ADT 2015 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2015 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

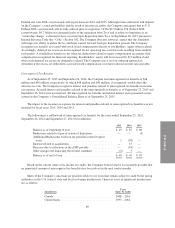

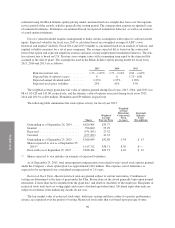

On November 18, 2013, the Company’s Board of Directors authorized a $1 billion increase to the

previously approved, $2 billion authorized repurchases under the FY2013 Share Repurchase Program expiring

November 26, 2015. During fiscal year 2014, the Company made open market repurchases of 14 million shares

of ADT’s common stock at an average price of $35.72 per share under the FY2013 Share Repurchase Program.

The total cost of open market repurchases for fiscal year 2014 was $500 million, all of which was paid during

fiscal year 2014.

On November 19, 2013, the Company entered into an accelerated share repurchase agreement under which

it paid $400 million for an initial delivery of approximately 8 million shares of ADT’s common stock. This

accelerated share repurchase program was completed on February 25, 2014. In total during fiscal year 2014, the

Company repurchased 10.9 million shares of ADT’s common stock at an average price of $36.86 per share under

this accelerated share repurchase agreement in accordance with the previously approved repurchase program.

On November 24, 2013, the Company entered into a Share Repurchase Agreement (“Share Repurchase

Agreement”) with Corvex. Pursuant to the Share Repurchase Agreement, the Company repurchased 10.2 million

shares from Corvex for a price per share equal to $44.01, resulting in $451 million of cash paid during fiscal year

2014. This repurchase was completed on November 29, 2013.

During fiscal year 2015, the Company made open market repurchases of 9.8 million shares of ADT’s

common stock at an average price of $33.16 per share. The total cost of open market repurchases for fiscal year

2015 was $324 million, all of which was paid during fiscal year 2015.

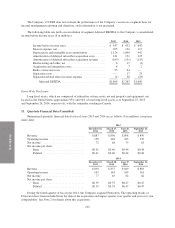

Open market share repurchases during fiscal years 2015, 2014 and 2013, including shares repurchased from

Corvex and shares repurchased under the accelerated share repurchase agreement, were made in accordance with

the FY2013 Share Repurchase Program. As of September 25, 2015, $57 million remains authorized for

repurchase under the FY2013 Share Repurchase Program.

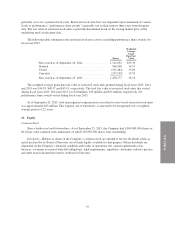

On July 17, 2015, the Company’s Board of Directors approved a new, three-year share repurchase program

(“FY2015 Share Repurchase Program”) authorizing the Company to purchase up to $1 billion of its common

stock. Pursuant to this approval, the Company may enter into accelerated share repurchase plans, as well as

repurchase shares on the open market pursuant to pre-set trading plans meeting the requirements of Rule 10b5-1

under the Securities Exchange Act of 1934, in private transactions or otherwise. The FY2015 Share Repurchase

Program expires on July 17, 2018 and may be terminated at any time. The FY2015 Share Repurchase Program

authorized amount of $1 billion is incremental to the remaining $57 million authorized to be repurchased under

the FY2013 Share Repurchase Program noted above. As of September 25, 2015, no shares have been

repurchased under the approved FY2015 Share Repurchase Program.

All of the Company’s repurchases were treated as effective retirements of the purchased shares and

therefore reduced reported shares issued and outstanding by the number of shares repurchased. In addition, the

Company recorded the excess of the purchase price over the par value of the common stock as a reduction to

additional paid-in capital.

99