Anthem Blue Cross 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

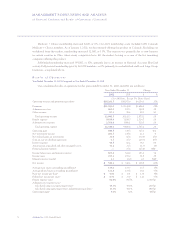

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

Anthem, Inc. 2002 Annual Report 29

changes in our ability to negotiate competitive rates with

our providers may impose further risks to our ability to

profitably underwrite our business.

This management’s discussion and analysis should be

read in conjunction with our audited consolidated financial

statements for the years ended December 31, 2002, 2001

and 2000.

Significant Transactions

On July 31, 2002, we completed the purchase of

100% of the outstanding stock of Trigon Healthcare, Inc.,

or Trigon, in accordance with an agreement and plan of

merger announced April 29, 2002. Trigon was Virginia’s

largest health benefits company and was the exclusive

Blue Cross and Blue Shield licensee in Virginia, exclud-

ing the Northern Virginia suburbs of Washington, D.C.

The merger provides us with a new segment, our

Southeast segment, with approximately 2.5 million mem-

bers and a nearly forty percent share of the Virginia mar-

ket. The Trigon merger allows us to further expand our

licensed territory as a Blue Cross Blue Shield licensee.

We believe the merger will enhance our earnings over

time, as it will allow us opportunities to leverage our cor-

porate and other fixed costs and to expand our specialty

businesses.

Trigon’s shareholders each received thirty dollars

in cash and 1.062 shares of Anthem common stock for

each Trigon share outstanding. The purchase price was

approximately $4,038.1 million, which included cash of

approximately $1,104.3 million, the issuance of approxi-

mately 39.0 million shares of Anthem common stock,

valued at approximately $2,708.1 million, Trigon stock

options converted into Anthem stock options for approx-

imately 3.9 million shares, valued at approximately

$195.5 million and approximately $30.2 million of trans-

action costs. Refer to the Liquidity and Capital Resources

section of this discussion for more information related to

the sources of funds for this acquisition. See Notes 2 and 3

of our audited consolidated financial statements for the

years ended December 31, 2002, 2001 and 2000 for addi-

tional information concerning the pro forma impact of

Trigon on our consolidated financial statements.

On May 31, 2001, we and Blue Cross and Blue Shield

of Kansas, or BCBS-KS, announced that we had signed a

definitive agreement pursuant to which BCBS-KS would

become our wholly owned subsidiary. Under the proposed

transaction, BCBS-KS would demutualize and convert to

a stock insurance company. The agreement calls for us to

pay $190.0 million in exchange for all of the shares of

BCBS-KS. On February 11, 2002, the Kansas Insurance

Commissioner disapproved the proposed transaction,

which had been previously approved by the BCBS-KS

policyholders in January 2002. On February 19, 2002, the

board of directors of BCBS-KS voted unanimously to

appeal the Kansas Insurance Commissioner’s decision and

BCBS-KS sought to have the Commissioner’s decision

overturned in Shawnee County District Court. We joined

BCBS-KS in the appeal, which was filed on March 7,

2002. On June 7, 2002, the Shawnee County District

Court ruled on the BCBS-KS appeal in favor of us and

BCBS-KS. The Shawnee County District Court directed

the Commissioner to re-evaluate her decision in accor-

dance with the Court’s very specific interpretation of the

Kansas law. On June 10, 2002, the Kansas Insurance

Commissioner appealed the District Court’s ruling to

the Kansas Supreme Court. The Kansas Supreme Court

began to hear oral arguments of the parties to this case on

March 5, 2003.

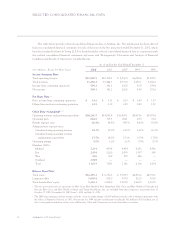

Membership—December 31, 2002

Compared to December 31, 2001

Our membership includes seven different customer

types: Local Large Group, Small Group, Individual,

National Accounts, Medicare + Choice, Federal Employee

Program and Medicaid.

•Local Large Group consists of those customers with 51

or more employees eligible to participate as a member

in one of our health plans.

•Small Group consists of those customers with one to 50

eligible employees.

•Individual members include those in our under age 65

business and our Medicare Supplement (age 65 and

over) business.