Anthem Blue Cross 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

Anthem, Inc. 2002 Annual Report 71

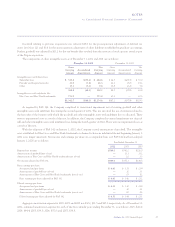

A summary of the stock option activity for the years ended December 31 is as follows:

Number of Weighted-Average

Options Exercise Price

Balance at January 1, 2001 — $ —

Granted 1,479,000 36.00

Forfeited (20,368) 36.00

Balance at December 31, 2001 1,458,632 36.00

Granted 1,579,970 71.80

Conversion of Trigon options 3,866,770 30.86

Exercised (877,959) 27.36

Forfeited (162,677) 38.53

Balance at December 31, 2002 5,864,736 $43.48

Options exercisable at December 31, 2001 36 $36.00

Options exercisable at December 31, 2002 2,992,899 31.90

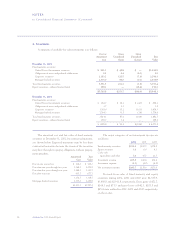

Information about stock options outstanding and exercisable as of December 31, 2002 is summarized as follows:

Options Outstanding Options Exercisable

Weighted

Average Weighted Weighted

Remaining Average Average

Number Contractual Exercise Number Exercise

Range of Exercise Prices Outstanding Life Price Exercisable Price

$11.95–$25.46 1,663,294 5.86 $20.22 1,662,594 $20.22

36.00– 45.41 1,983,432 8.75 38.79 679,740 44.13

45.48– 68.89 682,065 8.10 49.90 650,565 48.99

71.86– 71.86 1,535,945 9.34 71.86 — —

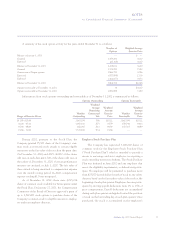

During 2002, pursuant to the Stock Plan, the

Company granted 95,300 shares of the Company’s com-

mon stock as restricted stock awards to certain eligible

executives at the fair value of the stock on the grant date.

On December 31, 2004 and 2005, 46,800 of the shares

will vest on each date and 1,700 of the shares will vest on

the earlier of, December 31, 2005, if certain performance

measures are attained, or July 1, 2007. The fair value of

these awards is being amortized to compensation expense

over the awards vesting period. In 2002, compensation

expense totaling $1.5 was recognized.

As of December 31, 2002, there were 4,025,034

shares of common stock available for future grants under

the Stock Plan. On January 27, 2003, the Compensation

Committee of the Board of Directors approved a grant of

up to 2,500,000 stock options to purchase shares of the

Company’s common stock to eligible executives, employ-

ees and non-employee directors.

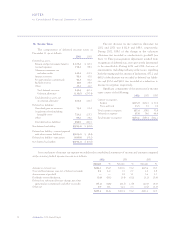

Employee Stock Purchase Plan

The Company has registered 3,000,000 shares of

common stock for the Employee Stock Purchase Plan

(“Stock Purchase Plan”) which is intended to provide a

means to encourage and assist employees in acquiring a

stock ownership interest in Anthem. The Stock Purchase

Plan was initiated in June 2002 and any employee that

meets the eligibility requirements, as defined, may partic-

ipate. No employee will be permitted to purchase more

than $25,000 (actual dollars) worth of stock in any calen-

dar year, based on the fair market value of the stock at the

beginning of each plan quarter. Employees become partic-

ipants by electing payroll deductions from 1% to 15% of

gross compensation. Payroll deductions are accumulated

during each plan quarter and applied toward the purchase

of stock on the last trading day of each plan quarter. Once

purchased, the stock is accumulated in the employee’s