Anthem Blue Cross 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

74 Anthem, Inc. 2002 Annual Report

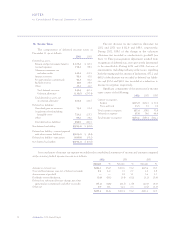

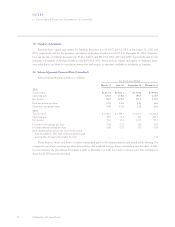

12. Income Taxes

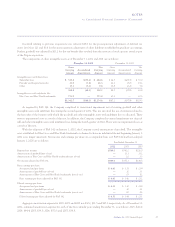

The components of deferred income taxes at

December 31 are as follows:

2002 2001

Deferred tax assets:

Pension and postretirement benefits $ 107.2 $ 60.5

Accrued expenses 156.3 98.3

Alternative minimum tax

and other credits 120.1 133.5

Insurance reserves 58.3 47.8

Net operating loss carryforwards 46.3 66.2

Bad debt reserves 16.9 19.8

Other 35.3 41.0

Total deferred tax assets 540.4 467.1

Valuation allowance (138.0) (250.4)

Total deferred tax assets, net

of valuation allowance 402.4 216.7

Deferred tax liabilities:

Unrealized gains on securities 74.1 25.4

Acquisition related including

intangible assets 723.2 225.7

Other 99.2 29.2

Total deferred tax liabilities 896.5 280.3

Net deferred tax liability $(494.1) $ (63.6)

Deferred tax liability—current (reported

with other current liabilities) $(104.2) $ (8.4)

Deferred tax liability—noncurrent (389.9) (55.2)

Net deferred tax liability $(494.1) $ (63.6)

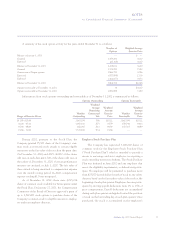

The net decrease in the valuation allowance for

2002 and 2001 was $112.4 and $88.3, respectively.

During 2002, $18.0 of the change in the valuation

allowance was recorded as a reduction to goodwill (see

Note 3). This postacquisition adjustment resulted from

recognition of deferred tax assets previously determined

to be unrealizable. During 2002 and 2001, because of

uncertainties including industry-wide issues regarding

both the timing and the amount of deductions, $57.2 and

$68.0 of the decrease was recorded as deferred tax liabili-

ties and $37.2 and $20.3 was recorded as a reduction to

income tax expense, respectively.

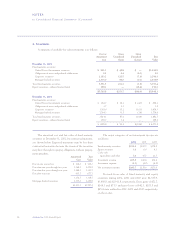

Significant components of the provision for income

taxes consist of the following:

2002 2001 2000

Current tax expense:

Federal $173.9 $101.1 $ 53.9

State and local 13.5 7.7 3.9

Total current tax expense 187.4 108.8 57.8

Deferred tax expense 67.8 74.6 44.4

Total income tax expense $255.2 $183.4 $102.2

A reconciliation of income tax expense recorded in the consolidated statements of income and amounts computed

at the statutory federal income tax rate is as follows:

2002 2001 2000

Amount % Amount % Amount %

Amount at statutory rate $282.7 35.0 $183.6 35.0 $115.4 35.0

State and local income taxes net of federal tax benefit 9.4 1.2 3.5 0.7 2.6 0.8

Amortization of goodwill —— 5.9 1.1 5.6 1.7

Dividends received deduction (0.6) (0.1) (1.4) (0.2) (1.2) (0.4)

Deferred tax valuation allowance change, net of net

operating loss carryforwards and other tax credits (37.2) (4.6) (20.3) (3.9) (20.0) (6.0)

Other, net 0.9 0.1 12.1 2.3 (0.2) (0.1)

$255.2 31.6 $183.4 35.0 $102.2 31.0