Anthem Blue Cross 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

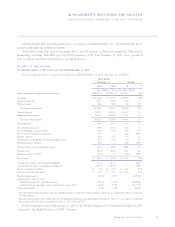

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

48 Anthem, Inc. 2002 Annual Report

Additional review of Note 8 indicates that we are

paying claims faster. The percentage of claims paid in the

same year as they were incurred increased to 84.3% in

2002 compared with 83.1% in 2001 and 81.3% in 2000.

This is primarily attributable to our implementation of

new systems and improved electronic connectivity with

our networks. As a result of our improved connectivity we

are able to adjudicate and pay claims more swiftly.

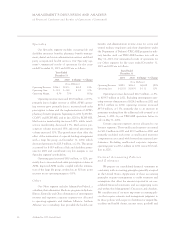

Income Taxes

We account for income taxes in accordance with

Statement of Financial Accounting Standards No. 109,

Accounting for Income Taxes. This standard requires, among

other things, the separate recognition of deferred tax assets

and deferred tax liabilities. Such deferred tax assets and

deferred tax liabilities represent the tax effect of temporary

differences between financial reporting and tax reporting

measured at tax rates enacted at the time the deferred tax

asset or liability is recorded. A valuation allowance must be

established for deferred tax assets if it is “more likely than

not” that all or a portion may be unrealized.

At each quarterly financial reporting date, we assess

the adequacy of the valuation allowance by evaluating

each of our deferred tax assets based on the key elements

that follow:

•the types of temporary differences that created the

deferred tax asset;

•the amount of taxes paid in prior periods and available

for a carry-back claim;

•the forecasted future taxable income and therefore

likely future deduction of the deferred tax item; and

•any significant other issues impacting the likely realiza-

tion of the benefit of the temporary differences.

During 2002, based on our quarterly assessments of

the valuation allowance it was determined that the only

items that require a valuation allowance are those that

relate to specific deferred tax temporary differences and

not those that relate to the anticipation of future taxable

income. This determination was due to the levels of tax-

able income reported on our 2001 tax return, income

generated during 2002 and taxable income expected in

future periods. As a result of this determination, during

2002, we reduced our valuation allowance. The net

decrease in the valuation allowance for 2002 was $112.4

million. During 2002, $18.0 million of the change in the

valuation allowance was recorded as a reduction to good-

will. This postacquisition adjustment resulted from recog-

nition of deferred tax assets previously determined to be

unrealizable. Because of uncertainties including industry-

wide issues regarding both the timing and the amount of

deductions, we recorded a $57.2 million deferred tax

liability. We also recorded a reduction to income tax

expense of $37.2 million. This reduction contributed to a

reduced effective tax rate of 31.6%.

To the extent we prevail in matters we have accrued

for or are required to pay more than reserved, our future

effective tax rate and net income in any given period

could be materially impacted. In addition, the Internal

Revenue Service continues its examination of two of our

five open tax years.

For additional information, see Note 12 to our

audited consolidated financial statements for the years

ended December 31, 2002, 2001 and 2000.

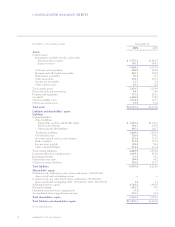

Goodwill and Other Intangible Assets

On January 1, 2002, we adopted Statement of Finan-

cial Accounting Standards No. 141, Business Combinations,

and Statement of Accounting Standards No. 142, Goodwill

and Other Intangible Assets. FAS 141 requires business com-

binations completed after June 30, 2001 to be accounted

for using the purchase method of accounting. It also speci-

fies the types of acquired intangible assets that are required

to be recognized and reported separately from goodwill.

On July 31, 2002, we completed our purchase of

100% of the outstanding stock of Trigon. In accordance

with FAS 141, we allocated the purchase price to the fair

value of assets acquired and liabilities assumed, including

identifiable intangible assets. The allocation resulted in

$2,166.6 million of estimated non-tax deductible good-

will and $1,172.7 million of acquired intangible assets.

Following this acquisition, our consolidated goodwill at

December 31, 2002 was $2,484.9 million and intangible

assets were $1,274.6 million. The sum of goodwill and

intangible assets represented 31% of our total consoli-

dated assets at December 31, 2002.

Under FAS 142, goodwill and other intangible assets

(with indefinite lives) will not be amortized but will be

tested for impairment at least annually. We completed