ADT 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

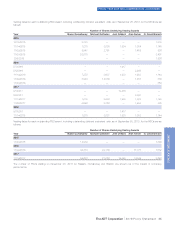

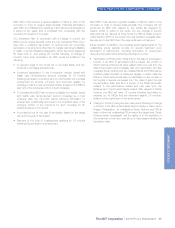

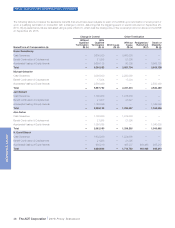

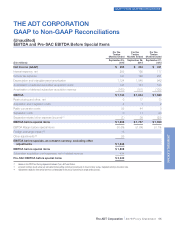

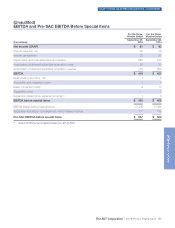

RECONCILIATION OF NON-GAAP MEASURES TO GAAP MEASURES AND SELECTED DEFINITIONS—CONTINUED

SSFCF is a useful measure of pre-levered cash that is generated by the Company after the cost of replacing recurring revenue lost to attrition,

but before the cost of new subscribers that drive recurring revenue growth. The difference between Net Income (the most comparable GAAP

measure) and SSFCF (the non-GAAP measure) consists of the factors discussed above regarding pre-SAC EBITDA, on a quarter-to-date basis.

Pre-SAC EBITDA is then annualized and adjusted for additional factors, described in the reconciliation below, required to maintain the steady-

state. Certain components of these inputs are determined using trailing twelve month information or information from the most recent quarter.

In addition, from time to time the Company may present SSFCF before special items, which is SSFCF adjusted to exclude the impact of the

special items highlighted below. These numbers provide information to investors regarding the impact of certain items management believes are

useful to identify, as described below.

The limitation associated with using SSFCF is that they adjust for certain items that are ultimately within management’s and the Board of

Directors’ discretion to direct, and therefore, may imply that there is less or more cash that is available than the most comparable GAAP

measure. This limitation is best addressed by using SSFCF in combination with other GAAP financial measures.

SSFCF as presented herein may not be comparable to similarly titled measures reported by other companies. This measure should be used in

conjunction with other GAAP financial measures. Investors are urged to read the Company’s financial statements as filed with the U.S. Securities

and Exchange Commission, as well as the accompanying reconciliations below that show the elements of the GAAP measure.

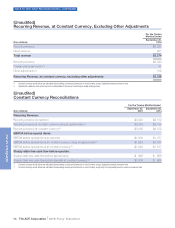

The Company has presented EBITDA, EBITDA Margin, pre-SAC EBITDA, SSFCF and other measures (such as recurring revenue) before special

items. Special items include charges and gains related to acquisitions, integrations, restructurings, impairments, and other income or charges

that may mask the underlying operating results and/or business trends of the Company. The Company utilizes these measures to assess overall

operating performance, as well as to provide insight to management in evaluating overall operating plan execution and underlying market

conditions. These measures may be used as components in the Company’s incentive compensation plans in which case may include other

adjustments which were not contemplated in the annual incentive plan target setting process. These measures are useful for investors because

they may permit more meaningful comparisons of the Company’s underlying operating results and business trends between periods. The

difference between the measures before and after special items and/or the results of recent acquisitions is the impact of those items. The

limitation of these measures is that they exclude the impact (which may be material) of items that increase or decrease the Company’s reported

operating income, operating margin, net income and EPS. This limitation is best addressed by using the non-GAAP measures in combination

with the most comparable GAAP measures in order to better understand the amounts, character and impact of any increase or decrease on

reported results.

54 The ADT Corporation 2016 Proxy Statement

PROXY STATEMENT