Anthem Blue Cross 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our mission is to improve the health of the people we serve, and we continued to make signif-

icant progress in 2002. At the same time, we improved the company’s overall performance in

providing value to our shareholders, customers and communities.

•We acquired Trigon Healthcare, Inc., a highly successful Blue Cross and Blue Shield licensee in

Virginia, to form a new Southeast region. We were pleased to have been able to establish our

fourth region with such a high-performing company whose best practices make our entire Anthem

organization even stronger.

•Our membership surpassed 11 million at year’s end, a 40 percent increase over 2001. Our Trigon

acquisition added 2.5 million members and our existing customer base grew by 8 percent.

•Membership growth resulted from listening to our customers and responding with products they

value. We introduced several new products under the umbrella name Anthem ByDesign that offer

customers more choices and more affordable health benefits.

•Customer retention, once again, exceeded 90 percent reflecting high levels of customer confidence

and satisfaction.

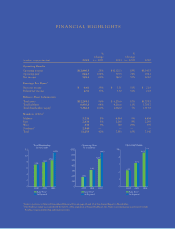

•Our growth resulted in operating revenue increasing 28 percent to $13 billion.

•Our financial strength improved, with net income increasing 60 percent to $549.1 million, or

$4.51 per diluted share, compared with $342.2 million, or $3.30 per diluted share, in 2001.

These results are a reflection of our strong commitment to serving our members and

continually improving our operations. Our financial strength provides the resources to invest

in the people, products, programs and technology essential to improving the quality and

affordability of health benefits and service to our members.

We continued to work closely with the medical community to improve care for our

members. We collaborated with physicians and hospitals on innovative programs in which they

receive enhanced reimbursement for clinical quality and excellence. We also worked with

hospitals to create reimbursement programs that reward exceptional results in patient safety

and other measures through our nationally recognized Midwest Hospital Quality Program, now

in its 10th year. Reimbursement programs focusing on quality were expanded to hospitals and

physicians in our East and Southeast regions as well.

To our shareholders, customers and communities:

a picture of health

10

Comparison of Cumulative Total Return* Among Anthem, Inc.,

the S&P 500 Index and the MS Healthcare Payor Index

0

50

100

150

$

200

12/31/

02

12/31/0110/30/01

Anthem, Inc. MS Healthcare Payor Index

S&P 500 Index

*Based upon an initial investment of $100 on 10/30/01 with dividends reinvested.