Anthem Blue Cross 2002 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

82 Anthem, Inc. 2002 Annual Report

Insurance Company (“Alliance”), under a contract

between Alliance and the United States Department of

Defense. Under that contract, Alliance managed and

administered the TRICARE Managed Care Support

Program for military families from May 1, 1998 through

May 31, 2001, at which time the TRICARE operations

were sold. There was no call on the guarantee for the

period from May 1, 1998 to May 31, 2001 (which period

is now “closed”).

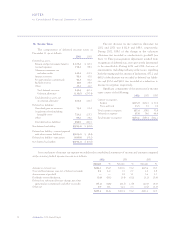

Vulnerability from Concentrations

Financial instruments that potentially subject the

Company to concentrations of credit risk consist primarily

of investment securities and premium receivables. All

investment securities are managed by professional invest-

ment managers within policies authorized by the Board of

Directors. Such policies limit the amounts that may be

invested in any one issuer and prescribe certain investee

company criteria. Concentrations of credit risk with

respect to premium receivables are limited due to the large

number of employer groups that constitute the Company’s

customer base in the geographic regions in which it con-

ducts business. As of December 31, 2002, there were no

significant concentrations of financial instruments in a

single investee, industry or geographic location.

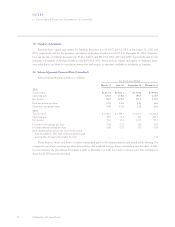

18. Segment Information

The Company’s principal reportable segments are

strategic business units primarily delineated by geographic

areas that essentially offer similar insurance products and

services. They are managed separately because each geo-

graphic region has unique market, regulatory and health

care delivery characteristics. The geographic regions are:

the Midwest region, which operates primarily in Indiana,

Kentucky and Ohio; the East region, which operates pri-

marily in Connecticut, New Hampshire and Maine; the

West region, which operates in Colorado and Nevada;

and the Southeast region, which operates in Virginia,

excluding the Northern Virginia suburbs of Washington,

D.C. BCBS-ME is included in the East segment since its

acquisition date of June 5, 2000. The Southeast region

was added with the July 31, 2002 acquisition of Trigon.

In addition to its four principal reportable geographic

segments, the Company operates a Specialty segment,

which includes business units providing group life and

disability insurance benefits, pharmacy benefit manage-

ment, dental and vision administration services and

behavioral health benefits services. Various ancillary

business units (reported with the Other segment) consist

primarily of AdminaStar Federal which administers

Medicare programs in Indiana, Illinois, Kentucky and

Ohio and Anthem Alliance, which provided health care

benefits and administration in nine states for the

Department of Defense’s TRICARE Program for military

families. The TRICARE operations were sold on May 31,

2001. The Other segment also includes intersegment

revenue and expense eliminations and corporate expenses

not allocated to reportable segments.

Through its participation in the Federal Employee

Program, Medicare, Medicare at Risk, and TRICARE

Program, the Company generated approximately 18%,

20% and 22% of its total consolidated revenues from

agencies of the U.S. government for the years ended

December 31, 2002, 2001 and 2000, respectively.

The Company defines operating revenues to include

premium income, administrative fees and other revenues.

Operating revenues are derived from premiums and fees

received primarily from the sale and administration of

health benefit products. Operating expenses are com-

prised of benefit and administrative expenses. The

Company calculates operating gain or loss as operating

revenue less operating expenses.

The accounting policies of the segments are the

same as those described in the summary of significant

accounting policies except that certain shared adminis-

trative expenses for each segment are recognized on a pro

rata allocated basis, which in aggregate approximates the

consolidated expense. Any difference between the allo-

cated expenses and actual consolidated expense is

included in other expenses not allocated to reportable

segments. Intersegment sales and expenses are recorded at

cost, and eliminated in the consolidated financial state-

ments. The Company evaluates performance of the

reportable segments based on operating gain or loss as

defined above. The Company evaluates investment

income, interest expense, amortization expense and

income taxes, and asset and liability details on a consoli-

dated basis as these items are managed in a corporate

shared service environment and are not the responsibility

of segment operating management.