Anthem Blue Cross 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

70 Anthem, Inc. 2002 Annual Report

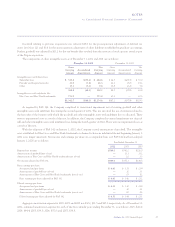

The effect of reinsurance on benefit expense for the

years ended December 31 is as follows:

2002 2001 2000

Assumed—increase in

benefit expense $ 6.7 $ 6.2 $ 8.6

Ceded—decrease in

benefit expense 27.4 38.0 233.0

The effect of reinsurance on certain assets and liabil-

ities at December 31 is as follows:

2002 2001

Policy liabilities assumed $37.5 $38.5

Unearned premiums assumed 0.8 0.7

Premiums payable ceded 6.4 7.8

Premiums receivable assumed 0.3 0.3

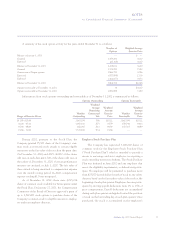

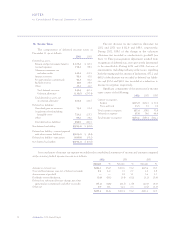

10. Capital Stock

Shares Issued for the Trigon Acquisition

Effective July 31, 2002, as partial consideration for

the purchase of Trigon, the Company issued 1.062 shares

of Anthem common stock for each Trigon share out-

standing, resulting in additional outstanding shares of

38,971,908. The $2,708.1 fair value of the common

shares issued was determined based on the average market

price of Anthem’s common stock over the two-day period

before and after the terms of the acquisition were agreed

to and announced. Offering costs of $4.1 reduced the

aggregate fair value and $2,704.0 was recorded as par

value of common stock and additional paid in capital.

Stock Repurchase Program

Anthem’s Board of Directors approved a common

stock repurchase program under which the Company may

purchase up to $400.0 of shares from time to time, subject

to business and market conditions. Subject to applicable

law, shares may be repurchased in the open market and in

negotiated transactions for a period of twelve months

beginning February 6, 2002. Under this completed pro-

gram, the Company repurchased and retired 4,121,392

shares at a cost of $256.2. The excess of cost of the repur-

chased shares over par value is charged on a pro rata basis

to additional paid in capital and retained earnings.

On January 27, 2003, the Board of Directors author-

ized the repurchase of up to $500.0 of stock under a new

program that will expire in February 2005. Under the new

program, repurchases may be made from time to time at

prevailing prices, subject to certain restrictions on vol-

ume, pricing and timing.

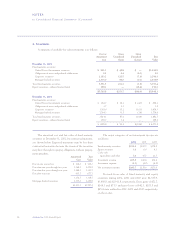

Stock Incentive Plans

The Company’s 2001 Stock Incentive Plan (“Stock

Plan”) provides for the granting of stock options,

restricted stock awards, performance stock awards, per-

formance awards and stock appreciation rights to eligible

employees and non-employee directors. The Company

has registered 7,000,000 shares of its common stock for

issuance under the Stock Plan, including 2,000,000

shares solely for issuance under grants of stock options to

substantially all employees and for issuance under similar

grants to new employees. Awards are granted by the

Compensation Committee of the Board of Directors.

Options vest and expire over terms as set by the Com-

mittee at the time of grant.

In accordance with the Plan, options to purchase

shares of common stock at an amount equal to the fair

market value of the stock at the date of grant were

granted to eligible employees and non-employee directors

during 2002 and 2001. These options generally vest at the

end of two or three years and expire 10 years from the

grant date.

In connection with the acquisition of Trigon,

Anthem assumed the Trigon 1997 Stock Incentive Plan

and the Trigon 1997 Non-Employee Directors Stock

Incentive Plan, which collectively provided for the grant-

ing of stock options to employees and non-employee

directors. Trigon stock options were converted to Anthem

stock options and 3,877,606 shares of Anthem common

stock were registered on July 31, 2002. Pursuant to this

registration, no additional options may be granted under

the converted Trigon plans. The converted stock options

were recorded at the acquisition date as additional paid

in capital and valued at $195.5 using a Black-Scholes

option-pricing model with weighted-average assumptions

as follows:

Risk-free interest rate 4.96%

Volatility factor 42.00%

Dividend yield —

Weighted-average expected life 7 years