Anthem Blue Cross 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

38 Anthem, Inc. 2002 Annual Report

Operating gain increased $54.6 million to $74.7 mil-

lion in 2002, primarily due to improved underwriting

results in our Local Large Group fully-insured and Small

Group businesses. Also contributing to the improvement

was $10.9 million in favorable prior year reserve releases

recorded during the third quarter of 2002. These reserve

releases were offset by a $10.1 million reserve increase

for case specific reserves incurred during the normal

course of business.

Membership increased 67,000, or 9%, primarily due

to increased BlueCard activity and higher sales in our

Individual business.

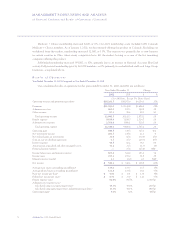

Southeast

Our Southeast segment is comprised of health benefit

and related business for members in Virginia, excluding

the Northern Virginia suburbs of Washington D.C. Our

Southeast segment’s summarized results of operations for

the five months ended December 31, 2002 are as follows:

Five Months

Ended December 31, 2002

($ in Millions)

Operating Revenue $1,467.9

Operating Gain $ 116.0

Operating Margin 7.9%

Membership (in 000s) 2,549

Our Southeast segment was established with the

acquisition of Trigon on July 31, 2002. Results of operations

for this segment have been included in our consolidated

financial statements from August 1, 2002 forward. These

five months of operating results may not be sustainable or

indicative of future performance, as we are in the early

stages of transitioning business practices and policies that

will govern our Southeast segment’s operations. Our inte-

gration activities remain on schedule, and we expect to

achieve $40.0 million to $50.0 million of synergies in

2003 and at least $75.0 million by 2004. We captured

approximately $11.0 million of synergies in 2002, prima-

rily related to corporate overhead and information tech-

nology cost savings.

Specialty

Our Specialty segment includes our group life and

disability insurance benefits, pharmacy benefit manage-

ment, dental and vision administration services and

behavioral health benefits services. During the third

quarter of 2002, we sold our third party occupational

health services businesses, the operating results of which

were not material to the earnings of this segment or our

consolidated results. On June 1, 2002, we acquired cer-

tain assets of PRO Behavioral Health, or PRO, a Denver,

Colorado-based behavioral health company in order to

broaden our specialty product offerings. Results from this

acquisition are included from that date forward and are

not material to the operating revenue or operating gain of

this segment in the year ended December 31, 2002.

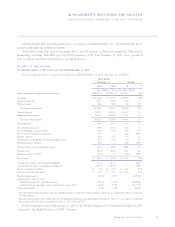

Our Specialty segment’s summarized results of opera-

tions for the years ended December 31, 2002 and 2001

are as follows:

Years Ended

December 31

2002 2001 $ Change % Change

($ in Millions)

Operating Revenue $523.5 $396.1 $127.4 32%

Operating Gain $ 50.7 $ 32.9 $ 17.8 54%

Operating Margin 9.7% 8.3% 140 bp

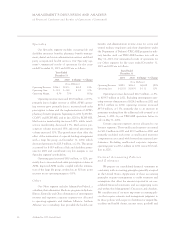

Operating revenue increased $127.4 million, or

32%, primarily due to increased mail-order prescription

volume at APM. APM launched mail-order campaigns to

inform members of the benefits and convenience of using

APM’s mail-order pharmacy option for maintenance

drugs. In addition, APM increased its penetration of our

health benefits members. APM implemented its phar-

macy benefit programs in our West segment and in Maine

during the first six months of 2001. Excluding the impact

of our TRICARE operations, mail-service prescription

volume increased 29% and retail prescription volume

increased 10%.