Anthem Blue Cross 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

Anthem, Inc. 2002 Annual Report 37

Operating gain increased $110.1 million, or 68%,

primarily due to improved underwriting results in our

Local Large Group fully-insured and Small Group busi-

nesses. Our operating gain was also impacted by the

recognition of a $15.7 million favorable adjustment for

prior year reserve releases recognized in the third quarter

of 2002 and an $11.2 million strengthening of reserves

during the third quarter of 2001. Operating gain improve-

ments were partially offset by a $23.0 million unfavorable

adjustment recorded during the third quarter of 2002 to

reflect the accrual of additional premium taxes in the

state of Ohio.

Membership increased 380,000, or 8%, primarily due

to additional BlueCard activity and enrollment gains in

our Local Large Group fully-insured and Individual busi-

nesses. Individual sales benefited from the introduction of

new, lower premium products. Our Midwest segment

experienced a decrease in Local Large Group self-funded

membership, which was anticipated and was a result of

pricing actions designed to better align revenue with costs

of services to this membership class.

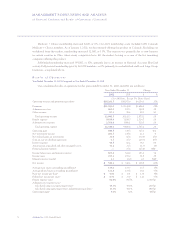

East

Our East segment is comprised of health benefit and

related business for members in Connecticut, New

Hampshire and Maine. Our East segment’s summarized

results of operations for the years ended December 31,

2002 and 2001 are as follows:

Years Ended

December 31

2002 2001 $ Change % Change

($ in Millions)

Operating

Revenue $4,151.5 $3,667.3 $484.2 13%

Operating Gain $ 222.9 $ 128.8 $ 94.1 73%

Operating

Margin 5.4% 3.5% 190 bp

Membership

(in 000s) 2,434 2,260 174 8%

Operating revenue increased $484.2 million, or

13%, primarily due to premium rate increases, particularly

in our Local Large Group and Small Group businesses.

Operating gain increased $94.1 million, or 73%,

primarily due to improved underwriting results, particu-

larly in our Individual and Local Large Group businesses,

and an unfavorable reserve strengthening adjustment of

$9.4 million recorded during the third quarter of 2001.

Membership increased 174,000, or 8%, primarily due

to increased BlueCard activity and enrollment gains in

our Local Large Group self-funded business. Our growth

in Local Large Group self-funded business primarily

resulted from changes in our Local Large Group mix of

business from fully-insured to self-funded.

On February 28, 2002, a subsidiary of Anthem

Insurance, Anthem Health Plans of Maine, Inc., com-

pleted its purchase of the remaining 50% ownership

interest in Maine Partners Health Plan, Inc. for an aggre-

gate purchase price of $10.6 million. We had previously

consolidated the financial results of this entity in our

consolidated financial statements and recorded minority

interest for the percentage we did not own.

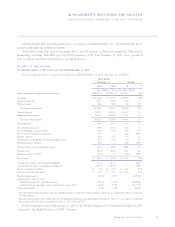

West

Our West segment is comprised of health benefit and

related business for members in Colorado and Nevada. Our

West segment’s summarized results of operations for the

years ended December 31, 2002 and 2001 are as follows:

Years Ended

December 31

2002 2001 $ Change % Change

($ in Millions)

Operating Revenue $920.1 $774.4 $145.7 19%

Operating Gain $ 74.7 $ 20.1 $ 54.6 272%

Operating Margin 8.1% 2.6% 550 bp

Membership

(in 000s) 836 769 67 9%

Operating revenue increased by $145.7 million, or

19%, primarily due to higher premium rates particularly in

our Local Large Group fully-insured and Small Group busi-

nesses, and higher membership in our Individual business.