Anthem Blue Cross 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

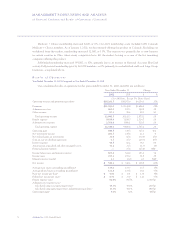

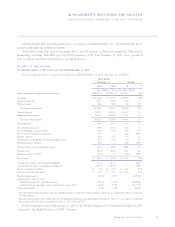

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

36 Anthem, Inc. 2002 Annual Report

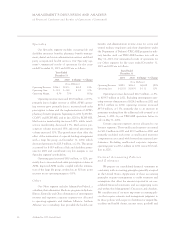

Net realized gains from the sale of equity securities

decreased $68.4 million primarily due to our realization of

$65.2 million of gains in 2001 resulting from the restruc-

turing of our portfolio. In 2002, we realized a $3.1 million

loss on a limited partnership, and in 2001 we recognized

$28.9 million of impairment losses on equity securities.

Net realized gains or losses on investments are influenced

by market conditions when an investment is sold or

deemed to be impaired, and will vary from period to period.

Our gain on the sale of subsidiary operations of $0.7

million in 2002 related primarily to the sale of our third

party occupational health services businesses, and the

$25.0 million gain in 2001 relates to the sale of our TRI-

CARE operations on May 31, 2001.

Interest expense increased $38.3 million, or 64%,

primarily reflecting additional interest expense incurred

on the debt issued in conjunction with our Trigon acqui-

sition and the issuance of our 6.00% Equity Security

Units on November 2, 2001.

Amortization of goodwill and other intangible assets

decreased $1.3 million. Due to our adoption of FAS 142

on January 1, 2002, amortization decreased approximately

$17.5 million. This decrease was partially offset by $16.2

million of new amortization expense, including $15.8

million of amortization expense on intangible assets

resulting from our Trigon acquisition. See Notes 2 and 3

to our audited consolidated financial statements for the

years ended December 31, 2002, 2001 and 2000 for addi-

tional information concerning our adoption of FAS 142.

Demutualization expenses associated with our con-

version from a mutual insurance company to a stock-

holder owned company on November 2, 2001 totaled

$27.6 million in 2001.

Income tax expense increased $71.8 million, or

39%, primarily due to increased income before taxes. Our

effective income tax rate decreased to 31.6% in 2002

from 35.0% in 2001. This 340 basis point decrease in the

effective income tax rate is primarily due to the reduction

of a deferred tax valuation allowance in 2002 due to our

continued improvement in taxable earnings, nonde-

ductible demutualization expenses incurred during 2001

and the impact of FAS 142.

Net income increased $206.9 million, or 60%, pri-

marily due to our Trigon acquisition, the improvement in

our operating results in each health business segment as

described below, higher net investment income, lower

amortization of goodwill and other intangible assets result-

ing from the adoption of FAS 142 on January 1, 2002 and

our reduced effective tax rate. Assuming FAS 142 had

been in effect for the year ended December 31, 2001, our

net income would have increased $191.8 million, or 54%.

Both basic and fully diluted earnings per share

increased as a result of increased net income as described

above and the impact of our stock repurchases under our

stock repurchase program in 2002. These increases were

partially offset by an increase in the number of average

shares outstanding due to the stock issued in conjunction

with our Trigon acquisition on July 31, 2002, and an

increase in the effect of dilutive securities.

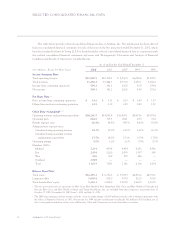

Midwest

Our Midwest segment is comprised of health benefit

and related business for members in Indiana, Kentucky

and Ohio. Our Midwest segment’s summarized results of

operations for the years ended December 31, 2002 and

2001 are as follows:

Years Ended

December 31

2002 2001 $ Change % Change

($ in Millions)

Operating

Revenue $6,051.4 $5,093.0 $958.4 19%

Operating Gain $ 271.6 $ 161.5 $110.1 68%

Operating

Margin 4.5% 3.2% 130 bp

Membership

(in 000s) 5,234 4,854 380 8%

Operating revenue increased $958.4 million, or

19%, primarily due to premium rate increases in our Local

Large Group and Small Group businesses and member-

ship increases in our Local Large Group fully-insured and

Individual businesses.