Anthem Blue Cross 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a picture of health

2002 annual report

Anthem®

Table of contents

-

Page 1

Anthem ® a picture of health 2002 annual report -

Page 2

ANTHEM'S MISSION IS TO IMPROVE THE HEALTH OF THE PEOPLE WE SERVE. -

Page 3

anthem was a picture of health in 2002. We are committed to further improvement in 2003. -

Page 4

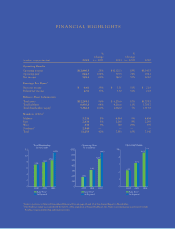

FINANCIAL HIGHLIGHTS (in millions, except per share data) 2002 % Change vs. 2001 2001 % Change vs. 2000 2000 Operating Results Operating revenue Operating gain1 Net income Earnings Per Share1 $12,990.5 644.5 549.1 28% 102% 60% $10,120.3 319.5 342.2 18% 74% 51% $8,543.5 184.1 226.0 ... -

Page 5

-

Page 6

-

Page 7

... This time, it would be different. The next day, a light appeared at the end of the tunnel. Stacey, an Anthem member from Concord, N.H., got a phone call from Diana Brighton, a high-risk pregnancy case manager for Anthem Blue Cross and Blue Shield. "Diana told me about Anthem's program for high-risk... -

Page 8

... Blue Cross and Blue Shield. The results are simple: the physicians earn rewards for their quality efforts, and Anthem members receive measurably better care. "Part of this program is to demonstrate that physicians and health plans can be collaborative," says Mike D'Eramo, executive administrator... -

Page 9

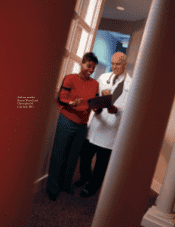

Anthem member Sharon Worrell and Christopher M. Copeland, M.D. -

Page 10

-

Page 11

... Janice, an Anthem member in Staunton, Va. "At first she was calling me every other day to check up on me. She answered all of my weird questions. She got me stable on my medications. She contacted my doctor, and he worked out a treatment plan for me." Today, Janice walks a mile at a time, weather... -

Page 12

... many small business owners struggle with: how to provide benefits to employees as health care costs keep rising. Adding to the problem is the fact that fewer and fewer insurance companies have remained in the small group market in Colorado. "I only know of five or six companies that offer plans to... -

Page 13

Ron Genuario, President, Wenco Industries -

Page 14

... to make significant progress in 2002. At the same time, we improved the company's overall performance in providing value to our shareholders, customers and communities. • We acquired Trigon Healthcare, Inc., a highly successful Blue Cross and Blue Shield licensee in Virginia, to form a new... -

Page 15

... Assurance (NCQA)-the nation's leading independent managed care accrediting organization-has awarded its coveted "Excellent" rating to our Blue Cross and Blue Shield health plans in Colorado, Connecticut, Maine, New Hampshire, Ohio and Virginia. Three Anthem health plans were recognized as being... -

Page 16

...an effective health benefits manager and insurer is increasingly a scale-driven business. Anthem's track record demonstrates that we improve the financial and service performance and market share of state-based Blue Cross and Blue Shield companies while keeping most jobs and control in the state. We... -

Page 17

13 -

Page 18

... in Ohio whose participation in an innovative Anthem program helps bring even higher quality care to their patients. • A small business owner in Colorado who can continue to provide health benefits to his employees thanks to new Anthem products. • A Virginia member whose quality of life has... -

Page 19

-

Page 20

-

Page 21

... time. • Providing distinctive service, allowing us to reduce our administrative costs while providing members with accurate, responsive answers to their health benefits questions. As leaders in our markets, we joined with other health care organizations, business groups and community leaders... -

Page 22

... our customers access to health, pharmacy benefit management, dental, vision, behavioral health and life insurance products in a seamless benefit package. We completed the acquisition of a behavioral health company, allowing us to launch Anthem Behavioral Health with a state-of-the-art information... -

Page 23

.... These programs also empower individuals to take active roles in their care and navigate through a complex health care system." Samuel Nussbaum, M.D. Executive Vice President and Chief Medical Officer Quality We recognize the need for far-reaching change in the health care system nationally to... -

Page 24

... the country we increased our outreach to local medical and specialty societies to discuss health care issues that affect our members. We are proud that the NCQA awarded the coveted "Excellent" rating to our health plans in Colorado, Connecticut, Maine, New Hampshire, Ohio and Virginia. In addition... -

Page 25

" One of the things that differentiates us is that our customer service has become very high-tech while also remaining very 'high-touch'." Michael Houk President Anthem Blue Cross and Blue Shield National Accounts -

