ADT 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

million plus penalties of $154 million are owed based on audits of the 1997 through 2000 tax years of Tyco and

its subsidiaries, as they existed at that time. Further, Tyco reported receiving Final Partnership Administrative

Adjustments (the “Partnership Notices”) for certain U.S. partnerships owned by its former U.S. subsidiaries, for

which Tyco has informed that it estimates an additional tax deficiency of approximately $30 million will be

asserted. The additional tax assessments related to the Tyco IRS Notices and the Partnership Notices exclude

interest and do not reflect the impact on subsequent periods if the IRS challenge to Tyco’s tax filings is proved

correct. Tyco has filed petitions with the U.S. Tax Court to contest the IRS assessments. Consistent with its

petitions filed with the U.S. Tax Court, Tyco has advised us that it strongly disagrees with the IRS position and

believes (i) it has meritorious defenses for the respective tax filings, (ii) the IRS positions with regard to these

matters are inconsistent with applicable tax laws and Treasury regulations, and (iii) the previously reported taxes

for the years in question are appropriate. If the IRS should successfully assert its position, our share of the

collective liability, if any, would be determined pursuant to the 2012 Tax Sharing Agreement. In accordance with

the 2012 Tax Sharing Agreement, the amount ultimately assessed under the Tyco IRS Notices and the

Partnership Notices would have to be in excess of $1.85 billion, including other assessments for unrelated

historical tax matters Tyco has, or may settle in the future, before we would be required to pay any of the

amounts assessed. In addition to the Company’s share of cash taxes pursuant to the 2012 Tax Sharing

Agreement, the Company’s NOL and credit carryforwards may be significantly reduced or eliminated by audit

adjustments to pre-2013 tax periods. NOL and credit carryforwards may be reduced prior to incurring any cash

tax liability, and will not be compensated for under the tax sharing agreement. We believe that our income tax

reserves and the liabilities recorded in the Consolidated Balance Sheet for the 2012 Tax Sharing Agreement

continue to be appropriate. No payments with respect to these matters would be required until the dispute is

resolved in the U.S. Tax Court. A trial date has been set for October 2016. However, the ultimate resolution of

these matters is uncertain, and if the IRS were to prevail, it could have a material adverse impact on our financial

condition, results of operations and cash flows, potentially including a reduction in our available tax attribute

carryforwards.

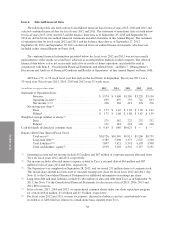

We are responsible for all of our own taxes that are not shared pursuant to the 2012 Tax Sharing

Agreement’s sharing formulae, and Tyco and Pentair are responsible for their tax liabilities that are not subject to

the 2012 Tax Sharing Agreement’s sharing formulae. We also have sole responsibility for any income tax

liability arising as a result of our acquisition of Broadview Security in May 2010, including any liability of

Broadview Security under the tax sharing agreement between Broadview Security and The Brink’s Company

dated October 31, 2008 (collectively, the “Broadview Tax Liabilities”). Costs and expenses associated with the

management of Shared Tax Liabilities and Broadview Tax Liabilities are generally shared 20% by Pentair,

27.5% by ADT, and 52.5% by Tyco.

All the tax liabilities that are associated with our businesses, including liabilities that arose prior to the

Separation, have become our tax liabilities. Although we have agreed to share certain of these tax liabilities with

Tyco and Pentair pursuant to the 2012 Tax Sharing Agreement, we remain primarily liable for all of these

liabilities. If Tyco and Pentair default on their obligations to us under the 2012 Tax Sharing Agreement, we

would be liable for the entire amount of these liabilities. In addition, if another party to the 2012 Tax Sharing

Agreement that is responsible for all or a portion of an income tax liability were to default in its payment of such

liability to a taxing authority, we could be legally liable under applicable tax law for such liabilities and required

to make additional tax payments. Accordingly, under certain circumstances, we may be obligated to pay amounts

in excess of our agreed-upon share of our, Tyco’s and Pentair’s tax liabilities.

We recognize potential liabilities and record tax liabilities for anticipated tax audit issues in the United

States and other tax jurisdictions based on our estimate of whether, and the extent to which, additional income

taxes will be due. These tax liabilities are reflected net of related tax loss carryforwards. We adjust these

liabilities in light of changing facts and circumstances; however, due to the complexity of some of these

uncertainties, the ultimate resolution may result in a payment that is materially different from our current

estimate of tax liabilities. Under the 2012 Tax Sharing Agreement, Tyco has the right to administer, control and

settle all U.S. income tax audits for periods prior to and including September 28, 2012. The timing, nature and

31