ADT 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

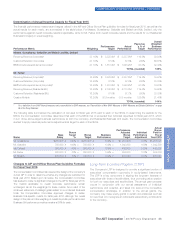

•RSUs are valued at the Company’s common stock price per

share.

•RSUs are accounted for without regard to the number of units

which have previously vested and the associated number of

shares withheld to satisfy tax obligations resulting from vesting

•PSUs are valued at the Company’s common stock price per

share, but are adjusted for actual Company performance

against PSU targets (for grants awarded in fiscal year 2013) or

estimated performance (for grants awarded in fiscal years

2014 and 2015).

•PSUs granted in fiscal year 2013 were earned at 35% of

target amount awarded.

•PSUs granted in fiscal year 2014 associated with TSR

performance are estimated at 0% of target, as TSR

performance through the end of fiscal year 2015 is below

threshold performance level; PSUs granted in fiscal year

2014 associated with Steady State Free Cash Flow Growth

are estimated at target.

•PSUs granted in fiscal year 2015 associated with TSR

performance are estimated at 89% of target, as TSR

performance through the end of fiscal year 2015 is

between threshold and target performance levels; PSUs

granted in fiscal year 2015 associated with EBITDA are

estimated at target.

In presenting an alternative view of compensation beyond what is

reported in the Summary Compensation Table, we have elected not

to include a view of pay actually received over a specified period of

time, commonly referred to as “realized pay.” The rationale for not

presenting a view of realized pay is that a portion of the stock awards

vested and all of the Stock Options exercised during fiscal years

2013, 2014 and 2015 by the CEO were granted to him while he was

an employee of Tyco International Ltd. (“Tyco”), ADT’s parent

company prior to the Company’s separation into a standalone

publicly-traded company. In addition, compensation decisions,

including the granting of equity awards, for Mr. Gursahaney prior to

ADT’s separation from Tyco were made by Tyco’s management and

approved by Tyco’s Compensation and Human Resources

Committee. The inclusion of a discussion of realized pay, including

the impact of equity awards granted by Tyco, would not accurately

reflect the compensation earned by Mr. Gursahaney relative to his

service with ADT as a standalone, publicly-traded company.

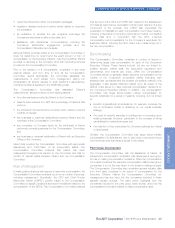

Overview of Executive Compensation Program and Practices

The Company’s executive compensation program is designed with the primary purpose of promoting long-term value creation for our stockholders. We

believe that the design of the executive compensation program and the compensation practices support this goal. The graphic below provides an

overview of the Company’s executive compensation program and practices, as well as a list of practices the Company does not adhere to.

WHAT WE DO WHAT WE DON’T DO

We align executive

compensation with

the interests of the

Company’s

stockholders

✓Pay clearly aligned with performance (page 26)

✓Executive compensation program designed to ensure majority of value is at risk

(page 30)

✓Double-trigger change in control provisions for cash and equity awards

(page 37)

We design the

Company’s

executive

compensation

program to avoid

excessive risk and

promote

sustainable growth

✓Mitigation of undue risk (page 37)

✓Mix of compensation components (fixed and variable pay, short- and long-term

incentives) that encourage focus on both the short- and long-term interests of

the Company and its stockholders (page 30)

✓Incentive awards with payouts based upon a variety of financial and operational

objectives, which minimizes the risk associated with any single performance

measure (page 31)

✓Share ownership guidelines (page 36)

✓Share retention policy (page 36)

We adhere to

executive

compensation best

practices

✓Independent compensation consultant (page 34) ✗No repricing of underwater

stock options

✓Executive Officers and Directors required to obtain pre-approval for all equity

transactions (page 37) ✗No inclusion of the value of

equity awards in

severance calculations

✓Reasonable post-employment/change in control provisions (page 46) ✗No excise tax gross-ups

upon change in control

✓Limited perquisites (page 36)

The ADT Corporation 2016 Proxy Statement 29

PROXY STATEMENT