Anthem Blue Cross 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

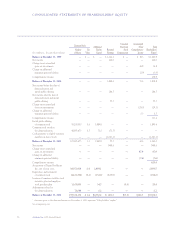

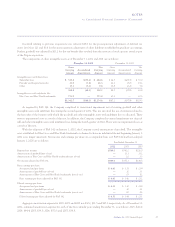

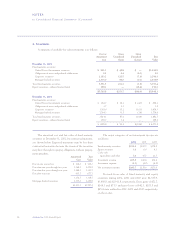

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

58 Anthem, Inc. 2002 Annual Report

Unearned Accumulated

Common Stock Additional Restricted Other Total

Number Par Paid in Retained Stock Comprehensive Shareholders’

(In Millions, Except Share Data)

of Shares Value Capital Earnings Compensation Income Equity1

Balance at December 31, 1999 — $ — $ — $ 1,622.6 $ — $ 38.3 $ 1,660.9

Net income — — — 226.0 — — 226.0

Change in net unrealized

gains on investments — — — — — 36.8 36.8

Change in additional

minimum pension liability — — — — — (3.9) (3.9)

Comprehensive income 258.9

Balance at December 31, 2000 — — — 1,848.6 — 71.2 1,919.8

Net income before the date of

demutualization and

initial public offering — — — 286.5 — — 286.5

Net income after the date of

demutualization and initial

public offering — — — 55.7 — — 55.7

Change in net unrealized

losses on investments — — — — — (29.3) (29.3)

Change in additional

minimum pension liability — — — — — 0.5 0.5

Comprehensive income 313.4

Initial public offering

of common stock 55,200,000 0.6 1,889.8 — — — 1,890.4

Common stock issued in

the demutualization 48,095,675 0.5 71.0 (71.5) — — —

Cash payments to eligible statutory

members in lieu of stock — — — (2,063.6) — — (2,063.6)

Balance at December 31, 2001 103,295,675 1.1 1,960.8 55.7 — 42.4 2,060.0

Net income — — — 549.1 — — 549.1

Change in net unrealized

gains on investments — — — — — 87.9 87.9

Change in additional

minimum pension liability — — — — — (7.6) (7.6)

Comprehensive income 629.4

Acquisition of Trigon Healthcare

Inc., net of issue costs 38,971,908 0.4 2,899.1 — — — 2,899.5

Repurchase and retirement

of common stock (4,121,392) (0.1) (132.6) (123.5) — — (256.2)

Issuance of common stock for stock

incentive plan and employee

stock purchase plan 1,109,893 — 34.7 — (5.3) — 29.4

Adjustments related to

the demutualization 76,048 — 0.2 — — — 0.2

Balance at December 31, 2002 139,332,132 $ 1.4 $4,762.2 $ 481.3 $(5.3) $122.7 $5,362.3

1Amounts prior to the demutualization on November 2, 2001 represent “Policyholders’ surplus”.

See accompanying notes.