Anthem Blue Cross 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

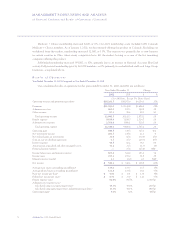

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

30 Anthem, Inc. 2002 Annual Report

•National Accounts customers are employer groups

which have multi-state locations and require partner-

ing with other Blue Cross and Blue Shield plans for

administration and/or access to non-Anthem provider

networks. Included within the National Accounts

business are our BlueCard威customers who represent

enrollees of health plans marketed by other Blue Cross

and Blue Shield Plans, or the home plans, who receive

health care services in our Blue Cross and Blue Shield

licensed markets.

•Medicare + Choice members (age 65 and over) have

enrolled in coverages that are managed care alterna-

tives for the Medicare program.

•The Federal Employee Program, or FEP, provides

health insurance coverage to United States govern-

ment employees and their dependents within our geo-

graphic markets through our participation in the

national contract between the BCBSA and the U.S.

Office of Personnel Management, or OPM.

•Medicaid membership represents eligible members with

state sponsored managed care alternatives in the

Medicaid programs which we manage for the states of

Connecticut, New Hampshire and Virginia.

BlueCard membership, mentioned above as part of

our National Accounts membership, is calculated based

on the amount of BlueCard administrative fees we receive

from the BlueCard members’ home plans. The adminis-

trative fees we receive are based on the number and type

of claims we process, both institutional and professional,

and a portion of the network discount on those claims

from providers in our network who have provided service

to BlueCard members. To calculate membership, adminis-

trative fees are divided by an average per member per

month, or PMPM, factor. The average PMPM factor is

determined using a historical average administrative fee

per claim and an average number of claims per member

per year based on our experience and BCBSA guidelines.

In addition to reporting our membership by customer

type, we report membership by funding arrangement

according to the level of risk we assume in the product

contract. Our two funding arrangement categories are

fully-insured and self-funded. Self-funded products are

offered to customers, generally larger employers, who

elect to retain some or all of the financial risk associated

with their employees’ health care costs. Some employers

choose to purchase stop-loss coverage to limit their

retained risk.

The renewal patterns of our fully-insured Local

Large Group and Small Group business, including our

Southeast segment, are as follows: approximately 35% of

renewals occur during the first quarter, approximately

18% of renewals occur during the second quarter, approx-

imately 31% of renewals occur during the third quarter

and approximately 16% of renewals occur during the

fourth quarter. These renewal patterns have remained

consistent over the past year and allow us to adjust our

pricing and benefit plan designs in response to market

conditions throughout the year.

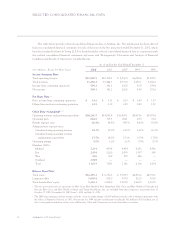

The following table presents our health membership

count by segment, customer type and funding arrange-

ment as of December 31, 2002 and 2001, comparing total

and same-store membership respectively. We define same-

store membership as our membership at a given period end

in a segment or for a particular customer or funding type,

after excluding the impact of members obtained through

acquisitions or lost through dispositions during such

period. We believe that same-store membership counts

best capture the rate of organic growth of our operations

period over period. The membership data presented is

unaudited and in certain instances includes estimates of

the number of members represented by each contract at

the end of the period, rounded to the nearest thousand.