Anthem Blue Cross 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

62 Anthem, Inc. 2002 Annual Report

claim amounts processed. Under the Company’s self-

funded arrangements, revenue is recognized as adminis-

trative services are performed. All benefit payments

under these programs are excluded from benefit expense.

Other revenue principally includes amounts from

mail-order prescription drug sales, which are recognized as

revenue when the Company ships prescription drug orders.

Federal Income Taxes: Anthem and the majority of its

subsidiaries file a consolidated income tax return.

Deferred income tax assets and liabilities are recognized

for the differences between the financial and income tax

reporting bases of assets and liabilities based on enacted

tax rates and laws. The deferred income tax expense or

benefit generally represents the net change in deferred

income tax assets and liabilities during the year. The cur-

rent income tax expense represents the tax consequences

of revenues and expense currently taxable or deductible

on various income tax returns for the year reported.

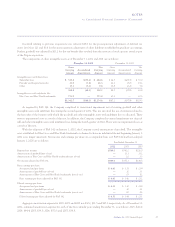

Stock-Based Compensation: The Company has a plan

that provides for stock-based compensation, including

stock options, restricted stock awards and an employee

stock purchase plan. Stock options are granted for a fixed

number of shares with an exercise price at least equal to

the fair value of the shares at the date of the grant.

Restricted stock awards are issued at the fair value of the

stock on the grant date. The employee stock purchase

plan allows for a purchase price per share which is 85% of

the lower of the fair value of a share of common stock on

(i) the first trading day of the plan quarter, or (ii) the last

trading day of the plan quarter. The Company accounts

for stock-based compensation using the intrinsic method

under Accounting Principles Board Opinion No. 25,

Accounting for Stock Issued to Employees, and, accordingly,

recognizes no compensation expense related to stock

options and employee stock purchases. For grants of

restricted stock, unearned compensation equivalent to

the fair value of the shares at the date of grant is recorded

as a separate component of shareholders’ equity and sub-

sequently amortized to compensation expense over the

vesting period. The Company has adopted the disclosure-

only provisions of FAS 123, as amended, Accounting for

Stock-Based Compensation.

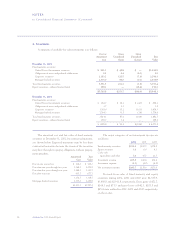

Earnings Per Share: Earnings per share amounts, on a

basic and diluted basis, have been calculated based upon

the weighted-average common shares outstanding for the

period after the date of the demutualization and initial

public offering.

Basic earnings per share excludes dilution and is com-

puted by dividing income available to common sharehold-

ers by the weighted-average number of common shares

outstanding for the period. Diluted earnings per share

includes the dilutive effect of all stock options, restricted

stock and purchase contracts included in Equity

Security Units, using the treasury stock method. Under

the treasury stock method, exercise of stock options,

restricted stock and purchase contracts is assumed, with

the proceeds used to purchase common stock at the aver-

age market price for the period. The difference between

the number of shares assumed issued and number of

shares assumed purchased represents the dilutive shares.

Reclassifications: Certain prior year amounts have been

reclassified to conform to the current year presentation.

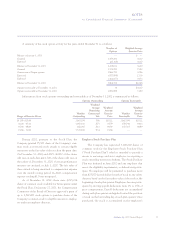

2. Acquisitions and Divestitures

Acquisition of Trigon Healthcare, Inc.

On July 31, 2002, Anthem completed its purchase of

100% of the outstanding stock of Trigon Healthcare, Inc.

(“Trigon”), in accordance with an agreement and plan of

merger announced April 29, 2002. Trigon was Virginia’s

largest health care company and was the Blue Cross and

Blue Shield licensee in Virginia, excluding the Northern

Virginia suburbs of Washington, D.C. The merger pro-

vides the Company with a new segment (Southeast) with

approximately 2.5 million members and a nearly forty

percent share of the Virginia market.

Trigon’s shareholders each received thirty dollars in

cash and 1.062 shares of Anthem common stock for each

Trigon share outstanding. The purchase price was approx-

imately $4,038.1 and included cash of $1,104.3, the

issuance of 38,971,908 shares of Anthem common stock,

valued at $2,708.1, Trigon stock options converted into

Anthem stock options for 3,866,770 shares, valued at

$195.5 and approximately $30.2 of transaction costs. On

July 31, 2002, the Company issued $950.0 of long term

senior unsecured notes which were used, along with the

sale of investment securities and available cash, to fund

the cash portion of the purchase price.