ADT 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

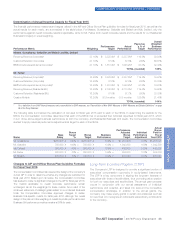

How Peer Group Companies are Selected How Peer Group Data is Utilized

•Similar or related industry sector

•Generally focused on generating subscription-based recurring

revenue, with operations and revenues primarily in the United

States and Canada

•Primarily business-to-consumer (B2C) focused, although

companies that are business-to-business (B2B) focused also

considered

•Generally between $1 and $10 billion in revenue, with

compensation data size-adjusted for the Company’s revenue

•As an input in determining base salaries, annual incentive

targets and long-term incentive award targets (CEO and CFO)

•As an input in the design of compensation plans

•To validate whether our Executive Compensation program is

aligned with Company performance

•To benchmark the form and mix of equity awards granted to

our employees

•To benchmark share ownership guidelines

The Compensation Committee reviews the peer group periodically to determine whether any significant changes to the business condition of the

Company or any of its peers would warrant any changes to the peer group. No changes were made to the peer group for fiscal year 2015. The

peer group utilized for fiscal year 2015 was:

Allegion plc EarthLink Holdings Corporation Stanley Black & Decker, Inc.

Cablevision Systems Corporation Frontier Communications Corporation Telephone & Data Systems, Inc.

CenturyLink, Inc. Netflix, Inc. The Brink’s Co.

Charter Communications, Inc. Rollins, Inc. Tyco International Ltd.

Cincinnati Bell SIRIUS XM Radio, Inc. Windstream Corporation

In addition to the peer group noted above, the Compensation Committee also considers design and practice information from a number of

“reference peers,” including: DIRECTV, T-Mobile US, Ascent Capital Group, Diebold Inc., US Cellular Corporation and ServiceMaster. While

these companies meet the subscription-based recurring revenue and primary B2C screening criteria, most of the reference peer companies

have annual revenues outside the range used in the screening process.

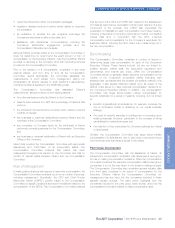

Executive Benefits and Perquisites

The Company’s Executive Officers, including the NEOs, are eligible to

participate in the benefit plans that are available to substantially all of the

Company’s employees, including its defined contribution savings plans,

medical, dental and life insurance plans and long-term disability plans.

Additionally, the Company provides relocation benefits when a move is

required. None of the NEOs participate in a defined benefit pension plan.

Supplemental Savings and Retirement Plan

Executive Officers (US-based) are eligible to participate in the

Company’s Supplemental Savings and Retirement Plan (the “SSRP”),

a deferred compensation plan that permits the elective deferral of

base salary and annual performance-based bonus for executives in

certain career bands. The SSRP provides eligible employees the

opportunity to:

•contribute retirement savings in addition to amounts permitted under

the Company’s Retirement Savings and Investment Plan (“RSIP”);

•defer compensation on a tax-deferred basis and receive

tax-deferred market-based growth; and

•receive any Company contributions that were reduced under the

RSIP due to Internal Revenue Service compensation limits.

Executive Physical Program

The Company strongly believes in investing in the health and well-

being of its executives as an important component in providing

continued effective leadership for the Company. As such, the

Company maintains an annual executive physical program, for which

all of the Executive Officers are eligible. The program allows for

expenses for an annual physical to be paid for by the Company, up

to a total of $3,000 per year.

Other Compensation Policies and Practices

The Company maintains certain policies and practices to ensure that

its compensation programs appropriately align the interests of its

executives with the interests of its stockholders. We believe that

these policies and practices are aligned with executive compensation

best practices.

Stock Ownership Guidelines and Share Retention Policy

The Compensation Committee believes that requiring executives to own and hold a significant amount of Company stock aligns the executives’

interests with those of its stockholders. The Compensation Committee has established the following stock ownership guidelines:

Level Ownership Guideline (as a multiple of base salary)

Chief Executive Officer 6x

Other Executive Officers 3x

36 The ADT Corporation 2016 Proxy Statement

PROXY STATEMENT