ADT 2015 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

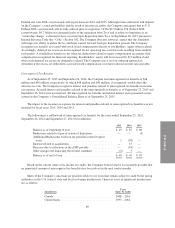

The Company also recognized other charges of $8 million related to accelerated depreciation on certain

assets in fiscal year 2014 in connection with the rationalization of its business processes and system landscape.

Restructuring and other charges during fiscal year 2013 were not material.

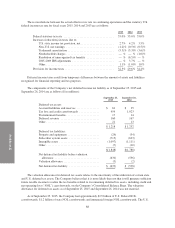

Guarantees—In the normal course of business, the Company is liable for contract completion and product

performance. In the opinion of management, such obligations will not significantly affect the Company’s

financial position, results of operations or cash flows. As of September 25, 2015 and September 26, 2014, the

Company did not have material guarantees.

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued authoritative guidance which sets

forth a single comprehensive model for entities to use in accounting for revenue arising from contracts with

customers. The guidance is effective for annual reporting periods, including interim reporting periods within

those periods, beginning after December 15, 2016, and early adoption is not permitted. Companies may use

either a full retrospective or a modified retrospective approach to adopt this guidance. The Company is currently

evaluating the impact of this guidance.

In August 2015, the FASB issued an amendment to the above mentioned revenue recognition guidance. This

amendment defers the effective date by one year to December 15, 2017, for annual reporting periods, including

interim reporting periods within those periods, beginning after that date. Early adoption is permitted, but not

before the original effective date of December 15, 2016.

In April 2015, the FASB issued authoritative guidance to simplify the presentation of debt issuance costs

and require that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a

direct deduction from the carrying amount of that debt liability. The recognition and measurement guidance for

debt issuance costs are not affected by the amendments in this guidance. The guidance is to be applied on a

retrospective basis and is effective for financial statements issued for fiscal years, and interim periods within

those fiscal years, beginning after December 15, 2015. Early adoption is permitted for financial statements that

have not been previously issued. The adoption of this guidance is not expected to have a material impact on the

Company’s financial position, results of operations or cash flows.

In April 2015, the FASB issued authoritative guidance regarding the accounting for fees paid in a cloud

computing arrangement. The new standard provides guidance to customers about whether a cloud computing

arrangement includes a software license. If a cloud computing arrangement includes a software license, then the

customer should account for the software license element of the arrangement consistent with the acquisition of

other software licenses. If a cloud computing arrangement does not include a software license, the customer

should account for the arrangement as a service contract. The guidance is effective for fiscal years, and interim

periods within those fiscal years, beginning after December 15, 2015. Early adoption is permitted. Companies

may elect to adopt this guidance using either (1) a prospective approach for all arrangements entered into or

materially modified after the effective date, or (2) a retrospective approach. The Company is currently evaluating

the impact of this guidance.

In July 2015, the FASB issued authoritative guidance to simplify the subsequent measurement of inventory.

Under this new standard, an entity should measure inventory at the lower of cost and net realizable value. Net

realizable value is the estimated selling price in the ordinary course of business, less reasonably predictable costs

of completion, disposal, and transportation. The guidance is effective for fiscal years, and interim periods within

those fiscal years, beginning after December 15, 2016. The amendments in this guidance should be applied

prospectively with earlier application permitted as of the beginning of an interim or annual reporting period. The

Company is currently evaluating the impact of this guidance.

81