Anthem Blue Cross 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

68 Anthem, Inc. 2002 Annual Report

be used for general corporate purposes, including the

repayment of debt, investments in or extensions of credit

to Anthem’s subsidiaries or the financing of possible

acquisitions or business expansion.

On January 27, 2003, the Board of Directors author-

ized management to establish a $1,000.0 commercial

paper program. Proceeds from any future issuance of com-

mercial paper may be used for general corporate purposes,

including the repurchase of debt and common stock of

the Company.

Interest paid during 2002, 2001 and 2000 was $70.5,

$57.4 and $49.9, respectively.

Future maturities of debt are as follows: 2003,

$100.2; 2004, $1.4; 2005, $149.6; 2006, $222.8; 2007,

$0.7 and thereafter $1,284.9.

6. Fair Value of Financial Instruments

Considerable judgment is required to develop esti-

mates of fair value for financial instruments. Accordingly,

the estimates shown are not necessarily indicative of the

amounts that would be realized in a one time, current

market exchange of all of the financial instruments.

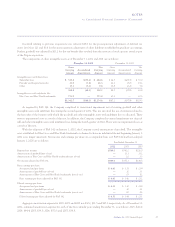

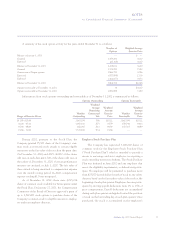

The carrying values and estimated fair values of cer-

tain financial instruments at December 31 are as follows:

2002 2001

Carrying Fair Carrying Fair

Value Value Value Value

Fixed maturity

securities $5,797.4 $5,797.4 $3,882.7 $3,882.7

Equity securities 150.7 150.7 189.1 189.1

Restricted

investments 48.4 48.4 38.7 38.7

Debt:

Equity Security

Units 222.2 357.3 220.2 294.4

Other 1,537.4 1,727.3 598.1 681.9

The carrying value of all other financial instruments

approximates fair value because of the relatively short

period of time between the origination of the instruments

and their expected realization. Fair values for securities,

restricted investments and Equity Security Units are based

on quoted market prices, where available. For securities not

actively traded, fair values are estimated using values

obtained from independent pricing services. The fair value

of other debt is estimated using discounted cash flow analy-

ses, based on the Company’s current incremental borrow-

ing rates for similar types of borrowing arrangements.

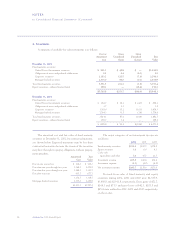

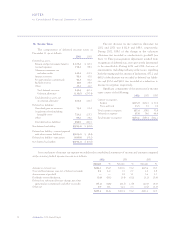

7. Property and Equipment

Property and equipment at December 31 is as follows:

2002 2001

Land and improvements $ 34.4 $ 21.8

Building and components 347.2 251.2

Data processing equipment,

furniture and other equipment 378.8 243.3

Computer software 262.2 189.4

Leasehold improvements 46.6 36.4

1,069.2 742.1

Less accumulated depreciation

and amortization 531.8 339.8

$ 537.4 $402.3

Property and equipment includes noncancelable

capital leases of $7.4 and $7.3 at December 31, 2002 and

2001, respectively. Total accumulated amortization on

these leases at December 31, 2002 and 2001 was $4.3 and

$3.9, respectively. The related lease amortization expense

is included in depreciation and amortization expense.

Depreciation and leasehold improvement amortization

expense for 2002, 2001 and 2000 was $108.1, $89.6 and

$75.3, respectively. Costs related to the development or

purchase of internal-use software of $116.4 and $91.4 at

December 31, 2002 and 2001, respectively, are reported

with computer software.