Anthem Blue Cross 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

Anthem, Inc. 2002 Annual Report 35

the lowest co-payment, brand name drugs included in the

drug formulary have a higher co-payment and brand

name drugs omitted from the drug formulary have the

highest co-payment. Drug formularies are lists of prescrip-

tion drugs that have been reviewed and selected for their

quality and effectiveness by a committee of community-

based practicing physicians and clinical pharmacists.

Through our pharmacy benefit design, we encourage use

of these formulary listed brand name and generic drugs to

ensure members receive quality and cost-effective med-

ication. The favorable impact of three-tier drug programs

on prescription drug cost trends is most significant in the

first year of implementation. Excluding the impact of our

Trigon acquisition, we have already implemented three-

tier drug programs for approximately 66% of our members

as of December 31, 2002, as compared to approximately

60% of our members as of December 31, 2001.

Inpatient services costs increased approximately 9%

including the impact of our Trigon acquisition for the

entire rolling 12-month periods, including periods prior

to July 31, 2002. Excluding the impact of our Trigon

acquisition, our inpatient services trend was approx-

imately one percentage point lower. Approximately

two thirds of this trend resulted from unit cost increases

and approximately one third of this trend resulted from

utilization increases. The cost trend was primarily due to

a health care industry shift of lower-cost procedures to

outpatient settings, leaving more expensive procedures

performed in inpatient settings. In addition, growth in

inpatient trend was due to implementation of new

provider contracts that reflect the hospital industry’s

more aggressive stance in their contracting with health

benefit companies. Utilization increases resulted prima-

rily from increases in the frequency of inpatient surgeries.

We are implementing advanced care management pro-

grams and disease management programs which have

been proven to reduce deterioration in health and the

need for hospitalization. As a result of these programs,

hospital utilization has been essentially stable.

Administrative expense increased $520.5 million, or

26%, in 2002. On a same-store basis, administrative

expense increased $319.6 million, or 17%, primarily due

to higher salary cost and merit increases, other volume

sensitive costs such as higher commissions and premium

taxes and higher incentive compensation costs associated

with above targeted results. On a same-store basis, our

administrative expense ratio, calculated using operating

revenue and premium equivalents, remained consistent

with 2001 at 14.0%.

Net investment income increased $22.1 million, or

9%. This increase in investment income primarily

resulted from the investment of additional assets in 2002

from our Trigon acquisition, which was partially offset by

decreased average yield from investment securities. Also

contributing to the increase was the impact of an

increased allocation of fixed income securities as a per-

centage of our investment portfolio during the third quar-

ter of 2001. As yields on investment securities are

dependent on market interest rates and changes in inter-

est rates are unpredictable, there is no certainty that past

investment performance will be repeated in the future.

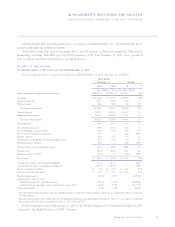

Net realized gains on investments decreased $30.4

million, or 50%. A summary is as follows:

Years Ended

December 31

2002 2001 $ Change % Change

($ in Millions)

Net realized gains

from the sale of

equity securities $ 0.6 $ 69.0 $(68.4) (99)%

Net realized gains

from the sale of

fixed maturity

securities 32.9 20.7 12.2 59%

Other than

temporary

impairments (3.1) (28.9) 25.8 89%

Net realized gains

on investments $30.4 $ 60.8 $(30.4) (50)%