Anthem Blue Cross 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

34 Anthem, Inc. 2002 Annual Report

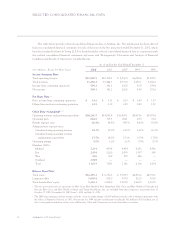

On a same-store basis, other revenue, which is com-

prised principally of co-pays and deductibles associated

with Anthem Prescription Management’s, or APM’s, sale

of mail-order drugs, increased $24.2 million, or 42%.

Mail-order revenues increased primarily due to additional

volume. APM launched mail conversion campaigns to

inform members of the benefits and convenience of using

APM’s mail-order pharmacy option during 2002. In addi-

tion, APM increased its penetration of our health bene-

fits membership, with a resulting larger enrollment base

and therefore greater demand for mail-order service.

Benefit expense increased $2,024.7 million, or 26%,

in 2002. On a same-store basis, benefit expense increased

$1,132.7 million, or 15%, primarily due to increased cost of

care trends and higher average membership. Higher costs

of care were driven primarily by higher costs in professional

services and outpatient services. Our benefit expense ratio

decreased 210 basis points from 84.5% in 2001 to 82.4% in

2002 due partly to the sale of our TRICARE operations in

2001 and the impact of our Trigon acquisition in 2002. On

a same-store basis, our benefit expense ratio decreased

160 basis points from 84.2% in 2001 to 82.6% in 2002,

primarily due to lower than anticipated medical costs in

all of our business segments. Our 2002 benefit expense

was also reduced by favorable developments of reserves

reported as of December 31, 2001.

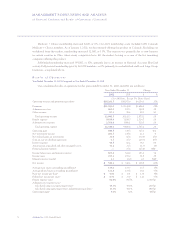

The following discussion summarizes our aggregate

cost of care trends for the 12-month period ended

December 31, 2002, for our Local Large Group and Small

Group fully-insured businesses only. Our cost of care

trends are calculated by comparing per member per month

claim costs for which Anthem is responsible, which

excludes member co-payments and deductibles. Our aggre-

gate cost of care trend including the impact of our Trigon

acquisition for the entire rolling 12-month periods, includ-

ing periods prior to July 31, 2002, was approximately

12%. Our aggregate cost of care trend excluding the

impact of our Trigon acquisition was approximately one-

half percentage point higher, driven primarily by pro-

fessional services costs and outpatient services costs,

weighted as a percentage of cost of care expense.

Cost increases for professional services were approxi-

mately 12% including the impact of our Trigon acquisi-

tion for the entire rolling 12-month periods, including

periods prior to July 31, 2002. Excluding the impact of

our Trigon acquisition, our professional services trend was

approximately one and one-half percentage points higher.

This trend is due to both higher utilization and higher

unit costs. Utilization increases were driven primarily by

increases in physician office visits, radiology procedures

such as Magnetic Resonance Imaging procedures, or

MRIs, Positron Emission Tomography procedures, or PET

scans, and laboratory procedures. Unit cost increases were

driven primarily by increases in physician fee reimburse-

ment schedules. In response to increasing professional

services costs, we continue to work with our providers

through education and contracting to ensure that our

members receive the most appropriate care at the proper

time in the appropriate clinical setting.

Cost increases for outpatient services were approxi-

mately 12% including the impact of our Trigon acquisi-

tion for the entire rolling 12-month periods, including

periods prior to July 31, 2002. Excluding the impact of

our Trigon acquisition, our outpatient services trend was

approximately one percentage point higher. Drivers of

this outpatient trend include a continuing shift of certain

procedures such as certain cardiac care procedures previ-

ously performed in an inpatient setting to an outpatient

setting and increased cost of emergency room services as

more procedures are being performed at each emergency

room visit. Costs are also increasing for outpatient surgery

and radiology services.

Pharmacy costs increased by approximately 16%

including the impact of our Trigon acquisition for the

entire rolling 12-month periods, including periods prior

to July 31, 2002. Excluding the impact of our Trigon

acquisition, our pharmacy cost trend remained consistent

at approximately 16%. Increases were primarily due to

the introduction of new, higher cost drugs and higher

overall utilization as a result of increases in direct-to-con-

sumer advertising by pharmaceutical companies and

expanded physician-prescribed use of drugs that manage

chronic conditions such as high cholesterol. In response

to increasing pharmacy costs, we are evaluating different

plan designs, recontracting with retail pharmacies and

continuing the implementation of tiered drug benefits for

our members. Three-tier drug programs reflect benefit

designs that have three different co-payment levels,

which depend on the drug selected. Generic drugs have