Anthem Blue Cross 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

Anthem, Inc. 2002 Annual Report 75

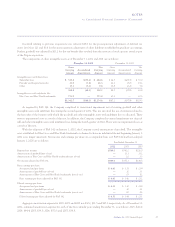

At December 31, 2002, the Company had unused

federal tax net operating loss carryforwards of approxi-

mately $132.3 to offset future taxable income. The loss

carryforwards expire in the years 2003 through 2021.

During 2002, 2001 and 2000 federal income taxes paid

totaled $151.2, $74.1 and $26.3, respectively.

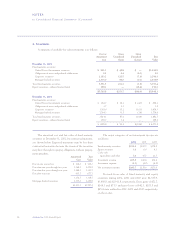

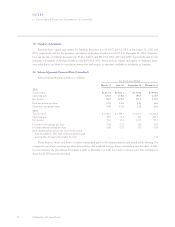

13. Accumulated Other Comprehensive Income

A reconciliation of the components of accumulated

other comprehensive income at December 31 is as follows:

2002 2001

Investments available-for-sale:

Gross unrealized gains $253.7 $ 90.4

Gross unrealized losses (46.4) (18.4)

Total pretax net unrealized gains 207.3 72.0

Deferred tax liability (73.6) (25.4)

Net unrealized gains 133.7 46.6

Restricted investments:

Gross unrealized gains 1.8 —

Gross unrealized losses (0.5) —

Total pretax net unrealized gains 1.3 —

Deferred tax liability (0.5) —

Net unrealized gains 0.8 —

Additional minimum pension liability:

Gross additional minimum

pension liability (18.2) (6.5)

Deferred tax asset 6.4 2.3

Net additional minimum

pension liability (11.8) (4.2)

Accumulated other

comprehensive income $122.7 $ 42.4

A reconciliation of the change in unrealized and

realized gains (losses) on investments included in accu-

mulated other comprehensive income is as follows:

2002 2001 2000

Change in pretax net unrealized

gains on investments $167.0 $ 15.5 $ 83.1

Less change in deferred taxes (58.3) (5.3) (28.4)

Less net realized gains on

investments, net of income

taxes (2002, $9.6; 2001, $21.3;

2000, $8.0), included

in net income (20.8) (39.5) (17.9)

Change in net unrealized gains

(losses) on investments $ 87.9 $(29.3) $ 36.8

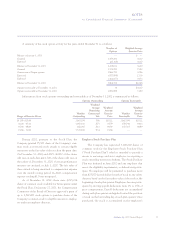

14. Leases

The Company leases office space and certain com-

puter equipment using noncancelable operating leases.

Related lease expense for 2002, 2001 and 2000 was $47.3,

$45.2, and $64.0, respectively.

At December 31, 2002, future lease payments for

operating leases with initial or remaining noncancelable

terms of one year or more consisted of the following:

2003, $43.5; 2004, $37.0; 2005, $32.9; 2006, $27.2; 2007,

$23.5; and thereafter $117.0.

A subsidiary of the Company acquired with the

Trigon acquisition is a fifty percent limited partner in a

partnership that owns a property occupied by the

Company’s subsidiary. Under an operating lease with the

limited partnership, the Company incurred lease expense

of $0.8 during 2002.

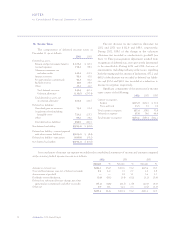

15. Retirement Benefits

Anthem Insurance, Anthem Health Plans of New

Hampshire, Inc. and Anthem Southeast, Inc. sponsor

defined benefit pension plans.

The Anthem Insurance plan is a cash balance

arrangement where participants have an account balance

and will earn a pay credit equal to three to six percent

of compensation, depending on years of service. The

Anthem Insurance plan covers part-time and temporary

employees as well as full-time employees who have com-

pleted one year of continuous service and attained the

age of twenty-one. In addition to the pay credit, partici-

pant accounts earn interest at a rate based on 10-year

Treasury notes.

Anthem Health Plans of New Hampshire, Inc. spon-

sors a plan that is also a cash balance arrangement where

participants have an account balance and will earn a pay

credit equal to five percent of compensation. This plan

generally covers all full-time employees who have com-

pleted one year of continuous service and have attained

the age of twenty-one. The participant accounts earn

interest at a rate based on the lesser of the 1-year Treasury

note or 7%. Effective January 1, 2002, participant

accounts earn interest at a rate based on 10-year Treasury

notes. This plan merged into the Anthem Insurance plan

effective December 31, 2002.