Page 26

...Affordable Quality Healthcare (CAQH), a not-for-profit consortium of health plans, networks and industry trade associations committed to improving the quality of care and making administrative processes and access to information easier for physicians and consumers across the country. In 2002, Anthem... -

Page 27

...@Anthem was named an "outstanding website" in the annual WebAward competition conducted by the Web Marketing Association and received a gold award in the 2002 World Wide Web Health Awards Program in the managed care category. • Our members now have 24-hour on-line access to provider directories... -

Page 28

... health of our communities. We continued to support the innovative "Shining Smiles" mobile dental clinic program in Nevada and Colorado. Recognizing these efforts, Colorado Biz magazine named Anthem Blue Cross and Blue Shield a 2002 Company of the Year. Business New Haven honored Anthem Blue Cross... -

Page 29

... of Business Administration Butler University Larry C. Glasscock President and Chief Executive Officer Anthem, Inc. William B. Hart Chairman National Trust for Historic Preservation Allan B. Hubbard President E & A Industries Victor S. Liss Vice Chairman and Director Trans-Lux Corporation William... -

Page 30

... Flows...Notes to Consolidated Financial Statements ...Report of Management ...Report of Independent Auditors...56 57 58 59 60 85 86 26 28 55 Company Information Corporate Information ...Board Committees, Corporate Officers and Principal Operations ...87 88 Anthem, Inc. 2002 Annual Report 25 -

Page 31

... agreement with the Office of Inspector General, or OIG. Net income for 1999 includes contributions totaling $114.1 million ($71.8 million, net of tax) to non-profit foundations in the states of Kentucky, Ohio and Connecticut to settle charitable asset claims. 2 26 Anthem, Inc. 2002 Annual Report -

Page 32

...benefits industry to allow for a comparison of operating efficiency among companies. It is calculated by adding to premiums, administrative fees and other revenue the amount of claims attributable to non-Medicare, self-funded health business where Anthem provides a complete array of customer service... -

Page 33

..., our reportable segments include a Specialty segment that is comprised of business units providing group life and disability insurance benefits, pharmacy benefit management, dental and vision administration services and behavioral health benefits services. During the third quarter of 2002, we... -

Page 34

... different customer types: Local Large Group, Small Group, Individual, National Accounts, Medicare + Choice, Federal Employee Program and Medicaid. • • • Local Large Group consists of those customers with 51 or more employees eligible to participate as a member in one of our health plans... -

Page 35

... Shield plans for administration and/or access to non-Anthem provider networks. Included within the National Accounts business are our BlueCard௡ customers who represent enrollees of health plans marketed by other Blue Cross and Blue Shield Plans, or the home plans, who receive health care services... -

Page 36

...of pricing actions taken to better align our administrative fee revenue with costs of administering this business. Federal Employee Program membership increased 27,000, or 6%, primarily due to our concentrated effort to serve our customers well, fewer competitors in the market and new cost-effective... -

Page 37

...primarily due to an increase in National Accounts BlueCard activity. Fully-insured membership grew by 222,000 members, or 6%, primarily in our Individual and Local Large Group businesses, as explained above. Results of Operations Year Ended December 31, 2002 Compared to Year Ended December 31, 2001... -

Page 38

...funded health business where we provide a complete array of customer service, claims administration and billing and enrollment services, but the customer retains the risk of funding payments for health benefits provided to members. The self-funded claims included for the year ended December 31, 2002... -

Page 39

... 31, 2002, for our Local Large Group and Small Group fully-insured businesses only. Our cost of care trends are calculated by comparing per member per month claim costs for which Anthem is responsible, which excludes member co-payments and deductibles. Our aggregate cost of care trend including the... -

Page 40

...of new provider contracts that reflect the hospital industry's more aggressive stance in their contracting with health benefit companies. Utilization increases resulted primarily from increases in the frequency of inpatient surgeries. We are implementing advanced care management programs and disease... -

Page 41

....4 $110.1 19% 68% 130 bp 8% Operating revenue increased $958.4 million, or 19%, primarily due to premium rate increases in our Local Large Group and Small Group businesses and membership increases in our Local Large Group fully-insured and Individual businesses. 36 Anthem, Inc. 2002 Annual Report -

Page 42

... 2001 are as follows: Years Ended December 31 2002 Operating Revenue Operating Gain Operating Margin Membership (in 000s) 2001 $ Change % Change 19% 272% 550 bp 9% East Our East segment is comprised of health benefit and related business for members in Connecticut, New Hampshire and Maine. Our East... -

