Anthem Blue Cross 2002 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

to Consolidated Financial Statements (Continued)

Anthem, Inc. 2002 Annual Report 73

will ultimately vary slightly when all distribution issues

are finalized) distributed to eligible statutory members in

the demutualization. In addition, on November 2, 2001,

Anthem issued 4,600,000 of 6.00% Equity Security Units.

Each Equity Security Unit contains a purchase contract

under which the holder agrees to purchase, for fifty dol-

lars, shares of Anthem common stock on November 15,

2004. The number of shares to be purchased will be deter-

mined based on the average trading price of Anthem

common stock at the time of settlement.

After underwriting discount and other offering and

demutualization expenses, net proceeds from the common

stock offering were approximately $1,862.8. After under-

writing discount and expenses, net proceeds from the

Equity Security Units offering were approximately

$219.8. In December 2001, proceeds from the common

stock and Equity Security Units offerings in the amount

of $2,063.6 were used to fund payments to eligible statu-

tory members of Anthem Insurance who received cash

instead of common stock in the demutualization.

11. Earnings Per Share

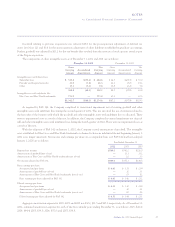

The denominator for basic and diluted earnings per share for 2002, and for the period from November 2, 2001 (date

of demutualization and initial public offering) through December 31, 2001 is as follows:

2002 2001

Denominator for basic earnings per share—weighted-average shares 118,988,092 103,295,675

Effect of dilutive securities—employee and director stock options

and nonvested restricted stock awards 1,280,640 313,397

Effect of dilutive securities—incremental shares from conversion

of Equity Security Unit purchase contracts 1,529,519 212,766

Denominator for diluted earnings per share 121,798,251 103,821,838

Weighted-average shares used for basic earnings per

share assumes that shares distributed to eligible statutory

members as consideration in the demutualization were

issued on the effective date of the demutualization.

Weighted-average shares used for basic earnings per share

also assumes that adjustments, if any, to the common stock

distributed in the demutualization occurred at the begin-

ning of the quarter in which changes were identified.

There were no shares or dilutive securities outstand-

ing prior to the demutualization and initial public offer-

ing. For comparative pro forma earnings per share

presentation, the weighted-average shares outstanding

and the effect of dilutive securities for the period from

November 2, 2001 to December 31, 2001 as shown above

was used to calculate pro forma earnings per share for

2001 and 2000.

Stock options, restricted stock awards and the pur-

chase contracts included in the Equity Security Units are

not considered outstanding in computing the weighted

average number of shares outstanding for basic earnings

per share, but are included, from the grant date, in deter-

mining diluted earnings per share using the treasury stock

method. The stock options are dilutive in periods when

the average market price exceeds the grant price. The

restricted stock awards are dilutive when the aggregate

fair value exceeds the amount of unearned compensation

remaining to be amortized. The purchase contracts

included in the Equity Security Units are dilutive to

Anthem’s earnings per share, because the average market

price of Anthem’s common stock exceeds a stated thresh-

old price of $43.92 per share.