ADT 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

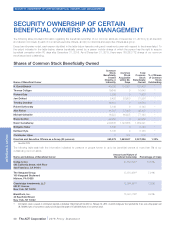

The above graph assumes the following:

(1) $100 invested at the close of business on October 1, 2012, in

ADT common stock, the S&P 500 Index and the S&P 500

Industrial Index.

(2) The cumulative total return assumes reinvestment of dividends.

In November 2012, the Company granted PSUs to certain

employees (including Messrs. Gursahaney and Bleisch) as a

component of their annual long-term incentive award. The 3-year

performance period for these awards ended on September 25,

2015, and the earned number of PSUs vested on November 30,

2015, which was the third anniversary of the grant date. Based on

the results achieved by the Company shown in the table below, the

number of PSUs earned was 35% of the target number of PSUs

granted. This indicates alignment of pay and performance.

Metric Weighting Target Actual

Results Payout as

% of Target

Recurring Revenue Growth (Compound Annual Growth Rate or CAGR) 60% 6.8% 5.1% 57.8%

Adjusted Free Cash Flow Growth (CAGR) 40% 7.7% 1.1% 0%

Total Payout (rounded) 35%

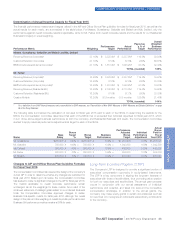

Impact of Company Performance on Compensation. Over the last

several years the Company has continued to have solid operating

performance, although TSR has lagged behind the market (defined as

the S&P 500 Index). We believe that the comparison between target

pay and “reported” pay (compensation as reported in the Summary

Compensation Table) is a useful measure of assessing performance,

but is only part of an overall view of how pay is aligned with Company

performance. We believe it is also helpful to look at performance-

based compensation from the perspective of “realizable pay,” which

is the value of pay that is earned or realizable as of a specific date.

The chart below provides a more complete perspective of total direct

compensation (base salary, annual incentive and long-term equity

compensation) by illustrating both target and “realizable” pay for

Mr. Gursahaney for fiscal years 2013, 2014 and 2015.

$900 $900 $900$900 $900 $900

$900 $900 $900

$693 $630 $1,251

$5,250

(1) (2)

$7,050

Target Compensation Realizable Pay

$3,750 $4,125

$993 $1,308

$2,481

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

FY13

Target

FY13

Realizable

FY14

Target

FY14

Realizable

FY15

Target

FY15

Realizable

In Thousands

FY13 - FY15 Target Compensation vs. Realizable Pay

Base Salary

Annual Incentive

Long-Term Equity Compensation

Base Salary

Annual Incentive

Long-Term Equity Compensation

$2,586

$5,550

$2,838

$5,925

$4,632

(3)

(1) (1)

(3)

(3)

(1) Represents target value of equity-based long-term incentive

compensation, which differs from the actual accounting value

delivered (as reported in the Summary Compensation Table).

(2) Includes the target value of one-time Founders’ Award equity

grants made in recognition of the Company becoming a

standalone, publicly-traded company.

(3) Represents realizable value of equity awards granted in each fiscal

year, as calculated at the end of fiscal year 2015 based upon a

stock price of $30.70, which was the closing price per share of the

Company’s common stock on September 25, 2015. The realizable

value of each type of equity awarded is calculated as follows:

•Stock Options are valued based upon the amount, if any, that

the Company’s common stock price per share exceeds the

exercise price per share of the options.

28 The ADT Corporation 2016 Proxy Statement

PROXY STATEMENT