Page 43

...business. Specialty Our Specialty segment includes our group life and disability insurance benefits, pharmacy benefit management, dental and vision administration services and behavioral health benefits services. During the third quarter of 2002, we sold our third party occupational health services... -

Page 44

... Small Group, Individual, National Accounts, Medicare + Choice, Federal Employee Program, Medicaid and TRICARE. The first seven customer types are consistent with those described in the "Membership-December 31, 2002 Compared to December 31, 2001" discussion. Our TRICARE program provided managed care... -

Page 45

...% December 31, 2001 Segment Midwest East West Total Customer Type Local Large Group Small Group Individual National Accounts1 Medicare + Choice Federal Employee Program Medicaid Same-Store TRICARE Total Funding Arrangement Self-funded Fully-insured Total 1 2 December 31, 2000 4,582 2,093 595 7,270... -

Page 46

... primarily due to our 23% increase in BlueCard membership. Fully-insured membership, excluding TRICARE, grew by 170,000 members, or 5%, from December 31, 2000, due to growth in both Local Large and Small Group businesses, as explained above. Results of Operations Year Ended December 31, 2001... -

Page 47

... our Midwest health business segment during 2000. On June 5, 2000, we completed the purchase of Blue Cross and Blue Shield of Maine, or BCBS-ME. We accounted for this acquisition as a purchase and we included the net assets and results of operations in our consolidated financial statements from the... -

Page 48

... has allowed more complicated medical procedures to be performed on an outpatient basis rather than on an inpatient (hospitalized) basis, increasing both outpatient utilization rates and unit costs. For the 12-month period ended December 31, 2001, professional services cost trends generally averaged... -

Page 49

...earnings per share, which includes earnings prior to our initial public offering. See Note 11 to our audited consolidated financial statements for the years ended December 31, 2002, 2001 and 2000. Midwest Our Midwest segment is comprised of health benefit and related business for members in Indiana... -

Page 50

... Large Group business. our East segment increased primarily due to the withdrawal of two of our largest competitors from the New Hampshire and Maine markets. We s t East Our East segment is comprised of health benefit and related business for members in Connecticut, New Hampshire and Maine. BCBS... -

Page 51

...ANALYSIS of Financial Condition and Results of Operations (Continued) Specialty Our Specialty segment includes our group life and disability insurance benefits, pharmacy benefit management, dental and vision administration services and third party occupational health services. Our Specialty segment... -

Page 52

...benefits, which are discussed below. Our significant accounting policies are also summarized in Note 1 to our audited consolidated financial statements for the years ended December 31, 2002, 2001 and 2000. Liability for Unpaid Life, Accident and Health Claims The most significant accounting estimate... -

Page 53

MANAGEMENT'S DISCUSSION AND ANALYSIS of Financial Condition and Results of Operations (Continued) Additional review of Note 8 indicates that we are paying claims faster. The percentage of claims paid in the same year as they were incurred increased to 84.3% in 2002 compared with 83.1% in 2001 and ... -

Page 54

... current market fluctuations and are deemed to be temporary. For additional information, see "Quantitative and Qualitative Disclosures about Market Risk" and Note 4 to our audited consolidated financial statements for the years ended December 31, 2002, 2001 and 2000. Anthem, Inc. 2002 Annual Report... -

Page 55

... We provide most employees certain life, medical, vision and dental benefits upon retirement. We use various actuarial assumptions including the discount rate and the expected trend in health care costs to estimate the costs and benefit obligations for our retiree health plan. Our discount rate is... -

Page 56

....6 million used for the purchase price and transaction costs. The net decline in cash received from divestitures between the two years reflects proceeds from the sale of TRICARE in 2001, which did not occur in 2002. The purchase of investment securities increased as operating cash was moved into our... -

Page 57

... year ended December 31, 2000, a decrease of $28.9 million, or 38%. The $46.6 million of cash provided by financing activities in 2001 included net proceeds received from our initial public offering, after making payments to eligible statutory members. On November 2, 2001, Anthem Insurance Companies... -

Page 58

...less. A significant downgrade in our debt could adversely affect our borrowing capacity and costs. Future Sources and Uses of Liquidity On July 2, 2002, Anthem Insurance amended and restated its revolving lines of credit with its lender group to make Anthem the borrower and to increase the available... -

Page 59

... pricing below market trends of increasing costs; increased government regulation of health benefits and managed care; significant acquisitions or divestitures by major competitors; introduction and utilization of new prescription drugs and technology; a downgrade in our financial strength ratings... -

