Anthem Blue Cross 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

Anthem, Inc. 2002 Annual Report 45

Excluding TRICARE, membership increased 400,000,

or 9%, primarily due to higher BlueCard activity, higher

sales in National Accounts business and higher sales and

favorable retention of Local Large Group business.

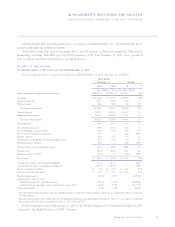

East

Our East segment is comprised of health benefit and

related business for members in Connecticut, New

Hampshire and Maine. BCBS-ME is included from its

acquisition date of June 5, 2000. Our East segment’s summa-

rized results of operations for the years ended December 31,

2001 and 2000 are as follows:

Years Ended

December 31

2001 2000 $ Change % Change

($ in Millions)

Operating

Revenue $3,667.3 $2,921.9 $745.4 26%

Operating Gain $ 128.8 $ 103.8 $ 25.0 24%

Operating

Margin 3.5% 3.6% (10) bp

Membership

(in 000s) 2,260 2,093 167 8%

Operating revenue increased $745.4 million, or

26%. Excluding our acquisition of BCBS-ME in June

2000 and the effect of our exit from the Medicare +

Choice business in Connecticut on January 1, 2001, oper-

ating revenue increased $449.0 million, or 20%, primarily

due to premium rate increases in our Local Large Group

business and higher average membership in our Local

Large Group and Small Group businesses.

Operating gain increased $25.0 million, or 24%, pri-

marily due to improved underwriting results in our Local

Large Group fully-insured business, exiting the Medicare

+ Choice market in Connecticut, and higher overall

membership. Operating margin decreased 10 basis points

primarily due to the relatively lower margins on our

Maine business.

Membership increased 167,000, or 8%, primarily due

to increased sales of Local Large Group business and

growth in BlueCard activity. Local Large Group sales in

our East segment increased primarily due to the with-

drawal of two of our largest competitors from the New

Hampshire and Maine markets.

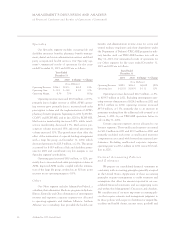

West

Our West segment is comprised of health benefit and

related business for members in Colorado and Nevada. Our

West segment’s summarized results of operations for the

years ended December 31, 2001 and 2000 are as follows:

Years Ended

December 31

2001 2000 $ Change % Change

($ in Millions)

Operating Revenue $774.4 $622.4 $152.0 24%

Operating Gain $ 20.1 $ 2.5 $ 17.6 704%

Operating Margin 2.6% 0.4% 220 bp

Membership

(in 000s) 769 595 174 29%

Operating revenue increased $152.0 million, or 24%,

primarily due to higher premium rates designed to bring our

pricing in line with cost of care and higher membership

in our Local Large Group and Small Group businesses.

Operating gain increased $17.6 million to $20.1 mil-

lion in 2001, primarily due to improved underwriting per-

formance as a result of premium rate increases exceeding

cost of care increases and higher average membership.

This improvement in our operating gain resulted in a 220

basis point increase in operating margin to 2.6% in 2001.

Membership increased 174,000, or 29%, due to

increased BlueCard activity, higher sales in Local Large

Group and Small Group businesses and favorable retention

in National Accounts business. We exited the Medicare +

Choice market in Colorado effective January 1, 2002. At

December 31, 2001, our Medicare + Choice membership

in Colorado was approximately 6,000.

We entered into an agreement with Sloan’s Lake

HMO in Colorado for the conversion of Sloan’s Lake

HMO business effective January 1, 2001. The terms of

the agreement include payment to Sloan’s Lake for each

member selecting our product at the group’s renewal date

and continuing as our member for a minimum of nine

months. Through December 31, 2001, we added approxi-

mately 35,000 members from Sloan’s Lake.