ADT 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

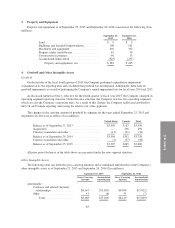

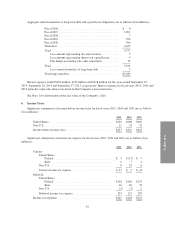

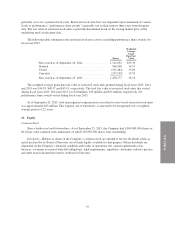

Aggregate annual maturities of long-term debt and capital lease obligations are as follows ($ in millions):

Fiscal 2016 ......................................... $ 8

Fiscal 2017 ......................................... 1,093

Fiscal 2018 ......................................... 7

Fiscal 2019 ......................................... 506

Fiscal 2020 ......................................... 306

Thereafter .......................................... 3,457

Total .............................................. 5,377

Less amount representing discount on notes ........... 9

Less amount representing interest on capital leases ...... 9

Plus hedge accounting fair value adjustment ........... 35

Total .............................................. 5,394

Less current maturities of long-term debt ............. 5

Total long-term debt .................................. $5,389

Interest expense totaled $209 million, $193 million and $118 million for the years ended September 25,

2015, September 26, 2014 and September 27, 2013, respectively. Interest expense for fiscal years 2015, 2014 and

2013 primarily represents interest incurred on the Company’s unsecured notes.

See Note 1 for information on the fair value of the Company’s debt.

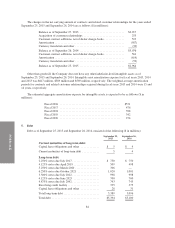

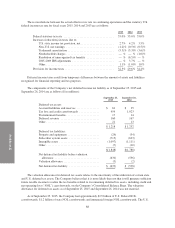

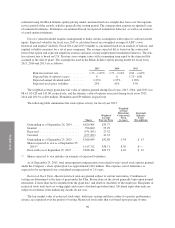

6. Income Taxes

Significant components of income before income taxes for fiscal years 2015, 2014 and 2013 are as follows

($ in millions):

2015 2014 2013

United States ........................................... $426 $408 $610

Non-U.S. .............................................. 11 24 32

Income before income taxes ............................... $437 $432 $642

Significant components of income tax expense for fiscal years 2015, 2014 and 2013 are as follows ($ in

millions):

2015 2014 2013

Current:

United States:

Federal ........................................ $ 7 $(17) $ 7

State ..........................................271

Non-U.S. .......................................... 8 15 6

Current income tax expense ........................... $ 17 $ 5 $ 14

Deferred:

United States:

Federal ........................................ $110 $110 $172

State .......................................... 16 20 33

Non-U.S. .......................................... (2) (7) 2

Deferred income tax expense .......................... 124 123 207

Income tax explense ..................................... $141 $128 $221

87