Anthem Blue Cross 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

44 Anthem, Inc. 2002 Annual Report

Amortization of goodwill and other intangible assets

increased $4.4 million, or 16%, primarily due to amortiza-

tion expense associated with our acquisition of BCBS-

ME. As we adopted FAS 142 on January 1, 2002, this

standard did not have any effect on these results. See

Notes 1, 2 and 3 to our audited consolidated financial

statements for the years ended December 31, 2002, 2001

and 2000 for additional information concerning our

adoption of FAS 142.

Demutualization expenses associated with our

conversion from a mutual insurance company to a

stockholder-owned company on November 2, 2001

totaled $27.6 million in 2001.

Income tax expense increased $81.2 million, or 79%,

primarily due to higher income before taxes. Our effective

income tax rate in 2001 was 35.0% and was 31.0% in

2000. Our rate was lower than the statutory effective tax

rate in 2000 primarily as a result of changes in our deferred

tax valuation allowance. Our effective tax rate increased in

2001 primarily due to the non-deductibility of demutual-

ization expenses and a portion of goodwill amortization for

income tax purposes.

Net income increased $116.2 million, or 51%, prima-

rily due to the improvement in our operating results, net

realized capital gains, gain on sale of subsidiary operations

and higher investment income. Excluding the gain on the

sale of our TRICARE business ($16.3 million after tax),

net realized gains on investments and demutualization

expenses, net income increased $105.0 million, or 51%.

Both basic and fully diluted earnings per share

increased as a result of increased net income as described

above. December 31, 2001 and 2000 amounts represent

pro forma earnings per share, which includes earnings

prior to our initial public offering. See Note 11 to our

audited consolidated financial statements for the years

ended December 31, 2002, 2001 and 2000.

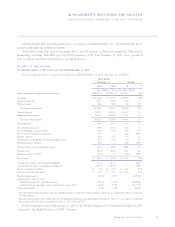

Midwest

Our Midwest segment is comprised of health benefit

and related business for members in Indiana, Kentucky

and Ohio. Our Midwest segment’s summarized results of

operations for the years ended December 31, 2001 and

2000 are as follows:

Years Ended

December 31

2001 2000 $ Change % Change

($ in Millions)

Operating

Revenue $5,093.0 $4,460.5 $632.5 14%

Operating Gain $ 161.5 $ 87.8 $ 73.7 84%

Operating

Margin 3.2% 2.0% 120 bp

Membership

(in 000s) 4,854 4,4541400 9%

1Excludes 128,000 TRICARE members.

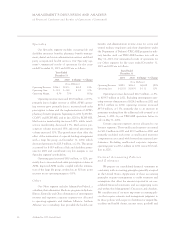

Operating revenue increased $632.5 million, or 14%,

due primarily to premium rate increases in our Local Large

Group and Small Group businesses and the effect of higher

average membership in our Medicare + Choice business.

Operating gain increased $73.7 million, or 84%,

resulting in an operating margin of 3.2% at December 31,

2001, a 120 basis point improvement from the year ended

December 31, 2000. This improvement was primarily

due to revenue growth and effective expense control.

Administrative expense increased at a slower rate than

premiums as we gained operating efficiencies and lever-

aged our fixed costs over higher membership.

Our Midwest segment assumed a portion of the risk for

Anthem Alliance’s TRICARE contract until December 31,

2000. Effective January 1, 2001, Anthem Alliance reas-

sumed this risk. For the year ended December 31, 2000,

our Midwest segment received $122.1 million of premium

income, no administrative fees or other income, incurred

$113.8 million of benefit expense and $7.4 million of

administrative expense, resulting in a $0.9 million operat-

ing gain on the TRICARE contract. We also had 128,000

TRICARE members included in our Midwest segment’s

membership at December 31, 2000, and no members at

December 31, 2001.