ADT 2015 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

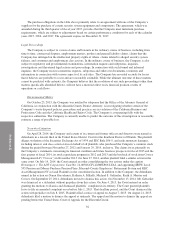

On January 14, 2015, the SEC sent the Company a letter stating that it is investigating the matters at issue in

the foregoing litigation and requesting that the Company voluntarily provide the information and documents set

forth in the letter concerning the same litigation. The Company is cooperating fully with the SEC in its

investigation.

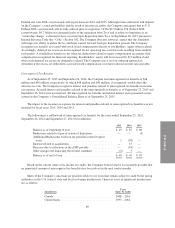

Derivative Litigation

In May and June 2014, four derivative actions were filed against a number of past and present officers and

directors of the Company. Like the securities actions described above, the derivative actions focus primarily on

the Company’s stock repurchase program in 2012 and 2013, the buyback of stock from Corvex in November

2013 and the Company’s statements concerning its financial condition and future business prospects for fiscal

2013 and the first quarter of fiscal 2014. Three of the derivative actions were filed in the United States District

Court for the Southern District of Florida. On July 16, 2014, the Court consolidated those three actions under the

caption In re The ADT Corporation Derivative Litigation, Lead Case No. 14-80570-CIV-DIMITROULEAS/

SNOW, and on September 12, 2014, defendants moved to dismiss the consolidated action. The fourth derivative

action, entitled Seidl v. Colligan, Case No. 2014CA007529, was filed in the Circuit Court of the 15th Judicial

Circuit, Palm Beach County, Florida. The action is currently stayed pending the resolution of the appeal in

the Ryan action, described below. A fifth derivative action asserting similar claims, entitled Ryan v. Gursahaney,

C.A. No. 9992-VCP (the “Ryan action”), was filed in the Delaware Court of Chancery on August 1, 2014, and

defendants moved to dismiss that action. In response to defendants’ motion, plaintiff filed an amended complaint

asserting similar claims and on October 13, 2014 defendants moved to dismiss the amended complaint. On

April 28, 2015 the Court granted defendants’ motion to dismiss the Ryan action for failure to make a litigation

demand on ADT’s Board of Directors or to adequately plead that making such a demand would be futile. A sixth

derivative action asserting similar claims against the same group of past and present officers and directors was

filed in the Delaware Court of Chancery on January 27, 2015 under the caption entitled Binning v. Gursahaney,

C.A. No. 10586-VCP (the “Binning action”). On February 18, 2015, the Delaware Court of Chancery entered an

order staying the date for the defendants to respond to the Binning complaint until 45 days after its ruling on

defendants’ motion to dismiss the Ryan action. On May 15, 2015, plaintiffs in the consolidated derivative action

in Florida federal court notified the Court that, in light of the Delaware Court of Chancery’s dismissal of

the Ryan action, they had made a demand on ADT’s Board of Directors to bring the claims that plaintiffs had

asserted in that action. Following that notice, on May 20, 2015, the Florida federal court entered an order

dismissing the consolidated derivative action. On May 27, 2015, plaintiff in the Ryan action filed a notice of

appeal to the Delaware Supreme Court. The appeal has been fully briefed and remains pending. On June 9, 2015,

plaintiff in the Binning action filed an amended complaint asserting claims similar to his initial

complaint. Defendants moved to dismiss Binning’s amended complaint on July 7, 2015 and the motion is

pending.

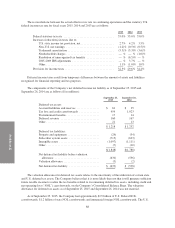

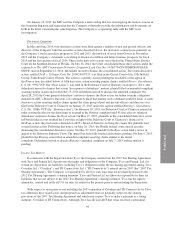

Income Tax Matters

In connection with the Separation from Tyco, the Company entered into the 2012 Tax Sharing Agreement

with Tyco and Pentair Ltd. that governs the rights and obligations of the Company, Tyco and Pentair, Ltd. for

certain pre-Separation tax liabilities, including Tyco’s obligations under the tax sharing agreement among Tyco,

Covidien Ltd. (“Covidien”), and TE Connectivity Ltd. (“TE Connectivity”) entered into in 2007 (the “2007 Tax

Sharing Agreement”). The Company is responsible for all of its own taxes that are not shared pursuant to the

2012 Tax Sharing Agreement’s sharing formulae. Tyco and Pentair Ltd. are likewise responsible for their tax

liabilities that are not subject to the 2012 Tax Sharing Agreement’s sharing formulae. Tyco has the right to

administer, control and settle all U.S. income tax audits for the periods prior to and including the Separation.

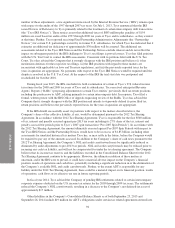

With respect to years prior to and including the 2007 separation of Covidien and TE Connectivity by Tyco,

tax authorities have raised issues and proposed tax adjustments that are generally subject to the sharing

provisions of the 2007 Tax Sharing Agreement and which may require Tyco to make a payment to a taxing

authority, Covidien or TE Connectivity. Although Tyco has advised ADT that it has resolved a substantial

93