Anthem Blue Cross 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations (Continued)

52 Anthem, Inc. 2002 Annual Report

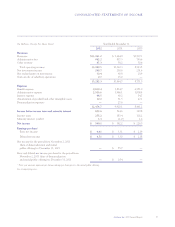

Liquidity—Year Ended December 31, 2001

Compared to Year Ended December 31, 2000

Net cash flow provided by operating activities was

$654.6 million for the year ended December 31, 2001, and

$684.5 million for the year ended December 31, 2000, a

decrease of $29.9 million, or 4%. In both 2001 and 2000,

net cash flow provided by operating activities was impacted

by better balance sheet management resulting from the

conversion of certain operating assets, such as receivables

and investments in non-strategic assets, to cash. As the

continuing focus on balance sheet management began in

early 2000, our cash flow provided by operating activities

in 2000 was unusually high. During 2001, demutualization

expenses of $27.6 million were incurred relating to our

conversion to a stockholder owned company. Also during

2001, incentive compensation payments were made which

had been accrued over the previous three years. Neither of

these items occurred during 2000.

Net cash used in investing activities was $498.1 mil-

lion for the year ended December 31, 2001, and $761.1

million for the year ended December 31, 2000, a decrease

of $263.0 million, or 35%. The table below outlines

where the changes between the two years occurred:

Decrease in purchases of subsidiaries $ 81.0

Increase in proceeds from sales of subsidiaries 39.6

Decrease in net purchases of investments 146.9

Decrease in net purchases and proceeds

from sale of property and equipment (4.5)

Total decrease in cash used

in investing activities $263.0

The decrease in purchase of subsidiaries reflects the

cash used to purchase BCBS-ME in 2000, which did not

occur again in 2001. The increase in proceeds from sale of

subsidiaries resulted from the sale of our TRICARE opera-

tions in 2001. The decreased net purchase of investments

was primarily a result of our direction to investment

mangers to maintain greater liquidity at December 31,

2001 as compared to December 31, 2000. The slight

decline in the purchase of property and equipment

reflects the sale of our TRICARE operations, which had

minimum property additions in 2001 as compared to the

prior year, and higher levels of purchases for furniture and

capitalized software in 2000.

Net cash provided by financing activities was $46.6

million for the year ended December 31, 2001, and $75.5

million for the year ended December 31, 2000, a decrease

of $28.9 million, or 38%.

The $46.6 million of cash provided by financing

activities in 2001 included net proceeds received from our

initial public offering, after making payments to eligible

statutory members.

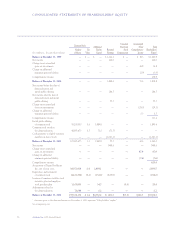

On November 2, 2001, Anthem Insurance Companies,

Inc. (“Anthem Insurance”) converted from a mutual insur-

ance company to a stock insurance company in a process

known as a demutualization. Effective with the demutual-

ization, Anthem, Inc. (“Anthem”) completed an initial

public offering of 55.2 million shares of common stock at

an initial public offering price of $36.00 per share. The

shares issued in the initial public offering are in addition to

48.1 million shares of common stock (which will ulti-

mately vary slightly as all distribution issues are finalized)

distributed to eligible statutory members in the demutual-

ization. Concurrent with our initial public offering of com-

mon stock, we issued 4.6 million 6.00% Equity Security

Units at $50.00 per unit.

After an underwriting discount and other offering

expenses, net proceeds from our common stock offering were

approximately $1,890.4 million (excluding demutualization

expenses of $27.6 million). After underwriting discount and

expenses, net proceeds from our Units offering were approx-

imately $219.8 million. In December 2001, proceeds from

our common stock and Units offerings in the amount of

$2,063.6 million were used to fund payments to eligible

statutory members of Anthem Insurance who received cash

instead of common stock in our demutualization.

Our 2000 financing activities of $75.5 million con-

sisted of $295.9 million net proceeds received from the

issuance of $300.0 million of surplus notes on a discounted

basis, less $220.4 million repayment of bank debt.

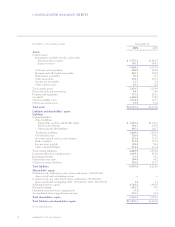

Financial Condition

We maintained a strong financial condition and liq-

uidity position, with consolidated cash and investments

of $6.6 billion at December 31, 2002. Total cash and

investments increased by $2.2 billion since December 31,

2001, primarily resulting from our acquisition of Trigon

and strong cash flows from operations, partially offset by

cash used for stock repurchases.