Page 60

... market risks, including those resulting from changes in interest rates and changes in equity market valuations. Potential impacts discussed below are based upon sensitivity analyses performed on Anthem's financial positions as of December 31, 2002. Actual results could vary from these estimates... -

Page 61

...life, accident and health claims Future policy benefits Other policyholder liabilities Total policy liabilities Unearned income Accounts payable and accrued expenses Bank overdrafts Income taxes payable Other current liabilities Total current liabilities Long term...56 Anthem, Inc. 2002 Annual Report -

Page 62

....3 12,990.5 260.7 30.4 0.7 13,282.3 9,839.4 2,506.6 98.5 30.2 - 12,474.7 807.6 255.2 3.3 $ $ $ 549.1 4.61 4.51 - $ 55.7 - - $ 0.54 - Prior year amounts represent pro forma earnings per share prior to the initial public offering. See accompanying notes. Anthem, Inc. 2002 Annual Report 57 -

Page 63

... of Trigon Healthcare Inc., net of issue costs Repurchase and retirement of common stock Issuance of common stock for stock incentive plan and employee stock purchase plan Adjustments related to the demutualization Balance at December 31, 2002 1 - - - 286.5 - - 286.5 - - - - - - - - - 55... -

Page 64

...from long term borrowings Payments on long term borrowings Repurchase and retirement of common stock Proceeds from employee stock purchase plan and exercise of stock options Costs related to the issuance of shares for the Trigon acquisition Net proceeds from common stock issued in the initial public... -

Page 65

...in Indiana, Kentucky, Ohio, Connecticut, New Hampshire, Maine, Colorado, Nevada, and Virginia (excluding the Northern Virginia suburbs of Washington, D.C.). Products include health and group life insurance, managed health care, pharmacy benefit management and government health program administration... -

Page 66

... bases, provider and hospital networks, Blue Cross and Blue Shield trademarks, licenses, non-compete and other agreements. Policy Liabilities: Liabilities for unpaid claims include estimated provisions for both reported and unreported claims incurred on an undiscounted basis, as well as estimated... -

Page 67

... health care company and was the Blue Cross and Blue Shield licensee in Virginia, excluding the Northern Virginia suburbs of Washington, D.C. The merger provides the Company with a new segment (Southeast) with approximately 2.5 million members and a nearly forty percent share of the Virginia market... -

Page 68

....7 of subscriber base with a weighted-average life of 23 years, $8.4 of provider and hospital networks with a 20 year life, and $4.2 of non-compete agreements with a 26 month life. The results of operations for Trigon are included in Anthem's consolidated income statement after the completion of the... -

Page 69

... all of the assets and liabilities of Associated Hospital Service of Maine, formerly d/b/a Blue Cross and Blue Shield of Maine ("BCBS-ME"), in accordance with the Asset Purchase Agreement dated July 13, 1999. The purchase price was $95.4 (including direct costs of acquisition) and resulted in $90... -

Page 70

... intangible assets as of December 31, 2002 and 2001 are as follows: December 31, 2002 Gross Carrying Amount Intangible assets with finite lives: Subscriber base Provider and hospital networks Other Intangible asset with indefinite life: Blue Cross and Blue Shield trademarks $ 519.8 33.9 15.1 568... -

Page 71

... to Consolidated Financial Statements (Continued) 4. Investments A summary of available-for-sale investments is as follows: Cost or Amortized Cost December 31, 2002 Fixed maturity securities: United States Government securities Obligations of states and political subdivisions Corporate securities... -

Page 72

... the note offerings were used to pay a portion of the $1,134.5 of cash consideration and expenses associated with Anthem's acquisition of Trigon. On July 2, 2002, Anthem amended and restated its revolving lines of credit with its lender group to make Anthem the borrower and to increase the available... -

Page 73

... independent pricing services. The fair value of other debt is estimated using discounted cash flow analyses, based on the Company's current incremental borrowing rates for similar types of borrowing arrangements. 7. Property and Equipment Property and equipment at December 31 is as follows: 2002... -

Page 74

...Consolidated Financial Statements (Continued) 8. Unpaid Life, Accident and Health Claims A reconciliation of the beginning and ending balances for unpaid life, accident and health claims is as follows: 2002 Balances at January 1, net of reinsurance Business purchases (divestitures) Incurred related... -

Page 75

... date as additional paid in capital and valued at $195.5 using a Black-Scholes option-pricing model with weighted-average assumptions as follows: Risk-free interest rate Volatility factor Dividend yield Weighted-average expected life 4.96% 42.00% - 7 years 70 Anthem, Inc. 2002 Annual Report -

