184.1

Net investment income 260.7 238.6 201.6

Net realized gains on

investments 30.4 60.8 25.9

Gain on sale of subsidiary

operations 0.7 25.0 —

Interest expense (98.5) (60.2) (54.7)

Amortization of goodwill

and other intangible assets (30.2) (31.5) (27.1)

Demutualization expenses —(27.6) —

Income before income taxes

and minority interest $807.6 $524.6 $329.8