Anthem Blue Cross 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

72 Anthem, Inc. 2002 Annual Report

investment account. The purchase price per share is 85%

of the lower of the fair market value of a share of common

stock on either the first or last trading day of the plan

quarter. Employee purchases under the Stock Purchase

Plan were $6.9, with 135,593 shares issued to employees

during the period ending December 31, 2002. As of

December 31, 2002, payroll deductions of $1.2 have been

accumulated toward purchases for the plan quarter ending

February 28, 2003. As of December 31, 2002, there were

2,864,407 shares of common stock available for issuance

under the Stock Purchase Plan.

Pro Forma Disclosure

The pro forma information regarding net income

and earnings per share have been determined as if the

Company accounted for its stock-based compensation

using the fair value method. The fair value for the

stock options was estimated at the date of grant using a

Black-Scholes option valuation model with the following

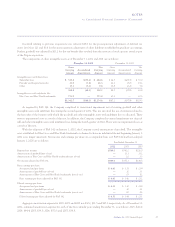

weighted-average assumptions:

2002 2001

Risk-free interest rate 4.16% 4.96%

Volatility factor 45.00% 42.00%

Dividend yield ——

Weighted-average expected life 4 years 4 years

The Black-Scholes option valuation model was

developed for use in estimating the fair value of traded

options that have no vesting restrictions and are fully

transferable. In addition, option valuation models require

the input of highly subjective assumptions including the

expected stock price volatility. Because the Company’s

stock option grants have characteristics significantly dif-

ferent from those of traded options, and because changes

in the subjective input assumptions can materially affect

the fair value estimate, in management’s opinion, the

existing models do not necessarily provide a reliable sin-

gle measure of the fair value of its stock option grants.

For purposes of pro forma disclosures, compensation

expense is increased for the estimated fair value of the

options amortized over the options’ vesting periods and

for the difference between the market price of the stock

and discounted purchase price of the shares on the pur-

chase date for the employee stock purchases. The

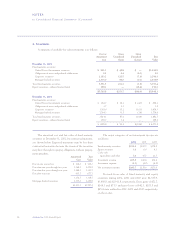

Company’s pro forma information is as follows:

2002 2001

Reported net income $549.1 $342.2

Total stock-based employee compensation

expense determined under fair value

based method for all awards (net of tax) (13.1) (1.1)

Pro forma net income $536.0 $341.1

2002 2001

As Pro As Pro

Reported Forma Reported Forma

Earnings per share:

Basic net income $4.61 $ 4.50 $3.31 $3.30

Diluted net income 4.51 4.42 3.30 3.30

Basic and diluted

net income after

demutualization and

initial public offering ——0.54 0.53

Weighted-average fair

value of options granted

during the year — 28.16 — 14.12

Weighted-average fair

value of employee

stock purchases

during the year — 15.23 ——

Weighted-average fair

value of restricted

stock awards granted

during the year — 62.57 ——

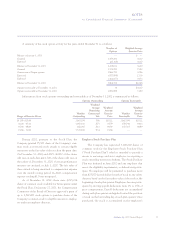

Initial Public Offering and Equity Security Units

On November 2, 2001, Anthem completed an ini-

tial public offering of 55,200,000 shares of common stock,

at an initial public offering price of $36.00 per share.

The shares issued in the initial public offering were in

addition to 48,095,675 shares of common stock (which