Page 76

... payroll deductions from 1% to 15% of gross compensation. Payroll deductions are accumulated during each plan quarter and applied toward the purchase of stock on the last trading day of each plan quarter. Once purchased, the stock is accumulated in the employee's Anthem, Inc. 2002 Annual Report 71 -

Page 77

...of the options amortized over the options' vesting periods and for the difference between the market price of the stock and discounted purchase price of the shares on the purchase date for the employee stock purchases. The Company's pro forma information is as follows: 2002 Reported net income Total... -

Page 78

... compensation remaining to be amortized. The purchase contracts included in the Equity Security Units are dilutive to Anthem's earnings per share, because the average market price of Anthem's common stock exceeds a stated threshold price of $43.92 per share. Anthem, Inc. 2002 Annual Report 73 -

Page 79

... computed at the statutory federal income tax rate is as follows: 2002 Amount Amount at statutory rate State and local income taxes net of federal tax benefit Amortization of goodwill Dividends received deduction Deferred tax valuation allowance change, net of net operating loss carryforwards and... -

Page 80

... employees as well as full-time employees who have completed one year of continuous service and attained the age of twenty-one. In addition to the pay credit, participant accounts earn interest at a rate based on 10-year Treasury notes. Anthem Health Plans of New Hampshire, Inc. sponsors a plan... -

Page 81

... contribution plans, the Company offers most employees certain life, medical, vision and dental benefits upon retirement. There are several plans, which differ in amounts of coverage, deductibles, retiree contributions, years of service and retirement age. The Company funds certain benefit costs... -

Page 82

... 2002, decreasing 1% per year to 5% in 2007. The health care cost trend rate assumption can have a significant effect on the amounts reported. A one-percentagepoint change in assumed health care cost trend rates would have the following effects: 1-Percentage Point Increase Effect on total of service... -

Page 83

... of action under federal and state law. These lawsuits typically allege that the defendant managed care organizations employ policies and procedures for providing health care benefits that are inconsistent with the terms of the coverage documents and other information provided to their members, and... -

Page 84

..., 2001, the Connecticut State Dental Association and five dental providers filed suit against the Company's Connecticut subsidiary. The suit alleged breach of contract and violation of the Connecticut Unfair Trade Practices Act. The suit was voluntarily withdrawn on November 9, 2001. The claims were... -

Page 85

... by the health care providers by not paying directly to them the health insurance benefits for medical treatment rendered to patients who had insurance with the Company. The Company paid its customers' claims for the health care providers' services by sending payments to its customers as called for... -

Page 86

... the consolidated financial position or results of operations. As a Blue Cross Blue Shield Association licensee, the Company participates in the Federal Employee Program ("FEP"), a nationwide contract with the Federal Office of Personnel Management to provide coverage to federal employees and their... -

Page 87

... includes business units providing group life and disability insurance benefits, pharmacy benefit management, dental and vision administration services and behavioral health benefits services. Various ancillary business units (reported with the Other segment) consist primarily of AdminaStar Federal... -

Page 88

...Financial Statements (Continued) Financial data by reportable segment is as follows: Midwest 2002 Operating revenue from external customers Intersegment revenues Operating gain (loss) Depreciation and amortization East West Southeast Specialty....7) (27.1) - $329.8 Anthem, Inc. 2002 Annual Report 83 -

Page 89

... pro forma earnings per share presentation, the weighted-average shares outstanding and the effect of dilutive securities for the period from November 2, 2001 to December 31, 2001 was used to calculate pro forma earnings per share for all 2001 periods presented. 84 Anthem, Inc. 2002 Annual Report -

Page 90

... and the independent auditors have full and free access to the Audit Committee, with and without management present. Larry C. Glasscock President and Chief Executive Officer Michael L. Smith Executive Vice President and Chief Financial and Accounting Officer Anthem, Inc. 2002 Annual Report 85 -

Page 91

...amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion... -

Page 92

... copy of Anthem's Annual Report on Form 10-K, including financial statements, as filed with the Securities and Exchange Commission. Anthem's Annual Report to Shareholders and other information are also available on Anthem's Investor Relations website at www.anthem.com. To request an Annual Report to... -

Page 93

... Operating Officer Anthem Blue Cross and Blue Shield Southeast Region Thomas G. Snead, Jr. President Anthem Blue Cross and Blue Shield National Accounts Michael D. Houk President Anthem Specialty Business John M. Murphy President Corporate Officers Larry C. Glasscock President and Chief Executive... -

Page 94

Anthem ா 120 Monument Circle Indianapolis, Indiana 46204 www.anthem.com 2320-AR-03