Anthem Blue Cross 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

Anthem, Inc. 2002 Annual Report 63

In accordance with FAS 141, Business Combinations,

Anthem allocated the purchase price to the fair value of

assets acquired and liabilities assumed, including identifi-

able intangible assets. The excess of purchase price over

the fair value of net assets acquired resulted in $2,166.6 of

estimated non-tax deductible goodwill. Additional refine-

ment to the allocation of the purchase price may occur,

however, any adjustments are not expected to be material

to the consolidated financial statements.

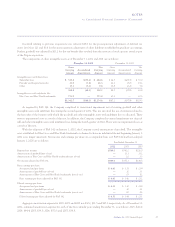

The estimated fair values of Trigon assets acquired

and liabilities assumed at the date of acquisition are sum-

marized as follows:

Current assets $1,953.5

Goodwill 2,166.6

Other intangible assets 1,172.7

Other noncurrent assets 206.4

Total assets acquired 5,499.2

Current liabilities 932.4

Noncurrent liabilities 528.7

Total liabilities assumed 1,461.1

Net assets acquired $4,038.1

Of the $1,172.7 of acquired intangible assets, $706.4

was assigned to Blue Cross and Blue Shield trademarks,

which are not subject to amortization due to their indefi-

nite life. The remaining acquired intangible assets consist

of $453.7 of subscriber base with a weighted-average life

of 23 years, $8.4 of provider and hospital networks with a

20 year life, and $4.2 of non-compete agreements with a

26 month life.

The results of operations for Trigon are included in

Anthem’s consolidated income statement after the com-

pletion of the acquisition. The following unaudited pro

forma summary presents revenues, net income and per

share data of Anthem as if the Trigon acquisition had

occurred on January 1, 2001. The pro forma financial

information is presented for informational purposes only

and may not be indicative of the results of operations had

Trigon been owned by Anthem for the full years ended

December 31, 2002 and 2001, nor is it necessarily indica-

tive of future results of operations. The pro forma infor-

mation includes the results of operations for Trigon for

the periods prior to the acquisition, adjusted for interest

expense on long term debt and reduced investment

income related to the cash and investment securities used

to fund the acquisition, additional amortization and

depreciation associated with the purchase and the related

income tax effects.

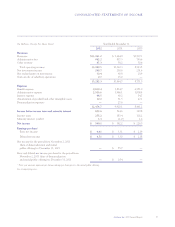

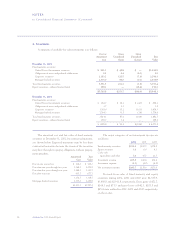

Year Ended December 31

2002 2001

Revenues $15,254.5 $13,446.2

Net income 592.0 377.7

Pro forma earnings per share:

Basic $ 4.18 $ 2.65

Diluted 4.07 N/A

Pro forma shares outstanding:

Basic 141,517,000 142,267,000

Diluted 145,392,000 N/A

The diluted pro forma earnings per share for the year

ended December 31, 2001 were not calculated as such

amounts would not be meaningful as no stock or dilutive

securities existed prior to November 2, 2001, the effective

date of the demutualization. The pro forma basic earnings

per share for the year ended December 31, 2001 were cal-

culated using the weighted-average shares outstanding for

the period from November 2, 2001 to December 31, 2001.

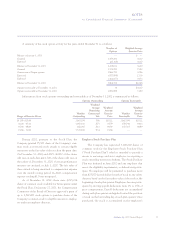

Other Acquisitions

2002

During 2002, the Company completed two other

acquisitions plus made an additional contingent purchase

price payment on a 1999 acquisition, for an aggregate

purchase price of $22.1 as follows:

•PRO Behavioral Health, a Denver, Colorado-based

behavioral health care company;

•Remaining 50% ownership interest in Maine Partners

Health Plan, Inc.; and

•Matthew Thornton Health Plan, Inc. contingent pur-

chase price payment.

Goodwill recognized in these transactions amounted

to $14.1 of which $9.4 is expected to be deductible for tax

purposes. Goodwill was assigned to the East and Specialty

segments in the amounts of $10.7 and $3.4, respectively.

The pro forma effects of the acquisitions on results for

periods prior to the purchase dates are not material to the

Company’s consolidated financial statements.