Anthem Blue Cross 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

64 Anthem, Inc. 2002 Annual Report

2000

On June 5, 2000, the Company completed its pur-

chase of substantially all of the assets and liabilities of

Associated Hospital Service of Maine, formerly d/b/a Blue

Cross and Blue Shield of Maine (“BCBS-ME”), in accor-

dance with the Asset Purchase Agreement dated July 13,

1999. The purchase price was $95.4 (including direct costs

of acquisition) and resulted in $90.5 of goodwill and other

intangible assets. Intangible assets with finite lives are

being amortized over ten years. In 2001, goodwill was

reduced by $2.1 for purchase price allocation adjustments

based on final valuation studies. This acquisition was

accounted for as a purchase and the net assets and results

of operations have been included in the Company’s con-

solidated financial statements from the purchase date. The

pro forma effects of the BCBS-ME acquisition were not

material to the Company’s consolidated results of opera-

tions for periods preceding the purchase date.

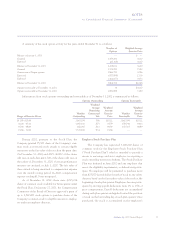

Pending Acquisition

On May 31, 2001, Anthem Insurance and Blue

Cross and Blue Shield of Kansas (“BCBS-KS”)

announced they had signed a definitive agreement pur-

suant to which BCBS-KS would become a wholly-owned

subsidiary of Anthem Insurance. Under the proposed

transaction, BCBS-KS would demutualize and convert to

a stock insurance company. The agreement calls for

Anthem Insurance to pay $190.0 in exchange for all of

the shares of BCBS-KS. On February 11, 2002, the

Kansas Insurance Commissioner disapproved the pro-

posed transaction, which had been previously approved

by the BCBS-KS policyholders in January 2002. On

February 19, 2002, the Board of Directors of BCBS-KS

voted unanimously to appeal the Kansas Insurance

Commissioner’s decision and BCBS-KS sought to have

the decision overturned in Shawnee County District

Court. The Company joined BCBS-KS in the appeal,

which was filed on March 7, 2002. On June 7, 2002, the

Shawnee County District Court ruled on the BCBS-KS

appeal. The Court ruled in favor of Anthem and BCBS-

KS, vacating the Commissioner’s decision and remanding

the matter to the Commissioner for further proceedings

not inconsistent with the Court’s order. On June 10,

2002, the Kansas Insurance Commissioner appealed the

Court’s ruling to the Kansas Supreme Court. The Kansas

Supreme Court will begin to hear oral arguments of the

parties to this case on March 5, 2003.

Divestitures

2002

During 2002, the Company divested of several small

business operations, which were no longer deemed to be

strategically aligned with objectives of the Company’s

Specialty business segment. The Company recognized an

aggregate pretax gain of $0.7 on these dispositions. The

pro forma effects of these divestitures are insignificant to

the consolidated results of operations.

2001

On May 31, 2001, Anthem Insurance and its sub-

sidiary Anthem Alliance Health Insurance Company

(“Alliance”), sold the TRICARE operations of Alliance

to a subsidiary of Humana, Inc. for $45.0. The transac-

tion, which closed on May 31, 2001, resulted in a pretax

gain on sale of subsidiary operations of $25.0, net of sell-

ing expenses.

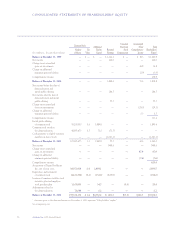

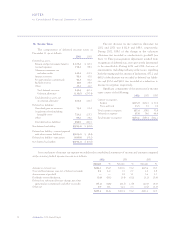

3. Goodwill and Other Intangible Assets

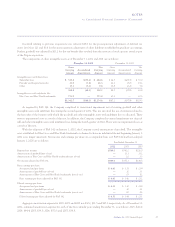

A summary of the change in the carrying amount of goodwill by reportable segment for 2002 is as follows:

Midwest East West Southeast Specialty Total

Balance as of January 1, 2002 $133.6 $121.5 $ 74.9 $ — $ 8.1 $ 338.1

Goodwill acquired — 10.7 — 2,166.6 3.4 2,180.7

Adjustments — (7.0) (13.8) (11.2) (0.8) (32.8)

Goodwill related to divestitures — — — — (1.1) (1.1)

Balance as of December 31, 2002 $133.6 $125.2 $ 61.1 $2,155.4 $ 9.6 $2,484.9