Anthem Blue Cross 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES

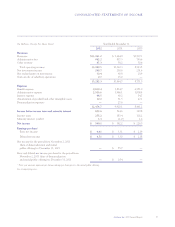

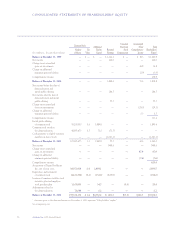

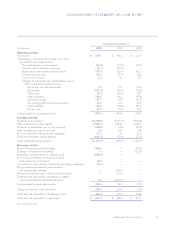

to Consolidated Financial Statements

60 Anthem, Inc. 2002 Annual Report

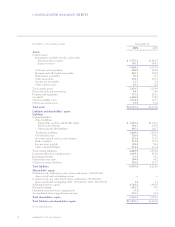

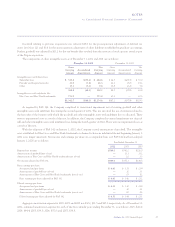

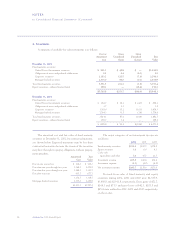

December 31, 2002 (Dollars in Millions, Except Share Data)

1. Basis of Presentation and

Significant Accounting Policies

Basis of Presentation: On November 2, 2001, Anthem

Insurance Companies, Inc. (“Anthem Insurance”) con-

verted from a mutual insurance company to a stock insur-

ance company in a process known as a demutualization.

Concurrent with the demutualization, Anthem Insurance

became a wholly owned subsidiary of Anthem, Inc.

(“Anthem”), and Anthem completed an initial public

offering of common stock. The demutualization was

accounted for as a reorganization using the historical car-

rying values of the assets and liabilities of Anthem

Insurance. Accordingly, immediately following the demu-

tualization and the initial public offering, Anthem

Insurance’s policyholders’ surplus was reclassified to par

value of common stock and additional paid in capital.

The accompanying consolidated financial state-

ments of Anthem and its subsidiaries (collectively, the

“Company”) have been prepared in conformity with

accounting principles generally accepted in the United

States. All significant intercompany accounts and trans-

actions have been eliminated in consolidation. The

Company is licensed in all 50 states and is the Blue Cross

Blue Shield Association licensee in Indiana, Kentucky,

Ohio, Connecticut, New Hampshire, Maine, Colorado,

Nevada, and Virginia (excluding the Northern Virginia

suburbs of Washington, D.C.). Products include health

and group life insurance, managed health care, pharmacy

benefit management and government health program

administration.

Minority interest represents other shareholders’ interests

in subsidiaries which are majority-owned by the Company.

Use of Estimates: Preparation of the consolidated

financial statements requires management to make esti-

mates and assumptions that affect the amounts reported

in the consolidated financial statements and accompany-

ing notes. Actual results could differ from those estimates.

Investments: All fixed maturity and equity securities are

classified as “available-for-sale” securities and are reported

at fair value. The Company has determined that all

investments in its portfolio are available to support cur-

rent operations and, accordingly, has classified such

investment securities as current assets. The unrealized

gains or losses on these securities are included in accumu-

lated other comprehensive income as a separate compo-

nent of shareholders’ equity unless the decline in value is

deemed to be other than temporary, in which case the

loss is charged to income.

Realized gains or losses, determined by specific iden-

tification of investments sold, are included in income.

Cash Equivalents: All highly liquid investments with

maturities of three months or less when purchased are

classified as cash equivalents.

Premium and Self-Funded Receivables: Premium and

self-funded receivables include the uncollected amounts

from insured and self-funded groups, less an allowance for

doubtful accounts of $29.5 and $32.6 at December 31,

2002 and 2001, respectively.

Reinsurance Receivables: Reinsurance receivables rep-

resent amounts recoverable on claims paid or incurred

and are estimated in a manner consistent with the liabili-

ties associated with the reinsured policies. There was no

allowance for uncollectible reinsurance receivables at

December 31, 2002 and 2001.

Other Receivables: Other receivables include amounts

for interest earned on investments, proceeds due from

brokers on investment trades, government programs,

pharmacy sales, claim recoveries and other miscellaneous

amounts due to the Company. These receivables have

been reduced by an allowance for uncollectible amounts

of $20.4 and $23.2 at December 31, 2002 and 2001,

respectively.

Restricted Cash and Investments: Restricted cash and

investments represent fiduciary amounts held under trust

arrangements used for future obligations under certain

unfunded benefit plans and are reported at fair value.

Property and Equipment: Property and equipment is

recorded at cost. Certain costs related to the development

or purchase of internal-use software are capitalized in

accordance with AICPA Statement of Position 98-1,

Accounting for the Costs of Computer Software Developed or

Obtained for Internal Use. Depreciation is computed prin-

cipally by the straight-line method over estimated useful

lives ranging from 15 to 39 years for buildings, three to

seven years for furniture and equipment, and three to ten