Anthem Blue Cross 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

46 Anthem, Inc. 2002 Annual Report

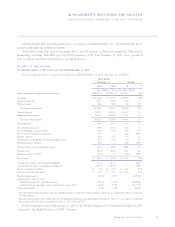

Specialty

Our Specialty segment includes our group life and

disability insurance benefits, pharmacy benefit manage-

ment, dental and vision administration services and third

party occupational health services. Our Specialty seg-

ment’s summarized results of operations for the years

ended December 31, 2001 and 2000 are as follows:

Years Ended

December 31

2001 2000 $ Change % Change

($ in Millions)

Operating Revenue $396.1 $332.3 $63.8 19%

Operating Gain $ 32.9 $ 24.9 $ 8.0 32%

Operating Margin 8.3% 7.5% 80 bp

Operating revenue increased $63.8 million, or 19%,

primarily due to higher revenue at APM. APM’s operat-

ing revenue grew primarily due to increased mail-order

prescription volume and the implementation of APM’s

pharmacy benefit programs beginning in 2001 by BCBS-

CO/NV and BCBS-ME, and in late 2000 by BCBS-NH.

Mail-service membership increased 28%, while retail-

service membership decreased 13%. Mail-service pre-

scription volume increased 38% and retail prescription

volume increased 31%. This growth more than offset the

effect of the termination of a special funding arrangement

with a large life group on December 31, 2000, which

decreased premiums by $28.8 million, or 23%. This group

accounted for $35.9 million of life and disability premi-

ums for 2000 and contributed very low margins to our

Specialty segment’s profitability.

Operating gain increased $8.0 million, or 32%, pri-

marily due to increased mail-order prescription volume at

APM. Improved APM results, coupled with the termina-

tion of the large life group, resulted in an 80 basis point

increase in our operating margin to 8.3%.

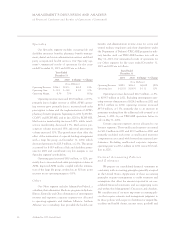

Other

Our Other segment includes AdminaStar Federal, a

subsidiary that administers Medicare programs in Indiana,

Illinois, Kentucky and Ohio; elimination of intersegment

revenue and expenses; corporate expenses not allocated

to operating segments; and Anthem Alliance. Anthem

Alliance was a subsidiary that provided the health care

benefits and administration in nine states for active and

retired military employees and their dependents under

the Department of Defense’s TRICARE program for mili-

tary families until our TRICARE business was sold on

May 31, 2001. Our summarized results of operations for

our Other segment for the years ended December 31,

2001 and 2000 are as follows:

Years Ended

December 31

2001 2000 $ Change % Change

($ in Millions)

Operating Revenue $189.5 $206.4 $(16.9) (8)%

Operating Loss $ (23.8) $(34.9) $ 11.1 32%

Operating revenue decreased $16.9 million, or 8%,

to $189.5 million in 2001. Excluding intersegment oper-

ating revenue eliminations of $214.0 million in 2001 and

$151.7 million in 2000, operating revenue increased

$45.4 million, or 13%, primarily due to an increase in

premiums resulting from the additional risk assumed as of

January 1, 2001, by our TRICARE operations before its

sale on May 31, 2001.

Certain corporate expenses are not allocated to our

business segments. These unallocated expenses accounted

for $33.0 million in 2001 and $39.9 million in 2000, and

primarily included such items as unallocated incentive

compensation associated with better than expected per-

formance. Excluding unallocated corporate expenses,

operating gain was $9.2 million in 2001 versus $5.0 mil-

lion in 2000.

Critical Accounting Policies

and Estimates

We prepare our consolidated financial statements in

conformity with accounting principles generally accepted

in the United States. Application of these accounting

principles requires management to make estimates and

assumptions that affect the amounts reported in our con-

solidated financial statements and accompanying notes

and within this Management’s Discussion and Analysis.

We consider some of our most important accounting poli-

cies that require estimates and management judgment to

be those policies with respect to liabilities for unpaid life,

accident and health claims, income taxes, goodwill and