Anthem Blue Cross 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

Anthem, Inc. 2002 Annual Report 51

securities. Cash disbursements result mainly from benefit

expenses, administrative expenses, taxes, purchase of

investment securities and interest expense. Cash outflows

fluctuate with the amount and timing of settlement of these

expenses. As such, any future decline in our profitability

would likely have some negative impact on our liquidity.

We manage our cash, investments and capital struc-

ture so we are able to meet the short- and long-term obli-

gations of our business while maintaining financial

flexibility and liquidity. We forecast, analyze and monitor

our cash flows to enable investment and financing within

the overall constraints of our financial strategy.

A substantial portion of the assets held by our regu-

lated subsidiaries are in the form of cash, cash equivalents

and investments. After considering expected cash flows

from operating activities, we generally invest cash that

exceeds our near term obligations in longer term mar-

ketable fixed maturity securities, to improve our overall

investment income returns. Our investment strategy is to

make investments consistent with insurance statutes and

other regulatory requirements, while preserving our asset

base. Our investments are available for sale to meet liq-

uidity and other needs. Excess capital is paid in the form

of dividends by subsidiaries to their respective parent

companies for general corporate use, annually as permit-

ted by applicable regulations.

The availability of financing in the form of debt or

equity is influenced by many factors including our prof-

itability, operating cash flows, debt levels, debt ratings,

contractual restrictions, regulatory requirements and mar-

ket conditions. We have access to $1.0 billion of revolv-

ing credit facilities, which allow us to maintain further

operating and financial flexibility.

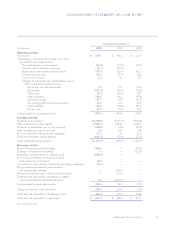

Liquidity—Year Ended December 31, 2002

Compared to Year Ended December 31, 2001

During 2002, net cash flow provided by operating

activities was $991.1 million, an increase of $336.5 million,

or 51%, over 2001. The increase is a reflection of our

improved net income. Higher non-cash expenses such as

depreciation and amortization, as well as favorable

changes in our operating assets and liabilities comple-

mented this increased net income to generate improved

cash flow from operations.

Net cash flow used in investing activities was

$1,411.9 million in 2002, compared to $498.1 million in

2001, an increase of $913.8 million. The table below out-

lines where the changes between the two years occurred:

Increase in purchases of subsidiaries $(785.5)

Decrease in proceeds from sales of subsidiaries (44.1)

Increase in net purchases of investments (40.9)

Increase in net purchases and proceeds

from sale of property and equipment (43.3)

Total increase in cash used

in investing activities $(913.8)

The increase in subsidiary purchases resulted prima-

rily from the Trigon acquisition in 2002, for which we

paid $772.4 million in net cash. Cash acquired on

Trigon’s balance sheet was $362.2 million, which partially

offset $1,134.6 million used for the purchase price and

transaction costs. The net decline in cash received from

divestitures between the two years reflects proceeds from

the sale of TRICARE in 2001, which did not occur in

2002. The purchase of investment securities increased as

operating cash was moved into our investment portfolio.

The increased property and equipment purchases include

$24.6 million of expenditures made by Trigon following

the acquisition date. The remainder of the increased

property purchases resulted from investments in computer

technology and software.

Net cash flow provided by financing activities was

$709.3 million in 2002 compared to $46.6 million in 2001.

On July 31, 2002, Anthem issued $950.0 million of long-

term senior unsecured notes ($150.0 million of 4.875%

notes due 2005, and $800.0 million of 6.800% notes due

2012). The net proceeds of $938.5 million from the note

offering were used to pay a portion of the approximately

$1,134.5 million of cash consideration and expenses associ-

ated with Anthem’s acquisition of Trigon. In addition,

$30.9 million of proceeds resulted from the issuance of

common stock related to the exercise of stock options and

through the employee stock purchase program. We used

$256.2 million to repurchase our common stock during

2002. The $46.6 million of cash provided by financing

activities during 2001 is related to the demutualization and

initial public offering, which is described below in

“Liquidity—Year Ended December 31, 2001 Compared to

Year Ended December 31, 2000.”