Anthem Blue Cross 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

Anthem, Inc. 2002 Annual Report 67

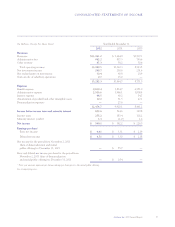

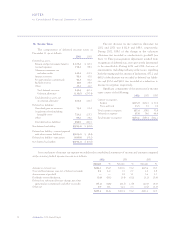

5. Long Term Debt and Commitments

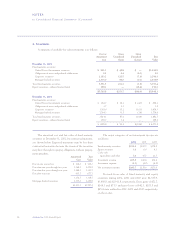

At December 31 debt consists of the following:

2002 2001

Surplus notes at 9.125% due 2010 $ 296.3 $295.9

Surplus notes at 9.000% due 2027 197.3 197.3

Senior guaranteed notes at

6.750% due 2003 99.9 99.7

Debentures included in Equity

Security Units at 5.950% due 2006 222.2 220.2

Senior unsecured notes at

6.800% due 2012 789.8 —

Senior unsecured notes at

4.875% due 2005 149.1 —

Other 5.0 5.2

Long-term debt 1,759.6 818.3

Current portion of long-term debt (100.2) (0.3)

Long-term debt, less current portion $1,659.4 $818.0

Surplus notes are unsecured obligations of Anthem

Insurance and are subordinate in right of payment to all

of Anthem Insurance’s existing and future indebtedness.

Any payment of interest or principal on the surplus notes

may be made only with the prior approval of the Indiana

Department of Insurance (“DOI”), and only out of capital

and surplus funds of Anthem Insurance that the DOI

determines to be available for the payment under Indiana

insurance laws.

Senior guaranteed notes are unsecured and unsubordi-

nated obligations of Anthem Insurance and will rank

equally in right of payment with all other existing and future

senior indebtedness of Anthem Insurance. Senior guaran-

teed notes of $99.9, which mature in July 2003, are reported

with other current liabilities as of December 31, 2002.

Debentures included in Equity Security Units are

obligations of Anthem and are unsecured and subordi-

nated in right of payment to all of Anthem’s existing and

future senior indebtedness. Each Equity Security Unit

contains a purchase contract under which the holder

agrees to purchase, for fifty dollars, shares of Anthem

common stock on November 15, 2004, and a 5.95% sub-

ordinated debenture. In addition, Anthem will pay quar-

terly contract fee payments on the purchase contracts at

the annual rate of 0.05% of the stated amount of fifty

dollars per purchase contract, subject to Anthem’s rights

to defer these payments.

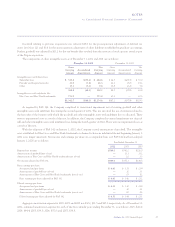

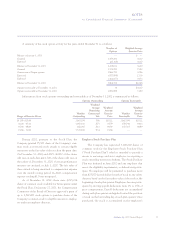

On July 31, 2002, Anthem issued $950.0 of long-

term senior unsecured notes ($150.0 of 4.875% notes due

2005, and $800.0 of 6.800% notes due 2012). The net

proceeds of $938.5 from the note offerings were used to

pay a portion of the $1,134.5 of cash consideration and

expenses associated with Anthem’s acquisition of Trigon.

On July 2, 2002, Anthem amended and restated its

revolving lines of credit with its lender group to make

Anthem the borrower and to increase the available bor-

rowings to $1,000.0. Under one facility, which expires

November 5, 2006, Anthem may borrow up to $400.0.

Under the other facility, which expires July 1, 2003,

Anthem may borrow up to $600.0. Any amounts out-

standing under this facility at July 1, 2003 (except

amounts which bear interest rates determined by a com-

petitive bidding process) convert to a one-year term loan

at Anthem’s option. The Company can select from three

options for borrowing under both credit facilities. The

first option is a floating rate equal to the greater of the

prime rate or the federal funds rate plus one-half percent.

The second option is a floating rate equal to LIBOR plus

a margin determined by reference to the ratings of

Anthem’s senior, unsecured debt. The third option, is a

competitive bid process, under which borrowings may

bear interest at floating rates determined by reference to

LIBOR, or at fixed rates. Anthem’s ability to borrow

under these credit facilities is subject to compliance with

certain covenants. Anthem Insurance’s two previous

revolving credit facilities totaling $800.0 were terminated

on July 2, 2002, as well as the two credit agreements

entered into in February 2002, allowing for $135.0 of

additional borrowings. No amounts were outstanding

under the current or prior facilities as of December 31,

2002 or 2001. In addition to the revolving credit facili-

ties, at December 31, 2001, Anthem Insurance had a

$300.0 commercial paper program, which was discontin-

ued as of July 2, 2002.

On December 18, 2002, Anthem filed a shelf regis-

tration with the Securities and Exchange Commission to

register any combination of debt or equity securities in

one or more offerings up to an aggregate amount of

$1,000.0. Specific information regarding terms of the

offering and the securities being offered will be provided

at the time of the offering. Proceeds from any offering will