ADT 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

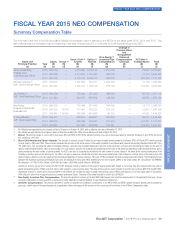

FISCAL YEAR 2015 NEO COMPENSATION—CONTINUED

Each NEO must execute a general release of claims in favor of the

Company in order to receive these benefits. Following termination,

each NEO is prohibited from soliciting customers and employees for

a period of two years, and is prohibited from competing with the

Company for a period of one year.

CIC Severance Plan. In connection with a Change in Control, the

NEOs would receive benefits under the CIC Severance Plan only if

they had a qualifying termination of employment (an involuntary

termination of employment other than for Cause, permanent disability

or death, or a Good Reason Resignation, within the period beginning

60 days prior to, and ending 24 months following, a Change in

Control). Upon such termination, an NEO would be entitled to the

following:

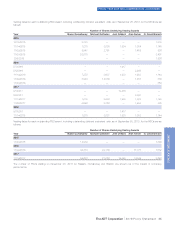

•A payment equal to two times his or her base salary and two

times his or her target annual bonus.

•Continued participation in the Company’s medical, dental and

health care reimbursement account coverage for 12 months

following termination of employment (or until the NEO commences

employment by another company and becomes eligible for

coverage under the new employer’s plans), subject to the NEO’s

payment of the employee portion of such coverage.

•To the extent the NEO has not become eligible for medical, dental

and health care reimbursement account coverage by a new

employer after the 12-month period following termination of

employment, a cash payment equal to the projected value of the

employer portion of the premiums for such coverage for an

additional period of 12 months.

•A pro-rata bonus for the year of termination based on the target

bonus for the year of termination.

•Payment of the cost of outplacement services for 12 months

following the termination of employment.

Each NEO must execute a general release of claims in favor of the

Company in order to receive these benefits. The Company will not

reimburse an NEO with respect to any excise tax triggered by

Section 280G or 4999 of the Code, but any Change in Control

payments will be capped at three times the NEO’s “base amount”

under Section 280G of the Code if the cap results in a greater after-

tax payment to the NEO than if the payments were not capped.

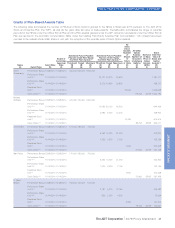

Equity Awards. In addition, the individual award agreements for the

outstanding equity awards provide for special treatment upon

termination of employment, including termination of employment

during the two-year period following a Change in Control.

•Termination of Employment. Other than in the case of a Change in

Control, if an NEO is terminated without Cause, the portion of

Stock Options which would have vested within one year from the

date of termination will immediately vest upon termination. All other

unvested Stock Options and all unvested RSUs and PSUs will be

forfeited unless the NEO is retirement eligible, in which case the

RSUs or Stock Options will vest pro rata based on the number of

full months of service completed from the date of grant through

the termination date, and all or a portion of the PSUs will remain

subject to the performance criteria and may vest upon the

achievement of such performance criteria. With respect to Stock

Options, the NEO will have 12 months following termination to

exercise (or, for NEOs that are retirement eligible, 36 months),

subject to the original term of the stock option.

•Change in Control. During the two year period following a Change

in Control, if the NEO is terminated without Cause or has a Good

Reason Resignation, all outstanding Stock Options and RSUs

vest in full and all outstanding PSUs vest at the target level. Stock

Options remain exercisable until the earlier of (i) the expiration of

the remainder of their term and (ii) up to three years following the

termination date.

The ADT Corporation 2016 Proxy Statement 47

PROXY STATEMENT