Anthem Blue Cross 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

Anthem, Inc. 2002 Annual Report 65

Goodwill relating to previous acquisitions was reduced $18.0 for the postacquisition adjustment of deferred tax

assets (see Note 12) and $3.6 for the postacquisition adjustment of other liabilities established in purchase accounting.

Further, goodwill was adjusted by $11.2 for the tax benefit that resulted from the exercise of stock options issued as part

of the Trigon acquisition.

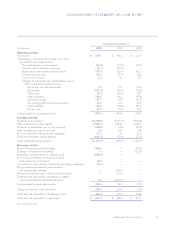

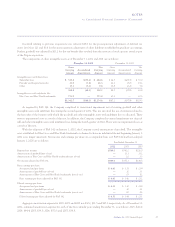

The components of other intangible assets as of December 31, 2002 and 2001 are as follows:

December 31, 2002 December 31, 2001

Gross Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

Amount Amortization Amount Amount Amortization Amount

Intangible assets with finite lives:

Subscriber base $ 519.8 $(55.2) $ 464.6 $ 64.7 $(29.7) $ 35.0

Provider and hospital networks 33.9 (7.6) 26.3 24.2 (5.0) 19.2

Other 15.1 (5.3) 9.8 10.8 (3.2) 7.6

568.8 (68.1) 500.7 99.7 (37.9) 61.8

Intangible asset with indefinite life:

Blue Cross and Blue Shield trademarks 773.9 — 773.9 67.5 — 67.5

$1,342.7 $(68.1) $1,274.6 $167.2 $(37.9) $129.3

As required by FAS 142, the Company completed its transitional impairment test of existing goodwill and other

intangible assets with indefinite lives during the second quarter of 2002. This test involved the use of estimates related to

the fair value of the business with which the goodwill and other intangible assets with indefinite lives is allocated. There

were no impairment losses as a result of this test. In addition, the Company completed its annual impairment test of good-

will and other intangible assets with indefinite lives during the fourth quarter of 2002. There were no impairment losses as

a result of this test.

With the adoption of FAS 142 on January 1, 2002, the Company ceased amortization of goodwill. The intangible

asset established for Blue Cross and Blue Shield trademarks is deemed to have an indefinite life and beginning January 1,

2002 is no longer amortized. Net income and earnings per share on a comparable basis as if FAS 142 had been adopted

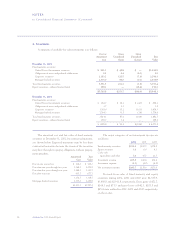

January 1, 2000 are as follows: Year Ended December 31

2002 2001 2000

Reported net income $549.1 $342.2 $226.0

Amortization of goodwill (net of tax) —13.1 11.2

Amortization of Blue Cross and Blue Shield trademarks (net of tax) —2.0 1.3

Net income adjusted for FAS 142 $549.1 $357.3 $238.5

Basic earnings per share:

As reported and pro forma $ 4.61 $ 3.31 $ 2.19

Amortization of goodwill (net of tax) —.12 .11

Amortization of Blue Cross and Blue Shield trademarks (net of tax) —.03 .02

Basic earnings per share adjusted for FAS 142 $ 4.61 $ 3.46 $ 2.32

Diluted earnings per share:

As reported and pro forma $ 4.51 $ 3.30 $ 2.18

Amortization of goodwill (net of tax) —.12 .11

Amortization of Blue Cross and Blue Shield trademarks (net of tax) —.02 .02

Diluted earnings per share adjusted for FAS 142 $ 4.51 $ 3.44 $ 2.31

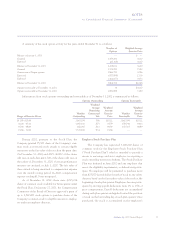

Aggregate amortization expense for 2002, 2001 and 2000 was $30.2, $31.5 and $27.1, respectively. As of December 31,

2002, estimated amortization expense for each of the five calendar years ending December 31, is as follows: 2003, $47.4;

2004, $44.4; 2005, $39.5; 2006, $37.0; and 2007, $34.8.