Anthem Blue Cross 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

Anthem, Inc. 2002 Annual Report 41

Individual membership increased primarily due to new business resulting from higher sales of Individual under age 65

products, particularly in our Midwest segment.

Self-funded membership increased primarily due to our 23% increase in BlueCard membership. Fully-insured

membership, excluding TRICARE, grew by 170,000 members, or 5%, from December 31, 2000, due to growth in

both Local Large and Small Group businesses, as explained above.

Results of Operations

Year Ended December 31, 2001 Compared to Year Ended December 31, 2000

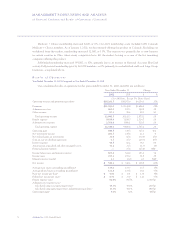

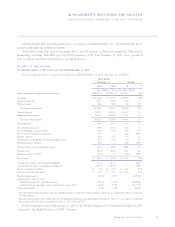

Our consolidated results of operations for the years ended December 31, 2001 and 2000 are as follows:

Years Ended

December 31 Change

2001 2000 $ %

($ in Millions, Except Per Share Data)

Operating revenue and premium equivalents1$14,057.4 $11,800.1 $2,257.3 19%

Premiums $ 9,244.8 $ 7,737.3 $1,507.5 19%

Administrative fees 817.3 755.6 61.7 8

Other revenue 58.2 50.6 7.6 15

Total operating revenue 10,120.3 8,543.5 1,576.8 18

Benefit expense 7,814.7 6,551.0 1,263.7 19

Administrative expense 1,986.1 1,808.4 177.7 10

Total operating expense 9,800.8 8,359.4 1,441.4 17

Operating gain2319.5 184.1 135.4 74

Net investment income 238.6 201.6 37.0 18

Net realized gains on investments 60.8 25.9 34.9 135

Gain on sale of subsidiary operations 25.0 — 25.0 NM3

Interest expense 60.2 54.7 5.5 10

Amortization of goodwill and other intangible assets 31.5 27.1 4.4 16

Demutualization expenses 27.6 — 27.6 NM3

Income before taxes and minority interest 524.6 329.8 194.8 59

Income taxes 183.4 102.2 81.2 79

Minority interest (credit) (1.0) 1.6 (2.6) NM3

Net income $ 342.2 $ 226.0 $ 116.2 51%

Average basic shares outstanding (in millions)4103.3 103.3 — NM3

Average diluted shares outstanding (in millions)4103.8 103.8 — NM3

Basic net income per share4$ 3.31 $ 2.19 $ 1.12 51%

Diluted net income per share4$ 3.30 $ 2.18 $ 1.12 51%

Benefit expense ratio584.5% 84.7% (20) bp6

Administrative expense ratio:7

Calculated using total operating revenue819.6% 21.2% (160) bp6

Calculated using operating revenue and premium equivalents914.1% 15.3% (120) bp6

Operating margin10 3.2% 2.2% 100 bp6

1The self-funded claims included for the year ended December 31, 2001 were $3,937.1 million and for the year ended December 31, 2000 were

$3,256.6 million.

4Amounts represent pro forma earnings per share including periods prior to our initial public offering. See Note 11 to our audited consolidated

financial statements for the years ended December 31, 2002, 2001 and 2000.

For the remaining footnote explanations, see table in the “Results of Operations—Year Ended December 31, 2002

Compared to Year Ended December 31, 2001” discussion.