Anthem Blue Cross 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

Anthem, Inc. 2002 Annual Report 47

other intangible assets, our investment portfolio and

retirement benefits, which are discussed below. Our sig-

nificant accounting policies are also summarized in Note

1 to our audited consolidated financial statements for the

years ended December 31, 2002, 2001 and 2000.

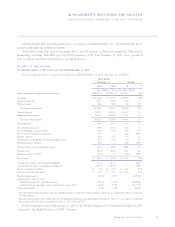

Liability for Unpaid Life, Accident and Health Claims

The most significant accounting estimate in our

consolidated financial statements is our liability for

unpaid life, accident and health claims. This liability was

$1,826.0 million and represented 26% of our total consol-

idated liabilities at December 31, 2002. We record this

liability and the corresponding benefit expense for pend-

ing claims and claims that are incurred but not reported.

Pending claims are those received by us, but not yet

processed through our systems. We determine the amount

of this liability for each of our business segments by fol-

lowing a detailed process that entails using both historical

claim payment patterns as well as emerging medical cost

trends to project our best estimate of claim liabilities. We

also look back to assess how our prior periods’ estimates

developed. To the extent appropriate, changes in such

development are recorded as a change to current period

claims expense. Since the average life of most claims is

just a few months, current medical cost trends and utiliza-

tion patterns are very important in our estimate of claims

liabilities. For information regarding our cost trends, refer

to the discussion of benefit expenses included within this

Management’s Discussion and Analysis.

In addition to the pending claims and incurred but

not reported claims, the liability for unpaid life, accident

and health claims includes reserves for premium deficiency

losses. The premium deficiency losses are recognized

when it is probable that expected claims and loss adjust-

ment expenses will exceed future premiums on existing

health and other insurance contracts without considera-

tion of investment income. For purposes of premium

deficiency losses, contracts are grouped in a manner

consistent with our method of acquiring, servicing and

measuring the profitability of such contracts.

Management constantly reviews its assumptions

regarding our claims liabilities, and makes adjustments to

claims expense recorded, if necessary, in the period it

deems appropriate. If it is determined that management’s

assumptions regarding cost trends and utilization are sig-

nificantly different than actual results, our income state-

ment and financial position could be impacted in future

periods. Adjustments of prior year estimates may result

in additional benefit expense or a reduction of benefit

expense in the period an adjustment is made. Further, due

to the considerable variability of health care costs, adjust-

ments to claims liabilities occur each quarter and are

sometimes significant as compared to the total expense

recorded in that quarter.

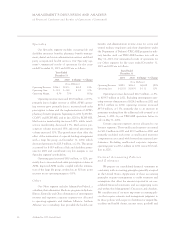

Note 8 to our audited consolidated financial state-

ments for the years ended December 31, 2002, 2001 and

2000 provides historical information regarding the accrual

and payment of our unpaid claims liability. Components

of the total incurred claims for each year include amounts

accrued for current year estimated claims expense as well

as adjustments to prior year estimated accruals.

In Note 8, the line labeled “incurred related to prior

years” accounts for those adjustments made to prior year

estimates. The impact of any reduction of “incurred related

to prior years” claims may be offset as we re-establish the

“incurred related to current year”. Our reserving practice

is to consistently recognize the actuarial best estimate of

our ultimate liability for our claims within a level of con-

fidence required to meet actuarial standards. Thus, only

when the release of a prior year reserve is not offset with

the same level of conservatism in estimating the current

year reserve will the redundancy reduce benefit expense.

When we recognize a release of the redundancy, we dis-

close the amount that is other than our normal release

being experienced. An example of a redundancy release is

discussed in the “Results of Operations—Year Ended

December 31, 2002 and 2001” included elsewhere in this

Management Discussion and Analysis.

We believe we have consistently applied this

methodology in determining our best estimate for unpaid

claims liability each year. This is demonstrated by com-

paring prior year redundancies to total incurred claims

recorded in each past year. This metric was 1.3% in 2000,

1.5% in 2001 and 1.9% at the end of 2002. When this

metric remains constant or increases, it is an indication of

the consistency of our reserving procedures and policies.