Anthem Blue Cross 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

Anthem, Inc. 2002 Annual Report 49

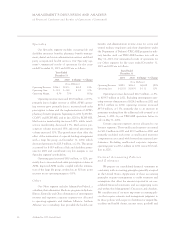

our transitional impairment test of existing goodwill

and other intangible assets (with indefinite lives) during

the second quarter of 2002. In addition, we completed

our annual impairment test of goodwill and other intangi-

ble assets (with indefinite lives) during the fourth quarter

of 2002. Based upon these tests we have not incurred any

impairment losses related to any intangible assets.

While we believe we have appropriately allocated the

purchase price of our acquisitions, this allocation requires

many assumptions to be made regarding the fair value of

assets and liabilities acquired. In addition, the annual

impairment testing required under FAS 142 requires us to

make assumptions and judgments regarding the estimated

fair value of our goodwill and intangibles. Such assump-

tions include the present value discount factor used to

determine the fair value of a reporting unit, which is ulti-

mately used to identify potential goodwill impairment.

Such estimated fair values might produce significantly dif-

ferent results if other reasonable assumptions and esti-

mates were to be used. Because of the amounts of goodwill

and other intangible assets included in our consolidated

balance sheet, the impairment analysis is significant. If we

are unable to support a fair value estimate in future annual

impairment tests, we may be required to record impair-

ment losses against future income.

For additional information, see Note 3 to our audited

consolidated financial statements for the years ended

December 31, 2002, 2001 and 2000.

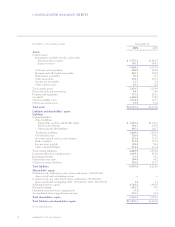

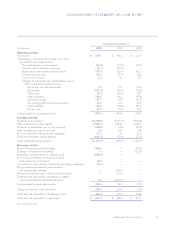

Investments

Total investment securities were $5,948.1 million at

December 31, 2002 and represented 48% of our total con-

solidated assets at December 31, 2002. Our fixed maturity

and equity securities are classified as “available-for-sale”

securities and are reported at fair value. We have deter-

mined that all investments in our portfolio are available

to support current operations, and accordingly, have clas-

sified such securities as current assets. Investment income

is recorded when earned, and realized gains or losses,

determined by specific identification of investments sold,

are included in income when sold.

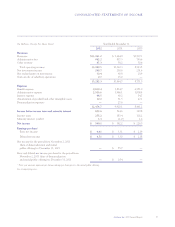

We evaluate our investment securities on a quarterly

basis, using both quantitative and qualitative factors, to

determine whether a decline in value is other than tem-

porary. Such factors considered include the length of time

and the extent to which a security’s market value has

been less than its cost, financial condition and near term

prospects of the issuer, recommendations of investment

advisors, and forecasts of economic, market or industry

trends. If any declines are determined to be other than

temporary, we charge the losses to income when that

determination is made. The current economic environ-

ment and recent volatility of securities markets increase

the difficulty of determining fair value and assessing

investment impairment. The same influences tend to

increase the risk of potentially impaired assets. Manage-

ment believes it has adequately reviewed for impairment

and that its investment securities are carried at fair value.

However, over time, the economic and market environ-

ment may provide additional insight regarding the fair

value of certain securities, which could change manage-

ment’s judgment regarding impairment. This could result

in realized losses relating to other than temporary

declines being charged against future income.

Through our investing activities, we are exposed to

financial market risks, including those resulting from

changes in interest rates and changes in equity market

valuations. Our primary objective is the preservation of

the asset base and maximization of portfolio income

given an acceptable level of risk. We manage the market

risks through our investment policy, which establishes

credit quality limits and percentage amount limits of

investments in individual issuers. If we are unable to

effectively manage these risks, it could have an impact on

our future earnings and financial position.

The unrealized losses of $7.8 million on our fixed

maturity securities at December 31, 2002 were substan-

tially related to interest rate changes. We expect the

scheduled principal and interest payments will be real-

ized. Our equity securities are comprised of indexed

mutual funds and the unrealized losses of $38.6 million at

December 31, 2002 were a result of the current market

fluctuations and are deemed to be temporary.

For additional information, see “Quantitative and

Qualitative Disclosures about Market Risk” and Note 4 to

our audited consolidated financial statements for the

years ended December 31, 2002, 2001 and 2000.