ADT 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Gross Subscriber Acquisition Cost Expenses. Gross subscriber acquisition cost expenses represent certain costs

related to the acquisition of new customers reflected in our Consolidated Statements of Operations such as

advertising, marketing, and both direct and indirect selling costs for all new customer accounts as well as sales

commissions and installation equipment and labor costs associated with transactions where title to the security

system is contractually transferred to the customer.

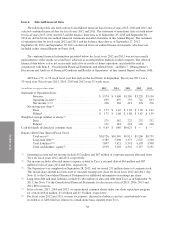

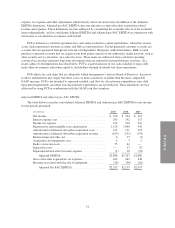

Adjusted Earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”). Adjusted

EBITDA is a non-GAAP measure reflecting net income adjusted for interest, taxes and certain non-cash items

which include depreciation of subscriber system assets and other fixed assets, amortization of deferred costs and

deferred revenue associated with customer acquisitions, and amortization of dealer and other intangible assets.

Adjusted EBITDA is also adjusted to exclude charges and gains related to acquisitions, restructurings,

impairments, and other income or charges. Such items are excluded to eliminate the impact of items that

management does not consider indicative of our core operating performance and/or business trends. We believe

Adjusted EBITDA is useful to provide investors with information about operating profits, adjusted for significant

non-cash and other items, generated from the existing customer base. A reconciliation of Adjusted EBITDA to

net income (the most comparable GAAP measure) and additional information, including a description of the

limitations relating to the use of Adjusted EDITDA, are provided under “-Non-GAAP Measures.”

Adjusted Pre Subscriber Acquisition Cost EBITDA (“Adjusted Pre-SAC EBITDA”). Adjusted Pre-SAC EBITDA

is a non-GAAP measure reflecting Adjusted EBITDA, as discussed above, adjusted for gross subscriber

acquisition cost expenses and revenue associated with the sale of equipment. We believe Adjusted pre-SAC

EBITDA is useful to provide investors with information on the operational profits from our existing customer

base by excluding certain revenue and expenses related to acquiring new customers. A reconciliation of Adjusted

pre-SAC EBITDA to net income (the most comparable GAAP measure) and additional information, including a

description of the limitations relating to the use of Adjusted pre-SAC EBITDA, are provided under “-Non-GAAP

Measures.”

Free Cash Flow (“FCF”). FCF is a non-GAAP measure that our management employs to measure cash that is

available to repay debt, make other investments and return capital to stockholders through dividends and share

repurchases. The difference between net cash provided by operating activities (the most comparable GAAP

measure) and FCF is the deduction of cash outlays for capital expenditures, subscriber system assets, dealer

generated customer accounts and bulk account purchases. A reconciliation of FCF to net cash provided by

operating activities and additional information, including a description of the limitations relating to the use of

FCF, are provided under “-Non-GAAP Measures.”

42